Rystad: macroeconomics to hold back growth rate despite a record-breaking 2024 for renewables

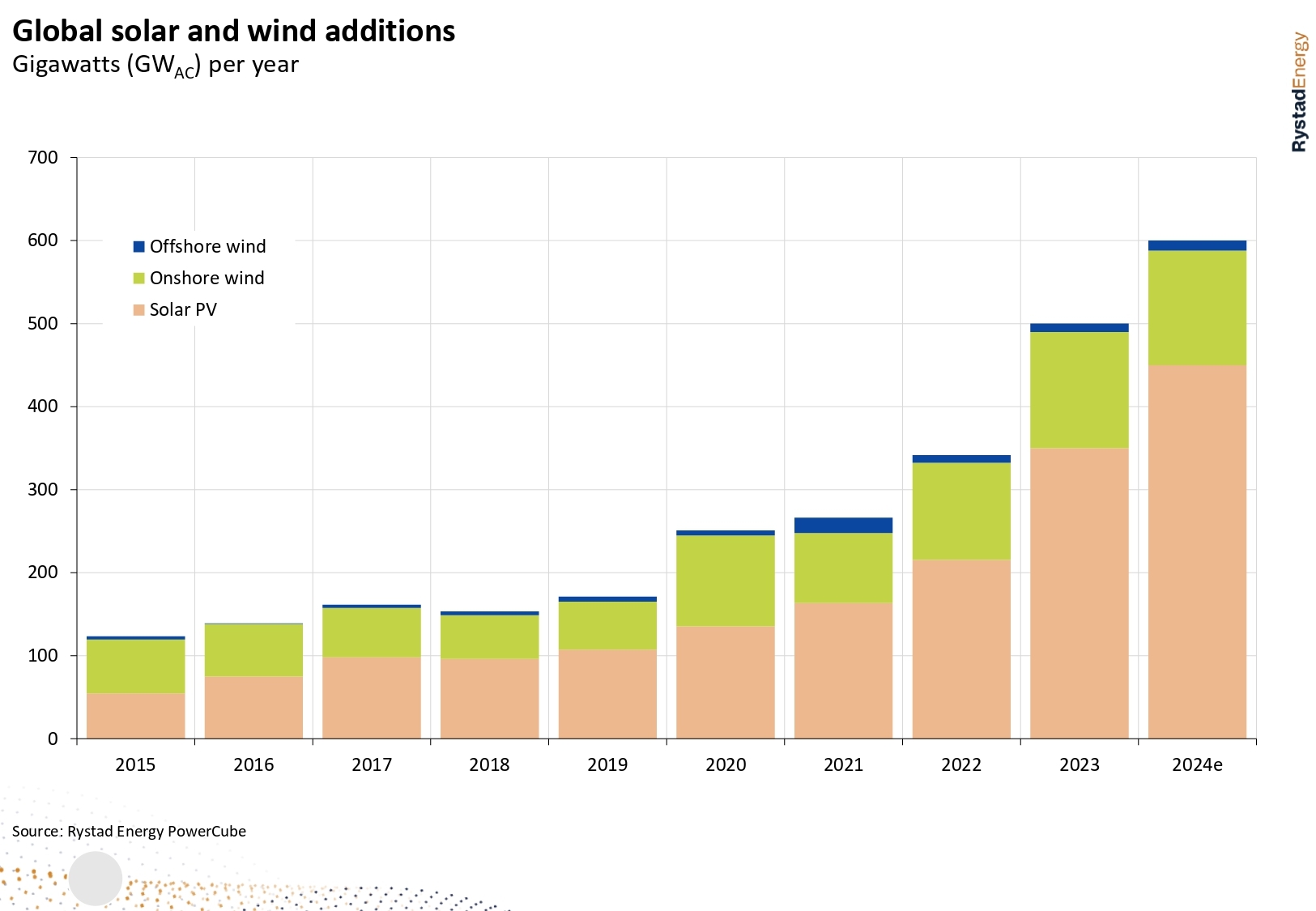

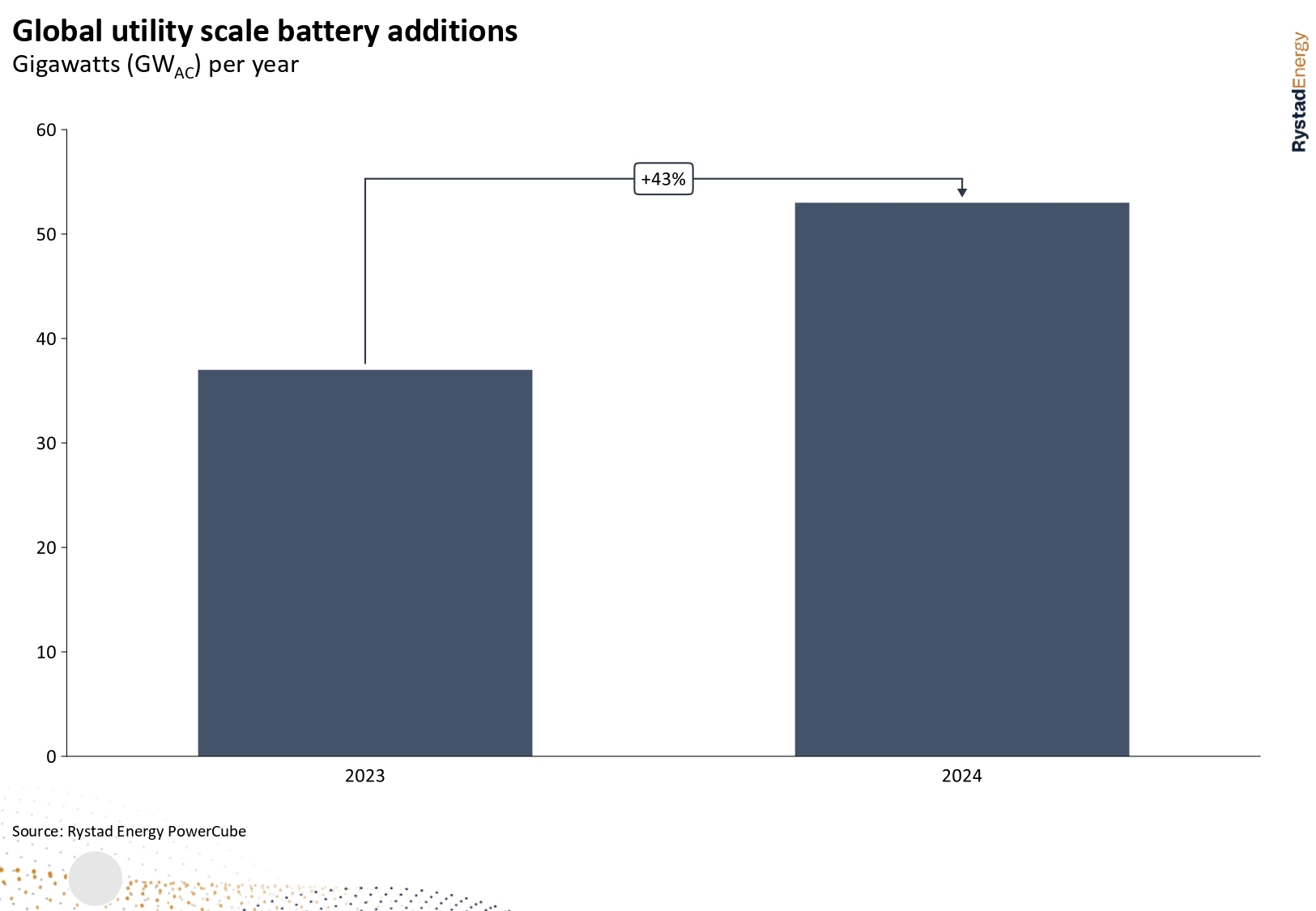

After a remarkable year for renewables in 2023, Rystad Energy estimates that 2024 will bring one of record-high capacity additions, but the growth rate will slow down significantly compared to previous years. This is due to an expected slowdown in solar PV additions across key renewable energy markets in China, Europe, and the US. Meanwhile, wind energy, which has struggled in recent years, could make a comeback with expected record-high additions globally. Overall, we expect the 500 gigawatts (GWAC) milestone for solar and wind additions to be broken for the first time in 2024, with about 600 GWAC solar and wind installed capacity globally by year-end. Furthermore, we find that storage technologies will play an increasingly important role balancing the increasingly intermittent power mix and that more than 50 GWAC of battery energy storage systems (BESS) will be installed in 2024.

Capital expenditure in renewable energy projects to reach new record

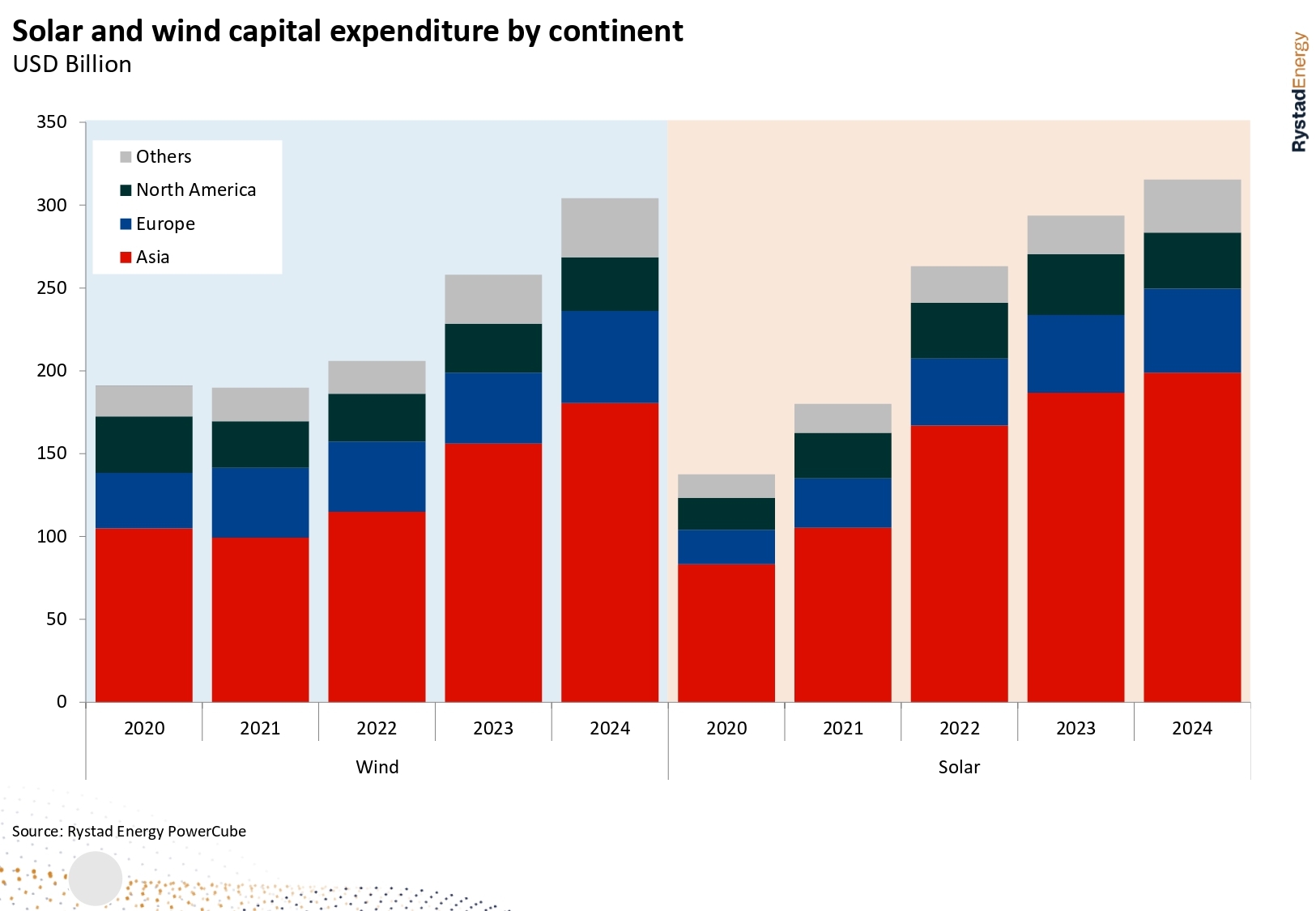

Capital expenditure (capex) in solar and wind project development has been steadily increasing over the past two decades and is set to reach a new record in 2024. Expenditure in solar project development totaled around $300 billion in 2023 and is expected to grow to $315 billion this year, with 63% of this taking place in Asia, 16% in Europe, and 11% in North America. The regional share in capex for both solar and wind has remained stable during the past five years and overall, China will continue to lead investments globally in 2024.

Will the renewable energy industry see new records in 2024?

After close to 40% year-on-year growth in capacity additions for solar and wind in 2023, in 2024, Rystad Energy expects a new record for solar additions but the growth rate will slow down considerably – only growing by about 12% year-on-year in 2024. We currently anticipate around 450 GWAC of additions in 2024 as our current base-case outlook amid increasing signs of a slowdown in installations in some key regions like China, Europe, and the US.

China has been the key growth market for solar installations in recent years, representing more than half of global installations. China saw more than a doubling in annual installations in 2023 relative to 2022, with preliminary data indicating around 190 GWAC added during 2023. Nevertheless, we do not expect further massive growth in 2024 landing at 240 GWAC as fewer large capacity projects are moving ahead and some provinces that have seen very high additions in recent years, have started experiencing grid congestions, which could be a bottleneck to further additions.

Markets to watch in Europe

In Europe, the residential & commercial markets will be especially important to watch. We are seeing signs of a slowdown in installations after a surge in 2022 and 2023 amid the big push for energy independence. The two segments are estimated to represent roughly 60% of yearly capacity additions in Europe in 2024. The overall macroeconomic situation and high-interest rate regime are impacting the investment decisions of many private consumers when it comes to acquiring solar panels. We do however still expect some growth across all segments, with a 15% year-on-year boost and installations of about 70 GWAC , but not the same extreme growth rate as in 2023, or previous years.

Unlike in Europe, the utility segment in the US is far greater than the rooftop segment. The US saw strong solar PV growth in 2023, with preliminary numbers suggesting about 24 GWAC of additions, meaning a 22% year-on-year boost. However, the same growth rate is not expected in the utility segment in 2024 judging from the project count. The rooftop segment is also expected to see a sluggish year, affected by policy changes in certain markets, most notably in California – the largest rooftop solar market in the US. The general economic situation with high interest rates is also impacting installations in many areas. Overall growth for solar in total is however expected to continue, and we expect total additions to be around 30 GWAC in 2024, roughly 17% increase compared to 2023.

Meanwhile, wind energy has in many ways seen sluggish development in recent years, with rising cost trends and supply chain issues impacting installations across the globe. Many projects were canceled or delayed in 2023, but despite this, wind energy saw about a total installation of 140 GWAC growth – a record high. We do expect relatively strong growth for global wind energy in 2024 as well, with total capacity additions reaching 150 GWAC, 7% growth. Growth is expected to be especially strong in Asia, which will represent roughly 60% of global wind installations in 2024. There is, however, significant downside risk to these projections given the trend in recent years, as we could see further delays and cancellations in 2024.

Utility-scale batteries to continue dominating the storage segment

Storage solutions are increasingly playing an important role backing up the intermittency of renewable energy sources. This will continue to drive exponential growth in storage capacity this year, mainly for utility-scale batteries. In 2023 close to 40 GW of battery capacity was installed with more than half of this occurring in Asia (predominantly in China). Despite a slowdown in the growth rate of solar and wind capacity, battery capacity installations in 2024 are expected to surpass 50 GW.

The continued fast growth in battery capacity is helping narrow the battery vs renewable energy capacity ratio. In most regions, gas power generation continues to play a very important role in backing up the intermittency of renewables. The battery technology is increasingly seen as a key technology to integrate into the power systems, especially as batteries continue to improve their duration.

In conclusion

As clear from earlier in this article, China will be by far the largest renewable energy market in terms of new installations in 2024, followed by the US and India. Solar set to dominate capacity growth in almost all the top 10 markets this year, except for France and Brazil. India is also expected to have a record 2024, surpassing mature renewables markets in Europe like Germany and Spain, but five out of the top 10 markets remain in Europe.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.