Europe’s energy crisis – from big ‘if’ to small ‘if’

The lights remained lit. Europe coped with the energy crisis better than most people feared. The economic doomsday scenarios and fears about Europe’s deindustralisation are overdone. In fact, by 2023 the scaled-up investments into renewables and the substantial expansion of overseas natural gas supplies could trigger a down cycle charactersed by overcapacity and deflation.

The severity of Europe’s energy crisis, the uncertainty it unleashed, the overlap with the energy transition, and the resulting political activism became a fast breeder for exceptionally heated debates. Yet the feared doomsday scenarios did not materialise; Europe’s lights remained lit. The energy crisis was limited to a price crisis and did not escalate into a supply crisis that included fuel scarcity and power outages.

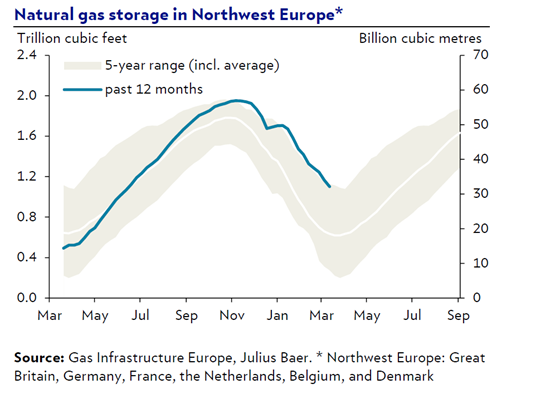

With natural gas storage levels well above seasonal norms, today’s supply situation is comfortable. Despite various cold spells, the winter season, has been comparably mild. However, today’s ample supplies can be explained by more than just the weather. The storage fill rates have been consistently elevated, even during the periods of cold spells. The availability of Russian gas flows up to the summer of 2022 does not change the fundamental outlook for 2023. Natural gas storage is a very short-term buffer, with inventories covering less than 1.5 months of demand. Europe imports were exceptionally strong and storage increased faster than normal in autumn, after the Russian curtailments.

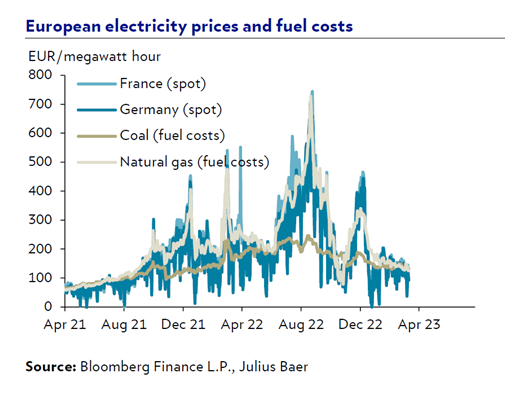

There are more reasons why 2023 should be less challenging than 2022. The global availability of energy has increased. China expands coal production, Asia revives nuclear output, and substantial clean energy capacities are connected to the grid globally. The panic energy buying ceased and inventories are ample globally. Europe should have more options to source natural gas and should not be forced to pay premiums for imports, not least as the global economy stagnates. It was mainly brute market forces, Europe’s willingness to outpay everyone else to secure natural gas imports, and less the weather or energy saving measures that solved the crisis. Furthermore, within Europe, France’s nuclear power is returning slowly, limiting coal and gas use somewhat. Often overlooked, power prices spiked because of natural gas prices, not because of a perceived electricity shortage.

The economy: Misplaced deindustrialisation fears

The feared economic doomsday scenarios did not materialise, as the easing of energy prices instantly lifted Europe’s economic prospects. Our initial non-consensus projection for stagnation and disinflation became a consensus view heading into 2023. Of course, the key questions are how swiftly the easing of the energy crisis will lead to an easing of the economic challenges, and whether Europe will suffer long-term scares. We maintain a more optimistic assessment of Europe’s economic prospects.

The economic costs of the energy crisis appear to be mostly temporary, and the fears about Europe’s deindustrialization are overdone. Europe has always had an energy supply disadvantage but has nevertheless flourished. To the contrary, the energy transition in all its aspects (ranging from solar power plant installations to battery manufacturing capacity additions) suggests that we are rather seeing substantial reindustrialisation efforts in Europe.

Most importantly, the odds are high that Europe will return to pre-crisis energy price levels and that some parts of Europe may even begin to benefit from structural energy advantages thanks to abundant clean resources. Moreover, the energy transition brings a shift from resources to technology, and Europe is well positioned to be a long-term beneficiary. Thus, the ongoing investment boom could well translate into a period of abundance, price pressure, and deflation. Longer-term scares will persist, but they appear to result from state intervention and the economic costs of excessive policymaking.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.