National Oil Companies in the GCC can absorb the cost of the energy transition for now

Gulf nations have all announced new sustainability targets or renewed their commitment to the Paris Agreement in the past two years. Their respective National Oil Companies (NOCs) are following suit. We see the GCC as highly exposed to the energy transition, since hydrocarbons contribute on average 70%-80% of central governments' revenue. Yet, compared with their global peers, NOCs in the GCC attract less direct pressure from shareholders, policymakers, and society to make rapid changes to their business models.

As such, we are not surprised by Gulf NOCs' approach to adapting to the energy transition. These companies remain focused on core upstream production, while slowly shifting their overall strategies to align with sustainability targets and nationally determined contributions (NDCs).

How The Market Is Shifting

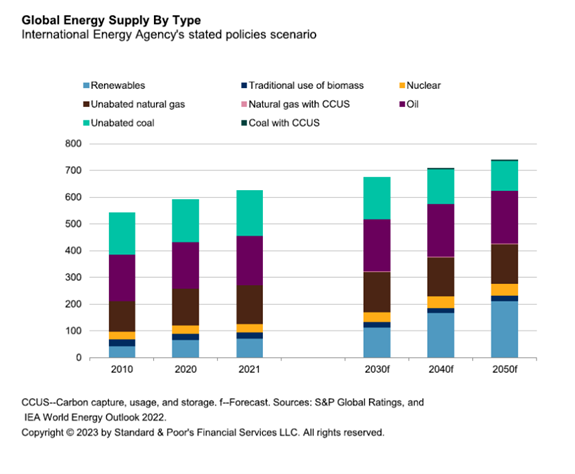

The energy transition will reshape the market for the GCC's main commodity export, potentially reducing demand for oil and putting pressure on prices over the coming years. S&P Global Commodity Insights anticipates that oil demand is likely to peak by the mid-2030s. Nonetheless, we expect oil and gas will remain key to the global energy mix for many years to come, contributing close to 50% of energy supply even until 2050, according to the International Energy Agency's (IEA) Stated Policies Scenario (see chart 1). In that respect, we believe the GCC will still attract demand for oil over the next decade, owing to their low-cost production profiles.

It's therefore not surprising that, although Gulf NOCs are aligning their strategies with governments' energy transition initiatives, meaningful investments are lagging. Abu Dhabi National Oil Company (ADNOC) and Saudi Aramco have announced plans to increase oil production capacity by 2027 to five million barrels per day (mb/d) and 13 mb/d, respectively.

Chart 1

OPEC currently estimates that 80.4% of the world's proven oil reserves are located in OPEC member countries, of which 67.1% are in the Middle East. In 2021, Saudi Arabia, the UAE, and Kuwait together accounted for about 38% of OPEC's total proven oil reserves. We expect global demand for oil will continue to increase during the next decade before peaking in the mid-2030s. Concurrently, the IEA assumes OPEC's share of the oil supply in the net-zero pathway will strengthen to more than 50% by 2050, from 34% in 2020. This in turn should benefit the region's NOCs more than international players and those outside the Gulf.

Leverage Withstands Exaggerated Capex in Our Hypothetical Scenario

To assess the potential credit implications of the NDCs and sustainability targets on Gulf oil companies, we have devised a hypothetical stress scenario, in which the NOCs substantially increase capital expenditure (capex) on sustainability-related projects.

In our scenario, we assume GCC NOCs increase spending on sustainability-related projects such as low carbon and renewable-energy investments, and we gauge the impact on leverage (debt to EBITDA), one of our key credit ratios. We used international peers' announced capex plans for sustainability investments, greenhouse gas (GHG) targets, and track records as a base for our capex assumption. Those sustainability investments include projects to develop carbon capture, usage, and storage (CCUS) facilities, produce low carbon fuels, and increase renewable electricity generation capacity. We estimate that Gulf NOCs (including publicly listed operators we do not rate) would need to upsize their current capex by 15%-20% annually (an increase of $13 billion-$25 billion, in aggregate) until 2030 to try to meet GHG reduction targets and the region's net-zero ambitions.

Even under this hypothetical scenario of potentially overstated capex, we do not anticipate a material impact on the NOCs' credit metrics, at least for now. We estimate their debt to EBITDA will average well below 1x until at least 2025. After that, and despite likely continued oil price uncertainty, weaker demand for hydrocarbons and ongoing elevated capex related to the energy transition could start putting pressure on this credit metric, although less so than for international peers.

Strong Balance Sheets Buy Time for Change

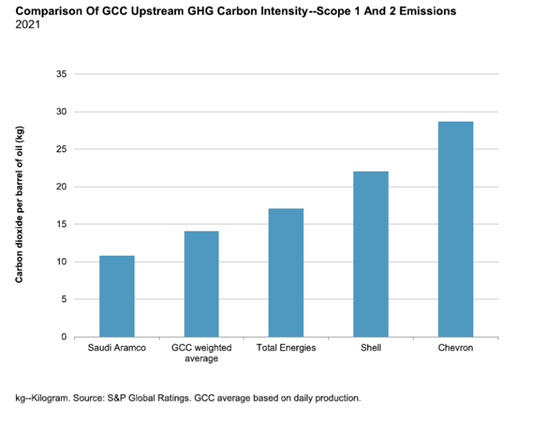

Some GCC countries are setting sustainability targets, but NOCs are yet to experience the implications. We estimate that NOCs have sufficient financial headroom to absorb strategic changes, including higher capex, and maintain credit quality for years to come. We consider their balance sheets able to withstand the financial impact, due to their competitive strengths compared with international peers. Gulf NOCs have abundant reserves and a cost advantage with operating costs lower than $10 per barrel. What's more, they enjoy overall shareholder oversight and support because the majority owners are highly rated sovereign nations, where NOCs are large revenue contributors and employers. NOCs already benefit from low upstream GHG intensity, since their reservoirs have low flaring rates and production releases a relatively small amount of water, thereby requiring less energy (see chart 2).

Chart 2

Combined, these factors provide a buffer against changes brought about by the energy transition and allow time for the companies to absorb the financial consequences. NOCs are embedding the energy transition in their long-term strategies, with announced targets and commitments that we view as positive for their credit profiles.

Credit Resilience Until 2030, All Else Being Equal

The GCC is highly exposed to the energy transition. Yet we expect the region's NOCs will have sufficient financial buffers and competitive advantages to absorb the incremental investments needed to adapt to the energy transition, and preserve their credit ratios, in the next three to five years.

While their strategies and announced initiatives indicate their commitment to adapting to the energy transition, how these NOCs will meet these targets remains unclear. The energy transition poses obvious financial and business challenges. Local stakeholders have reiterated the need for large financial buffers to preserve the NOCs' competitive advantages and transform them into renewables energy players while shifting away from oil and gas. Beyond the money to be invested, the measures of success will be in the execution of large projects and the accurate anticipation of global hydrocarbon demand trends, especially if demand peaks sooner.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.