Driving demand in the Canadian hydrogen market to meet the emerging supply

Clean hydrogen development is well underway in Canada as a low-carbon energy carrier that will help decarbonise the energy and transportation sectors and bring new industry and investment opportunities. Most incentive programs for hydrogen around the world deal with helping to lower the cost of supply for hydrogen. But what about helping crystallise the hydrogen equation's all-important demand side?

There are already incentives in place to encourage the production of hydrogen. Multiple levels of government have provided access to funding, financing and tax incentives supporting substantive capital costs. But where there is supply, there must also be demand. The current major risks and uncertainties for projects are with creating the market demand that will drive the supply, ensuring the financial success of hydrogen projects as they operationalise and commercialise.

With regard to generating domestic demand, there is the layered challenge of providing cost-competitive hydrogen concerning the global market. The potential to import hydrogen at a lower cost than domestic suppliers can match is very real. The US has seen tremendous investment from the Inflation Reduction Act, providing billions of dollars to hydrogen projects. As a result, businesses supplying and investing in, for example, US hydrogen hubs can now provide exported hydrogen at a lower price because their net cost of production, when combined with tax incentives and available funding, is lower.

On the demand side, consumers are in a less-supported position. They must make a sometimes- challenging decision to use hydrogen versus alternative decarbonisation options. There are limited government incentives for consumers in Canada who would like to adopt hydrogen fuel cells or higher-priced hydrogen substitutes for natural gas in cement manufacturing or other industries. At the same time as looking at the promise of hydrogen, they need to consider their retrofits, lifecycle costs, and the timing of such investments. And then there are the commercial considerations for hydrogen supply contracts, many of which are still forming in Europe and elsewhere. Key considerations will be volumes, timeframes, speed of delivery, reliability and price as factors that determine their purchasing decisions for hydrogen.

So, what can we do to facilitate consumer adaptation in this emerging market, and what strategies can businesses and governments implement to drive demand for this promising clean energy carrier? Here are three key drivers for demand in the Canadian hydrogen market:

- Bring suppliers and off-takers together to form hydrogen hubs

Hydrogen hubs – already being developed in the US and Canada, particularly Alberta - bring producers and consumers (supply and demand) together to form the foundations of a hydrogen economy. These hydrogen hubs are intended to reduce the risk of the “chicken and egg” effect. They can be either large-scale, around industrial cluster areas and city centers, or micro-hubs supporting small communities. Bringing hydrogen users together with a common goal of regionally decarbonizing solidifies the commitment to using hydrogen and ensures continued supply.

Within hydrogen hubs themselves, parties still need to come together commercially. Establishing partnerships between businesses with similar interests is also a strategy to consider. For commercial security, joint ventures between suppliers and the demand side, or that have strengths in different parts of the supply chain, are proving to be a way to lock in supply and demand. Hydrogen users share the benefits of being self-reliant for energy supply and can unlock an untapped revenue stream as a supplier to third parties as the economy grows.

- Develop commercial structures that incentivise demand and reduce risk

A large reason for the slower speed at which some hydrogen projects move forward is the uncertainty of hydrogen as the right solution and the timing of investments in this space.

Hydrogen suppliers must develop a commercial strategy early in the project, often in tandem with early concept studies. One part of a good strategy is to enable diversification of future off-takers to ensure financial strength and minimise single-party risk. Anchoring customers in key industries while supplementing the supply portfolio to include different sectors will bolster continued demand in varying markets. This includes industries such as cement, steel, ammonia, and hydrogen for the transportation market and blending opportunities with natural gas.

Project economics developed during early concept studies, and viability should consider the ability to scale the project to growing future demand, including from multiple parties in different industries.

Another way to drive demand is by offering incentives to consumers through fixed-price, long-term contracts, such as those available in the renewable natural gas (RNG) market. That helped propel rapid growth in the RNG sector across the Americas. For example, this might be for a portion of the total anticipated supply that will cover operating costs and allows demand-side businesses to make a strong business case for adopting hydrogen energy.

- Institute policy-level incentives to end-users and spur demand-side economics

Working directly with government to shape these policies is what the industry is presently doing. If end-users were similarly incentivised to purchase hydrogen (e.g. rebates for use, or grants for retrofits), this would drive demand from both end-users while enabling infrastructure which in turn creates further demand from suppliers.

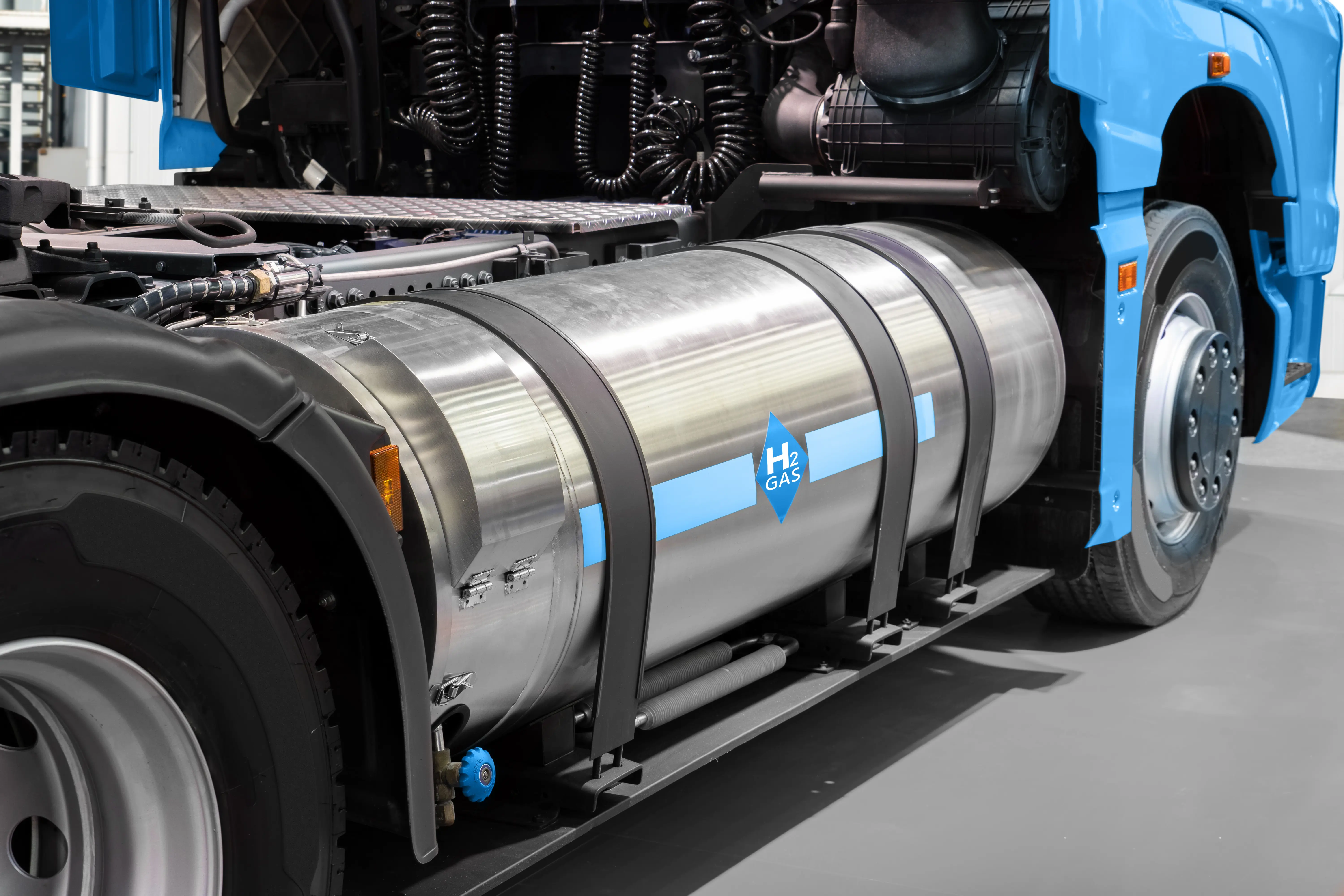

On the direct end-user demand side, specific, targeted rebates or tax credits for purchasing fuel cell hydrogen vehicles could make a huge impact on the industry that would then need to provide fuel for those vehicles. In fact, this demand-side lever could be targeted on, for example, heavy haul vehicles or long-distance transfer trailers. There is presently limited infrastructure in Canada to enable a hydrogen future in the heavy haul market – incentives for this segment to put fuel cell vehicles on the road would necessitate a matching response around demand, offering a primary decarbonisation opportunity.

When the Renewable Natural Gas (RNG) market was first emerging, we saw policy-level support with fixed-price contracts from the gaseous utility sector, particularly in Canada, to establish the demand side of the equation. This helped move the needle very quickly for RNG projects to get off the ground. The California low-carbon fuel standard is one great example of this, making the state the epicenter of a booming RNG industry. If the government were to employ a similar model for hydrogen, it would incentivise the consumption and production of hydrogen as a fuel and bring hydrogen to the forefront as a primary opportunity to decarbonise difficult-to-abate sectors.

The above three topics for spurring demand and addressing this key issue summarises what is possible. While there are different approaches to address the need to generate demand for hydrogen, it is important to look at ways to structure hydrogen producers’ business models to give them the best chance for success. Each project and opportunity is unique. Working with a consultant specialising in business advisory, project planning, and technical design brings immense value to projects early on. GHD can provide insights into project strategy and commercial structure with knowledge of highly technical considerations for design, construction, and operations of hydrogen projects across the value chain.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.