Controlling the course amid rising tides of inflation

Global supply chain disruptions and inflation have spiked service prices this year. From subsea to engineering, procurement and construction (EPC), and pipelines to wells, no sector has been immune to these cost challenges. Let’s digest what has happened and explore challenges and opportunities lined up for the next few years.

The subsea industry has seen inflation pick-up ahead of an expected demand surge

A significant growth in subsea equipment expenditure is expected across national markets, with Norway, Brazil, the US, Australia, and the UK leading the way. In the case of Norway, this projected increase will primarily be driven by subsea tieback projects on the Norwegian continental shelf (NCS). A significant factor bolstering demand is the Norwegian tax relief package, introduced in June 2020, as a temporary measure for the hard-pressed oil and gas industry. Faced with rising demand and operators rushing to secure orders, inflation in the sector will quickly follow suit.

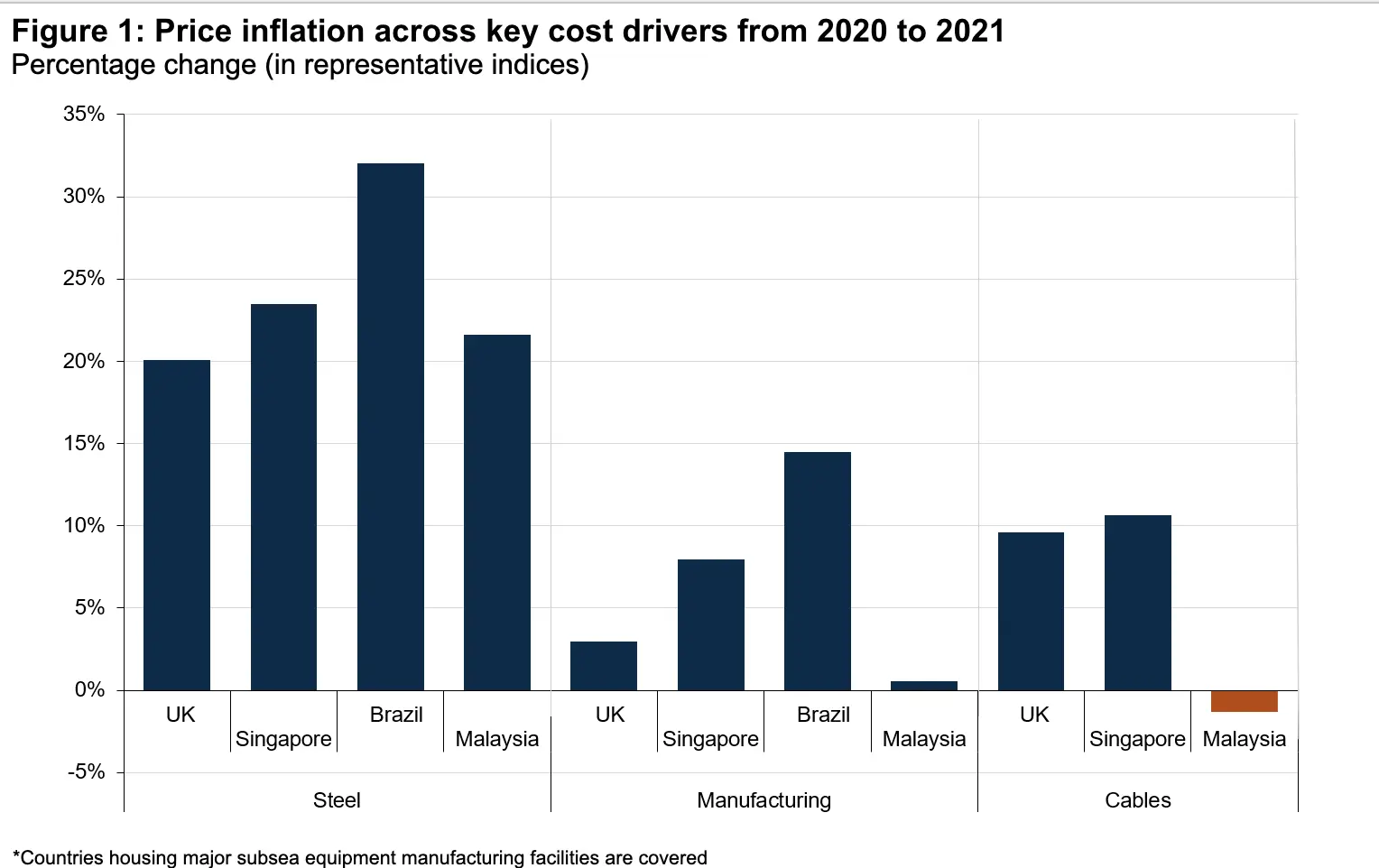

In the meantime, supply-side constraints continue to add to the inflationary pressure. The manufacturing capacity taken out of the market in response to the Covid-19-induced downturn will result in supply chain bottlenecks that could inflate costs. The closure of Aker Solutions’ Tranby manufacturing facility in Norway, for example, is set to remove a market capacity of about 60 christmas tree equivalents per annum. Key raw materials such as steel are seeing a meteoric rise in prices. As an illustration of the heavy inflation witnessed by steel products over the past year, Figure 1 details the change in prices for key cost drivers such as steel, manufacturing, and cables across the UK, Brazil, Malaysia, and Singapore. Since these countries house major subsea equipment manufacturing facilities, a rise in key material and manufacturing indices here will have a major impact on the final price for subsea equipment. Shipping prices have also soared to record highs, further adding to the inflation woes. According to Rystad Energy analysis, labor-related costs amount to about 30 percent of the final subsea equipment price. Wage increases in the industry, spurred by a persistent shortage of skilled labor, is therefore another key driver of inflation within the sector.

Figure 1: Price inflation across key cost drivers from 2020 to 2021.

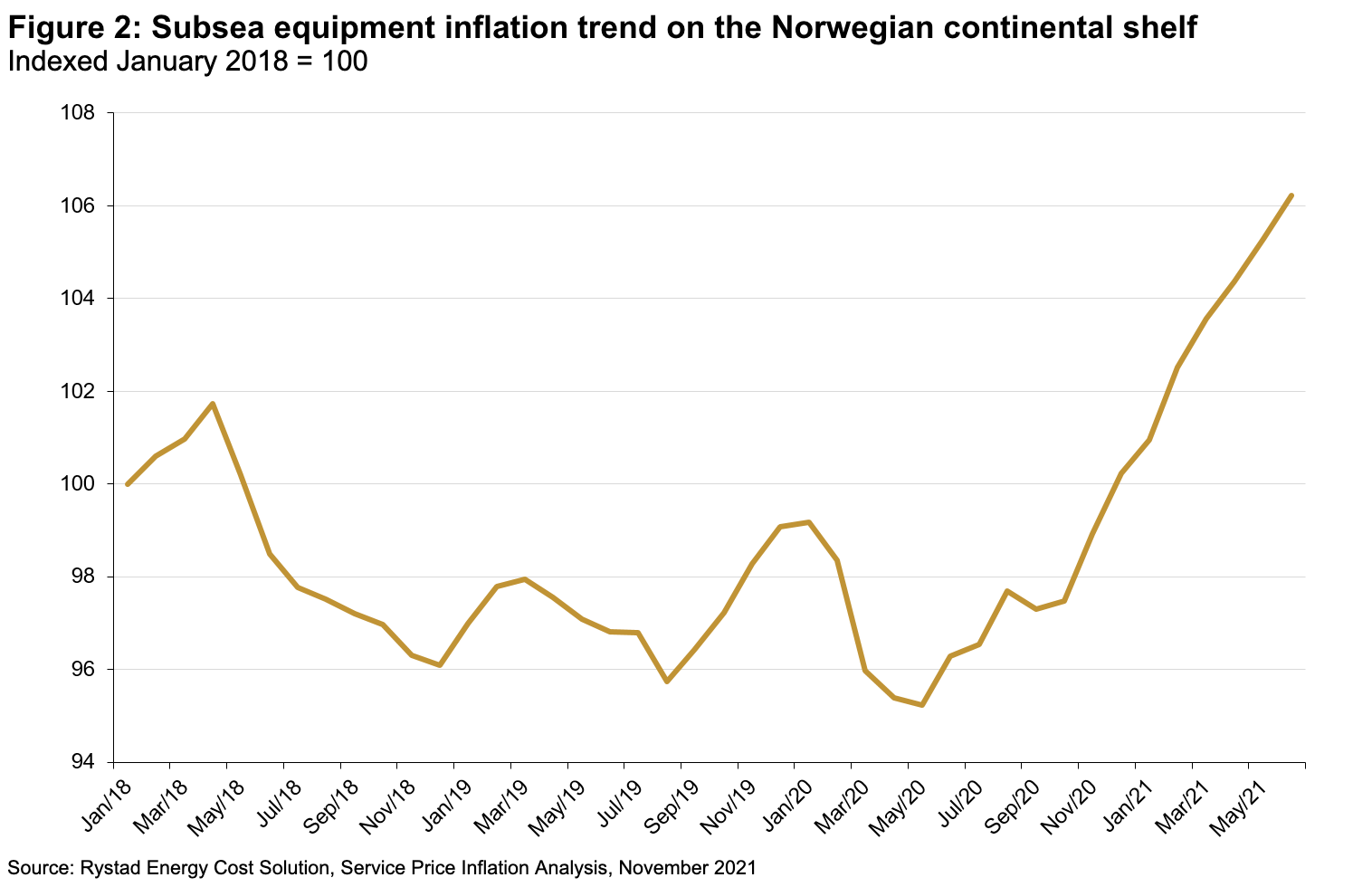

Figure 2 shows the steep escalation in inflation witnessed by the subsea equipment sector in the NCS region. In a market with high inflation and with waning pandemic effects, equipment suppliers may be in a position of power in relation to subsea operators. The subsea equipment market is heavily concentrated with a small number of key players accounting for the largest portion of the supply pie. Considering all factors, the sharp rise in subsea equipment prices seen over the past year is likely to continue.

Figure 2: Subsea equipment inflation trend on the Norwegian continental shelf

European EPC contractors can battle rising costs

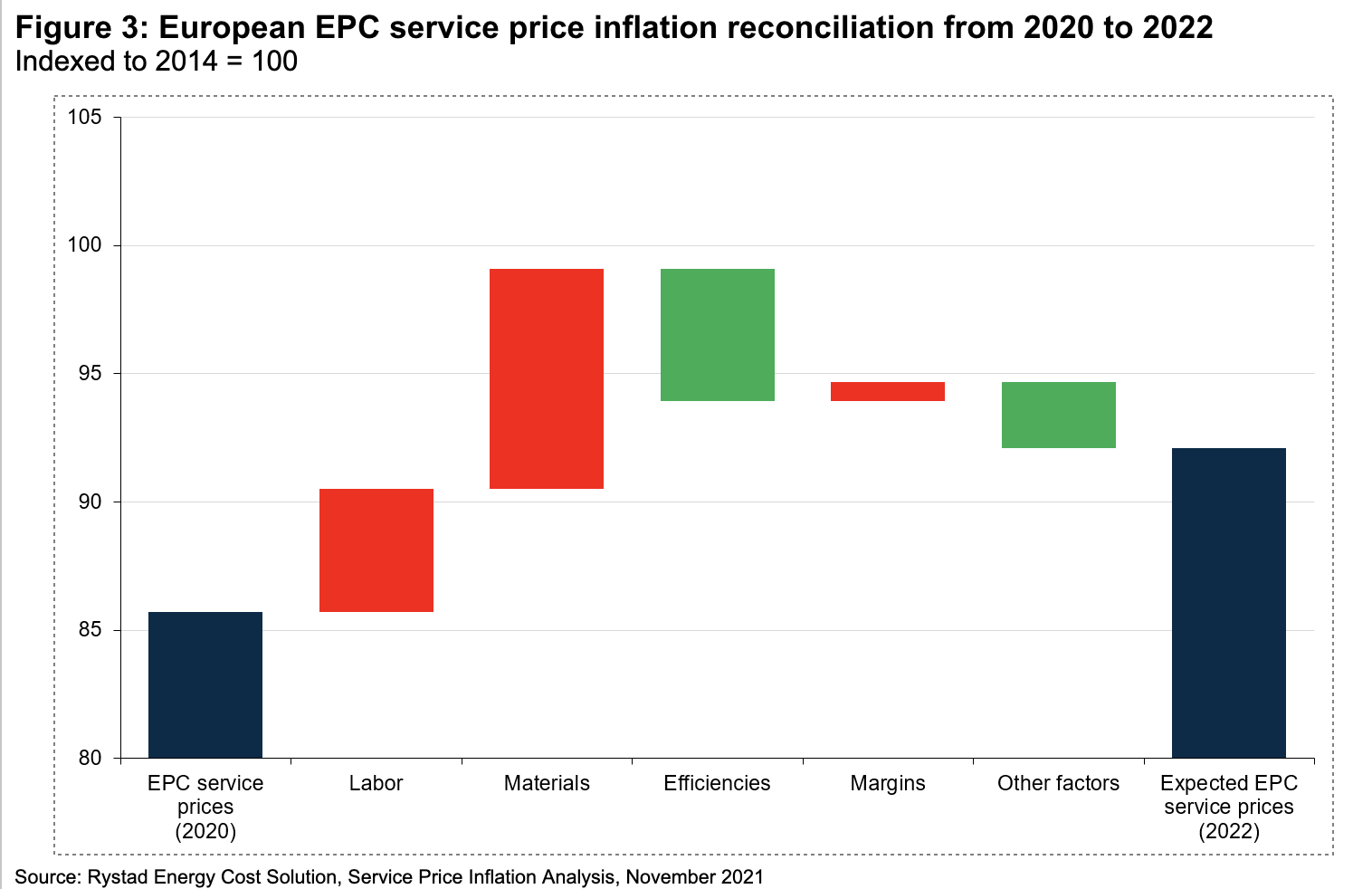

As we look beyond the coming year, some price relief can be expected for EPC prices. In a race to lock in onshore construction service contracts, European oil and gas onshore construction prices will continue to increase in 2022. On just one side of the North Sea, Norwegian construction laborers will see a 34% increase in oil and gas project demand from 2022 to 2024. However, we expect these prices to level off and to start declining in 2023 as most operators that submitted plans in the region availing of the new Norwegian tax structure will have locked in contractors by then. That year will also likely see lower demand from the oil and gas industry coupled with an easing of execution uncertainty due to the Covid-19 pandemic. This should help service companies recapture some of the efficiencies lost while navigating the pandemic-hit market and should allow for some cost offsets against rising material and labor costs. These efficiency gains will also enable some margin relief for service companies.

Figure 3: European EPC service price inflation reconciliation from 2020 to 2022.

Labor markets to challenge North American EPC prices

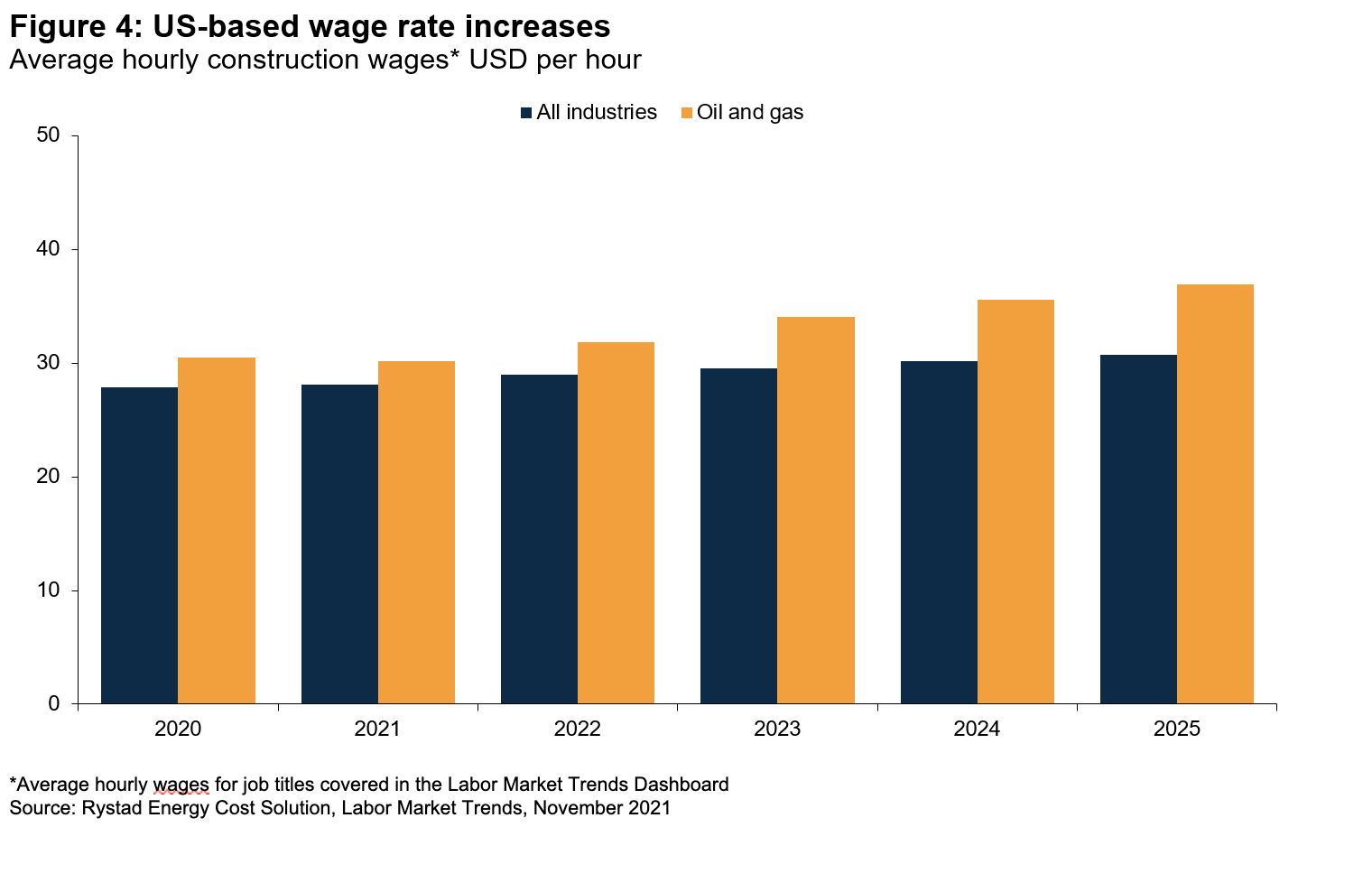

Jumping across the pond, North American projects in the construction phase are also challenged by the rise in costs. US construction wages across all industries are set to increase around 5% by 2023 relative to current levels. This trend is set to be more pronounced in the oil and gas industry, with increases expected to be closer to 15%. With construction services constituting nearly 50% of all EPCI costs and being primarily driven by construction labor costs, this could result in over $1 billion of additional capex being required for US-based oil and gas projects in 2023. Supply and demand imbalances within the labor market are boosting labor costs in nearly all industries.

Figure 4: US-based wage rate increases

If EPCI players fail to adapt to the rising costs, those executing lump sum contracts and using outdated assumptions for procurement and construction indices will see their margins squeezed. To mitigate the effects of rising costs, contractors will need to be creative with how they source engineering and procurement services. EPCI players have, in the recent past, increasingly started using high-value engineering centers to carry out a higher percentage of design work, especially as remote working has become more prevalent. On the procurement front, companies are also seeking out and validating new suppliers in lower cost regions to keep projects economically viable. EPCI players can also minimize risk by employing contracting strategies that tie some aspects of a project’s cost to independent indices, thereby enabling the risk posed to the cost base by unforeseen market forces to be shared between the contractor and the project owner.

Pipelines and wells teach us that in the face of inflation, scope is (still) king

Right of way costs have historically been largely limited to nearly 5% of total project costs across most regions. However, given the boom in renewable projects and shift in government sentiment, especially in regions like North America, it may not be surprising to see these costs also escalate in the coming years. The most prominent example of this shift in government attitude is the cancelled $7 billion Keystone XL pipeline by the US government. While re-routing the pipeline through more favorable areas ecologically is an obvious solution to mitigate environmental concerns, a change in topography can lead to major cost hikes. For instance, our Onshore Pipeline Cost Estimating Dashboard suggests rock clearing costs can more than quadruple for a pipeline stretch covered by solid rock instead of common rock. Similarly, a pipeline passing through a semi-urban setting instead of a rural setting could be around 30% more expensive.

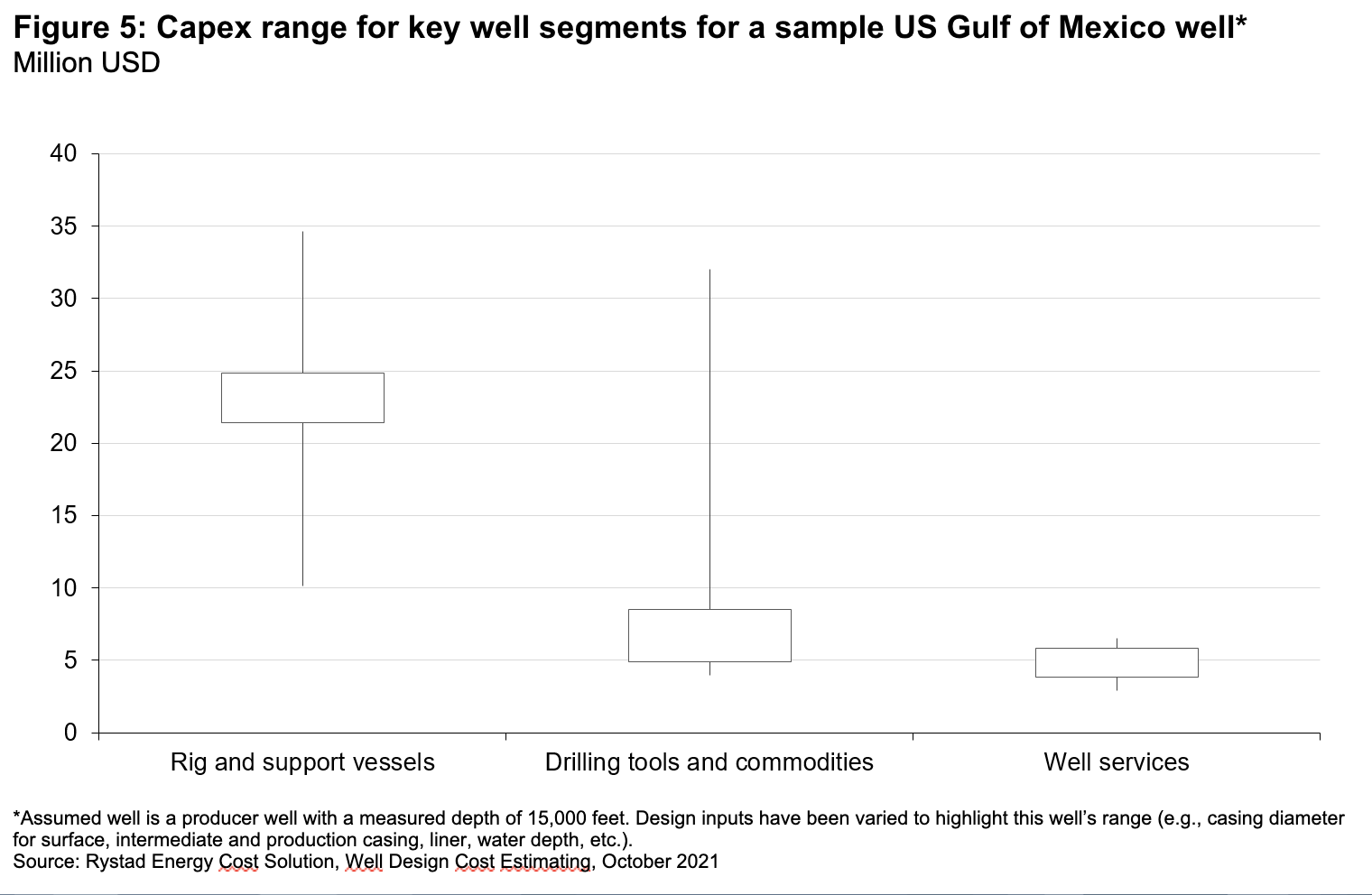

Well costs have risen led by a surge in oil country tubular goods (OCTG) prices, which for some grades have increased more than 50% above early 2020 levels. This is due to a steep increase in iron ore prices, supply chain bottlenecks caused by the Covid-19 pandemic, and the removal of tax rebates for OCTG from major export markets such as China. This has been a major source of concern for procurement teams as OCTG can easily account for more than 50% of drilling tools and commodities costs. While the worst now seems to be over for OCTG cost inflation, we still see upside potential for prices, especially in major export hubs such as China, where a combination of factors – among them an increase in global shipping charges, a reduction in materials sourcing and production due to an ongoing electricity crisis, and the possible introduction of an export tax – could keep prices high. As shown in Figure 5, Rystad Energy’s Well Design Cost Estimating tool gives a good reminder that despite material price increases, scope changes have a far greater impact on project cost performance.

Figure 5: Capex range for key well segments for a sample US Gulf of Mexico well*

Managing inflation to focus on what matters

While owners executing under reimbursable cost and unit rate contracts will pay for market-related cost increases directly, those executing under lump sum contracts will likely see other more indirect adverse effects. Although rising costs may not necessarily hit owners’ balance sheets directly, if contractors are not sufficiently prepared to deal with such increases, overall project metrics, such as start-up timing and plant quality or reliability, may be challenged. Owners and service players alike can, therefore, benefit from tying contracts to independent indices. Transparency surrounding cost increases due to market forces will enable a smoother change management process while also giving owners the opportunity to share in cost decreases indicated by the market. Understanding the impact of future service costs can help owners manage projects more effectively. It can also improve the long-term health of the service sector, which is critical to the future development of oil and gas projects as a larger and more competitive contractor pool is likely to lead to higher quality project execution and lower overall costs.

Energy Connects includes information by a variety of sources, such as contributing experts, external journalists and comments from attendees of our events, which may contain personal opinion of others. All opinions expressed are solely the views of the author(s) and do not necessarily reflect the opinions of Energy Connects, dmg events, its parent company DMGT or any affiliates of the same.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.