Energy Milestones of the Year

Heading into 2026, we examine the forces reshaping global energy following an eventful 2025. Last year saw tariffs and geopolitical shifts tighten their grip on prices and supply chains, while record temperatures pushed grids to their limits. However, 2025 also marked a turning point: LNG infrastructure expanded rapidly, European carbon capture projects reached scale, and critical minerals became a primary strategic focus.

These shifts coincide with a high-level recalibration across the industry. As major industry players undergo leadership changes, production strategies are being rewritten to address both climate goals and surging demand. The energy markets of 2026 must navigate this volatility while committing to a deeper transformation. Together, these developments define an era where energy security and long term sustainability are no longer separate goals, but a common priority for the industry.

US ANNOUNCES GLOBAL TARIFFS

WHAT

US President Donald Trump announced broad levies, subsequently modified by various bilateral deals and unilateral impositions.

WHEN

Levies were announced by the US President on 2 April 2025

WHAT'S THE IMPACT?

Brent crude prices plunged by $10 per barrel overnight following the announcement, reflecting an immediate market shock that increased uncertainty among traders.

60%

Although inflation in the US has remained elevated raising concerns about consumer spending and monetary policy, both the US and global economies have remained resilient. Economic activity, along with oil demand, continued to perform better than initially feared. However, trade frictions and uncertainties could continue to influence prospects moving into 2026, thus shaping the trend for growth, energy markets, and global supply chains.

FLARE UP IN THE MIDDLE EAST

WHAT

Israel and Iran fought their first direct war after decades of hostility.

WHEN

13 to 24 June - with Israel attacking Hamas leaders in the Qatari capital of Doha on 9 September and a shaky ceasefire in Gaza from 10 October.

WHAT'S THE IMPACT?

Fears of energy disruptions were mostly not borne out, and the oil market remained fairly relaxed. Apart from some damage to a refinery in Israel and oil storage in Iran, energy infrastructure was spared. Iran did not attempt its last resort of “closing” the Strait of Hormuz. Houthi forces in Yemen continued to threaten Red Sea tankers throughout the year, but the winddown of hostilities in Gaza suggested that normal shipping might be able to resume gradually. However, after the surprise attack on Doha, expectations remain that Israel is likely to launch another round of fighting in 2026. Iran’s regime also faces internal pressures from discontent and economic and environmental failure.

CCS ADVANCES IN EUROPE

WHAT

Norway’s Brevik CCS project started operating in June 2025, kicking off the Longship fullscale value chain. Several other Carbon Capture and Storage (CCS) projects in Scandinavia, the UK and Belgium also took final investment decisions in 2025.

WHEN

June 2025

WHAT'S THE IMPACT?

A more supportive European policy environment is finally seeing CCS establish itself as a key part of decarbonizing heavy industry, bioenergy and waste management operations. This growing momentum is critical not only for meeting the continent’s long-term net zero commitments, but also for safeguarding the competitiveness of Europe’s industrial base as climate standards tighten. It also helps address longstanding concerns from environmental groups by demonstrating that CCS can play a practical, accountable role in reducing emissions.

RUSSIA SANCTIONS AND GLOBAL OIL MARKET

WHAT

Russia’s oil sector came under intensifying pressure, from Ukrainian attacks on the one hand, sanctions on the other.

WHEN

On 27 August 2025, the US imposed an additional tariff on India over its continuing purchase of Russian oil, and the EU brought in additional measures. On 22 October, the US sanctioned Lukoil and Rosneft, forcing them to begin a sale of their international assets, and it blocked a planned sale by Lukoil to Gunvor.

1.5

million

Throughout the year, Ukraine attacked Russian oil installations with drones and missiles, at first mostly refineries, then broadened to terminals, pipelines and tankers.

WHAT'S THE IMPACT?

The refinery attacks tightened product markets, particularly for diesel, and forced Moscow to impose bans on refined product exports. Russian exports, particularly through the Black Sea, fell in November, and total production was about 500,000 bpd below the OPEC+ allowable level. With stalemate on the battlefield, a ceasefire still seemed far off.

IEA RETHINKS OIL DEMAND SCENARIO

WHAT

The International Energy Agency’s (IEA) September report highlighted the issue of field production declines, and its November outlook brought back a “current policies” scenario in which global oil demand would keep rising to 2050.

WHEN

September 2025

WHAT'S THE IMPACT?

The IEA report did not actually reverse its earlier scenarios of peak oil demand around 2030, despite many media reports. However, it did show how sensitive this is to assumptions about electric vehicle penetration, petrochemical demand and emerging market energy needs. Importantly, it highlighted the vulnerability of oil and gas markets to sustained underinvestment. If investment levels fail to keep pace with future demand, the resulting supply constraints could trigger significant price volatility and potential spikes in the 2030s, creating challenges for both producers and consumers navigating the energy transition.

LNG SURGE EXPECTED

WHAT

Global liquefied natural gas (LNG) supplies gained strongly from October 2025. 2026 will see the full ramp-up of plants such as LNG Canada and Golden Pass LNG, and the startup of Qatar’s North Field East (NFE) expansion in Q3.

WHEN

October 2025 into 2026

WHAT'S THE IMPACT?

LNG supply is projected to rise strongly in 2026, with a forecasted increase of roughly 7% - equivalent to about 40 BCM - as a wave

of new liquefaction projects comes online and existing facilities continue to raise output. This influx of supply will place additional downward pressure on European and broader international gas prices, even as US Henry Hub prices edge higher due to domestic market dynamics – thus resulting in tighter margins for exporters. Although these market shifts are not expected to trigger US LNG shut ins during 2026, the prevailing price environment will still fall short of covering full cycle project costs, particularly for newer or higher cost facilities.

Europe, meanwhile, will continue to benefit from gradually easing prices, but full relief from the exceptionally high post Ukraine invasion levels may not materialise until 2027-28, when the bulk of new global LNG capacity is fully operational and supply-demand balances improve.

IN NUMBERS

7%

projected rise in LNG supply in 2026

14%

projected rise in LNG supply in 2026

$462 million tonnes

amount raised in private funding

42 million tonnes

forecasted increase in LNG trade volume forecasted in 2026 (S&P global)

MIXED OUTCOMES AT COP30

WHAT

The 2025 United Nations Climate Change Conference (COP30) in Belém, Brazil - the “COP of Implementation” - delivered some progress, but also some disappointment.

WHEN

COP30 was held in Brazil in November 2025

WHAT'S THE IMPACT?

COP30 focused heavily on climate finance, with countries agreeing to triple global adaptation funding by 2035 to help vulnerable nations manage rising climate impacts. Delegates also debated how trade policy - tariffs, supply chain rules and green industrial strategy - can speed up or hinder climate action. A key outcome was a dedicated fund to protect tropical forests, recognising their value for biodiversity and carbon storage. However, many activists criticised the final agreement for lacking a clear, actionable plan to phase down or phase out fossil fuels, and said commitments did not match the urgency of the crisis. Despite being held in the Amazon (Belém), they also raised concerns that halting deforestation was not firmly secured.

EMERGING MARKETS DRIVE EVS

WHAT

The US terminated electric vehicle tax credits on 30 September 2025, and the European Union (EU) watered down its 2035 ban on new internal combustion engine sales on 16 December.

WHEN

30 September 2025

WHAT'S THE IMPACT?

Electric vehicle (EV) sales have dipped in the United States since 2024, reflecting consumer concerns over charging infrastructure, vehicle prices and policy uncertainty. However, more than a quarter of worldwide car sales in 2025 were electric, reflecting strong momentum for the industry.

9

million

While China leads in overall volume, emerging markets such as Vietnam, Indonesia and Thailand have seen their share of EVs surge, owing to supportive policies and lower cost models that are accelerating adoption among buyers. While Chinese EV exports to Organistion of Economic Cooperation and Development (OECD) countries have remained low since mid 2023 due to rising trade barriers, their shipments to non OECD markets have tripled, reshaping global EV supply chains.

NEW LEADERSHIP AT BP

WHAT

BP’s CEO, Murray Auchincloss, has been replaced by Meg O’Neill of Woodside, who will take over in April 2026.

WHEN

It was announced in December 2025 that Auchincloss would step down as CEO, after less than two years in the role.

WHAT'S THE IMPACT?

After focusing his strategy on steadying the BP ship following the surprise departure of Bernard Looney in September 2023, Murray Auchincloss’s strategic direction focused on growth, traditional oil and gas, and the Middle East. In December 2025, BP sold 65% of its stake in lubricants unit Castrol for $6 billion, a key divestment target. But BP’s lagging valuation and high debt load, relative to peers, shows just how tough it will be for the venerable British major to revive. Auchincloss will continue to serve in an advisory role until late 2026, with Carol Howle serving as interim CEO until O’Neill takes over in April.

Looking ahead at 2026

CRITICAL OPEC+ POLICY DECISIONS

WHAT

OPEC+ is expected to decide on the next phase of its production policy, possibly at its March 2026 meeting.

WHEN

March 2026

WHAT'S THE IMPACT?

The group could decide to keep production levels flat, cut back output, or continue with the 2025 approach of steady increases. A large market oversupply is expected in 2026, even if it is unlikely to reach the 3.84 million bpd forecasted by the IEA.

103

million

Despite this, OPEC+ is still expected to pursue a relatively assertive production increase policy, as long as Brent prices don’t dip below the $50 mark. Saudi Arabia is particularly focused on resetting production baselines, while slowing US shale growth gives the group additional room to manage supply without losing market share.

RECORD HEAT IN 2026

WHAT

While 2025 was the second-hottest year on record behind only 2024, 2026 is expected to be slightly cooler than 2024, but hotter than 2025 - and 2027 seems set for another record.

WHEN

2026

WHAT'S THE IMPACT?

The world has temporarily exceeded the 1.5°C warming threshold outlined in the Paris Agreement, highlighting how quickly climate risks are intensifying. Various factors, particularly the drop in sun-blocking sulphur emissions from marine fuel, and the hangover from a strong El Niño in 2023, may explain the recent surge in warming. As temperatures continue to rise, extreme weather events such as hurricanes, floods and prolonged heatwaves are expected to worsen. Heatwaves in 2025 triggered sudden spikes in gas and electricity demand, underscoring the growing strain on global energy systems.

GREEN HYDROGEN AT NEOM

WHAT

Saudi Arabia’s NEOM Green Hydrogen Project is expected to start commissioning in mid- 2026.

WHEN

Mid 2026

WHAT'S THE IMPACT?

China beat its national target for green hydrogen capacity, reaching more than 200,000 tonnes in 2025 and demonstrating rapid progress in scaling low-carbon fuels. Saudi Arabia’s NEOM Green Hydrogen Project is expected to produce around 220,000 tonnes annually for conversion into green ammonia and will exceed China’s output on its own once fully operational. Combined with progress on smaller projects in Europe and Oman, this will help broaden the global footprint of green hydrogen, giving it a chance to prove both its technical reliability and commercial potential, albeit on a far more modest scale than the early hype seen in 2021.

NEW REGIONS FOR DATA CENTRES

WHAT

US data centre growth could hit a ceiling, when air-conditioning loads peak in 2026.

WHEN

Summer 2026

WHAT'S THE IMPACT?

Sustained inflation and soaring electricity bills threaten a backlash against data centre construction in several states. The administration’s hostility to renewables limits its options, while natural gas supplies are stretched by the start-up of new LNG export plants.

$150

billion

State moratoria on new data centres will become popular. This could make alternative locations increasingly appealing for companies considering where to build new facilities, especially in regions offering lower costs, supportive regulation and strong energy infrastructure. Gulf countries such as Saudi Arabia and the United Arab Emirates (UAE) could potentially benefit, as they have been actively positioning themselves as competitive industrial hubs with reliable energy supplies, streamlined permitting processes and ambitious economic diversification strategies.

COAL IN CHINA REACHES PEAK CONSUMPTION

WHAT

Coal consumption recorded a year-on-year fall in 2025, and emissions are expected to be flat. The government appears to expect a coal peak by 2027, and a drop in emissions by 2030.

WHEN

China’s government expects coal to peak in 2027

WHAT'S THE IMPACT?

China’s rapid expansion of its solar, wind and nuclear capacity is reducing coal use in the power sector, while its economic slowdown has reduced steel and cement output, and electric vehicles continue their strong growth. At the same time, electric vehicles continue to surge in popularity, helping limit oil demand in transport. However, the ongoing expansion of China’s petrochemical sector is still driving additional oil consumption and associated emissions. As China accounts for roughly one third of global greenhouse gas output, its pathway to 2030 remains central to global climate progress.

FOCUS ON NEW MINERAL SOURCES

WHAT

US and Europe’s hunt for critical minerals moved up a gear, with new funding, tougher supply chain rules, and fresh partnerships aimed at securing reliable supplies for clean-tech and industry.

WHEN

From early 2026

WHAT'S THE IMPACT?

The US’s geopolitical manoeuvres - from pressure on Greenland and Venezuela to Ukraine–Russia negotiations - appear increasingly driven by the race for critical minerals. In 2026, this search is widening beyond rare earths, lithium, cobalt, nickel and copper to include minerals with military uses such as antimony, tungsten and gallium. Strategic investments are expected to evolve into concrete projects, with attention shifting from extraction alone to domestic processing and broader supply chain control. The new European Critical Raw Minerals Centre, launching in early 2026, will coordinate joint purchasing and stockpiling, while China is likely to respond with more export curbs and overseas investments, particularly in Africa. Growing “securitisation” of supply chains will also shape 2026, as governments treat mineral access as national defence, prompting new alliances focused on investment, technology sharing and reducing external dependence.

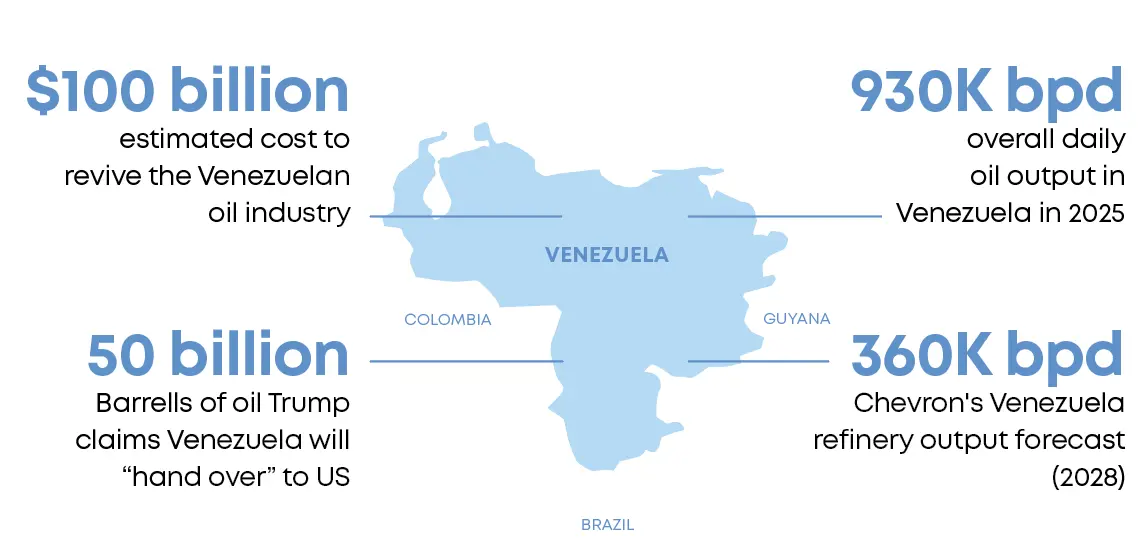

US INTERVENTION OF VENEZUELA

WHAT

Operation Absolute Resolve spelled disrupted leadership, captured crude exports and rerouted tankers, as part of a new deal spearheaded by US President Donald Trump.

WHEN

From 3 January 2026

WHAT'S THE IMPACT?

OPERATION LAUNCH

US military forces launched “Operation Absolute Resolve,” striking Venezuela, capturing President Nicolás Maduro, disrupting oil exports, and asserting control over Venezuelan energy assets, causing tremors in the global energy landscape.

303

billion

CARGO REROUTE

Following the capture of President Maduro with the intent of ensuring regional and global security, Venezue-lan-linked oil tankers were seized and rerouted, specifically those that serviced China - historically their biggest buyers of sanctioned oil.

POTENTIAL INVESTORS

For Venezuela to achieve its target output, President Trump estimated the total capital value required to revitalise aging infrastructure would amount to $100 billion. However, that would require a near-unanimous commitment to investing, and a complete overhaul of production facilities, refineries, tech and logistics systems. As such, the administration began issuing special licenses to select energy companies, enabling them to distribute Venezuelan cargoes under new regulatory conditions.

- Chevron

- Vitol

- Trafigura

- Repsol (in talks)

THE WHITE HOUSE MEETING

At a high-level meeting of the oil industry’s elite at the White House aimed at convincing prospective investors, several major oil companies expressed caution including Exxon Mobil Corp., whose assets had been seized twice in the past, deeming Venezuela “uninvestable”.

PRESENT AND FUTURE

Even early-stage rehabilitation is expected to cost upwards of $10 billion, to achieve an increase of only between 1 and 1.5 million bpd.