Rystad markets watch: global gas and LNG markets trade lower and react to Norwegian supply outage

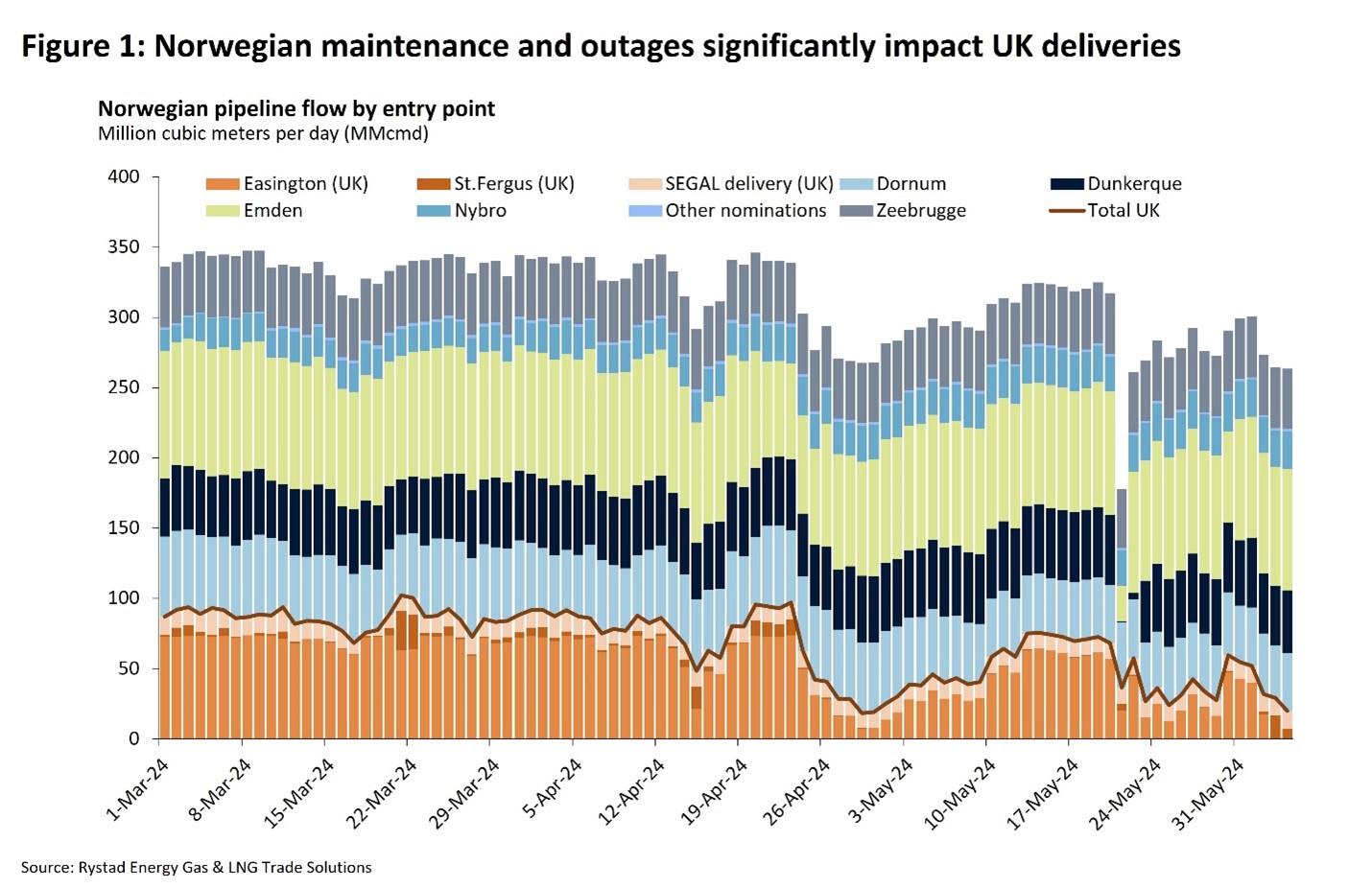

Prices on Europe’s Title Transfer Facility (TTF) and the UK’s National Balance Point (NBP) soared by 11.4% and 13.1%, respectively on 3 June, from the previous week’s closing prices following news of an unplanned outage at the Gassco-operated Nyhamna processing plant in Norway.

While Europe’s gas storage levels remain comfortable, pipeline flows continue to be fairly concentrated, keeping traders alert to news of unforeseen supply disruptions. However, market momentum has cooled over the course of the week due to high storage levels and record-low gas-for-power demand, according to Rystad Energy’s latest gas and LNG market update from analyst, Christoph Halser.

On 5 June, spot TTF gas prices closed at $10.677 per million British thermal units (MMBtu), down just 0.3% from $10.71 MMBtu on 29 May. Meanwhile, elevated gas-for-power demand in Asia persists, with spot liquefied natural gas (LNG) prices for July trading 1.4% higher week-on-week at $11.985 MMBtu on 5 June.

Nervousness in Europe

Markets reacted nervously on 3 June to news of an unplanned outage at the 80 million cubic meter per day (MMcmd) Nyhamna processing plant. The outage coincided with planned maintenance at Visund and Gullfaks, leading TTF futures to peak at around €38.6 ($42) per megawatt-hour (MWh), up 11.4% from Friday’s closing price of €34.64 per MWh. Meanwhile, NBP prices jumped to 93.78 British pence ($1.20) per therm, up 13.1% from the previous closing price of 82.95 per therm.

The extension of planned maintenance at the Gassco-operated Karsto processing plant appears to have contributed to the price spike, potentially trapping and squeezing some traders seeking coverage. Recent maintenance schedules and Nyhamna’s unplanned outage have impacted pipeline flow to the UK, which has received some of the lowest volumes from Norway since late April 2024.

In the context of a lingering supply halt of Russian gas following OMV’s recent market warning, European storage levels were comfortable at 79.93 billion cubic meters, or 70.62% of capacity, on 3 June. This was 1.5% higher than a year earlier and up 2.3% from the prior week. Norwegian flows declined 4.6% week-on-week to 263.5 MMcmd on 4 June, while Russian pipeline flows dropped by 7% over the same period to 95.3 MMcmd, down from 102.4 MMcmd the previous week.

In May, LNG deliveries to Europe fell to their lowest level since May 2022, down 7.4% at 8.52 million tonnes (Mt). Gas-for-power demand in Europe was muted in May, down by 25.9%, or 6 terawatt-hours (TWh) from a year ago. This was driven by a total year-on-year demand decrease of 16.6 TWh. As of 5 June, prices for LNG deliveries into north-western Europe were 1.4% lower week-on-week, at $10.5 per MMBtu.

On the policy side, Germany shared plans to exempt interconnectors from its gas storage levy laid on all gas infrastructure usage. The levy had been introduced earlier to recoup expenses accrued in efforts to fill underground storages since the 2022/23 winter season. Effective in January 2025, the measure will reduce costs for eastward gas flows from Germany into Central Europe, incentivizing diversification from Russian gas for countries such as Austria. Here, officials had previously objected to the storage levy, as it conflicted with EU single market rules. At €1.86 per MWh, the share of the gas levy peaked at 8% relative to Germany’s Trading Hub Europe (THE) prices in April last year.

Heatwave in Asia

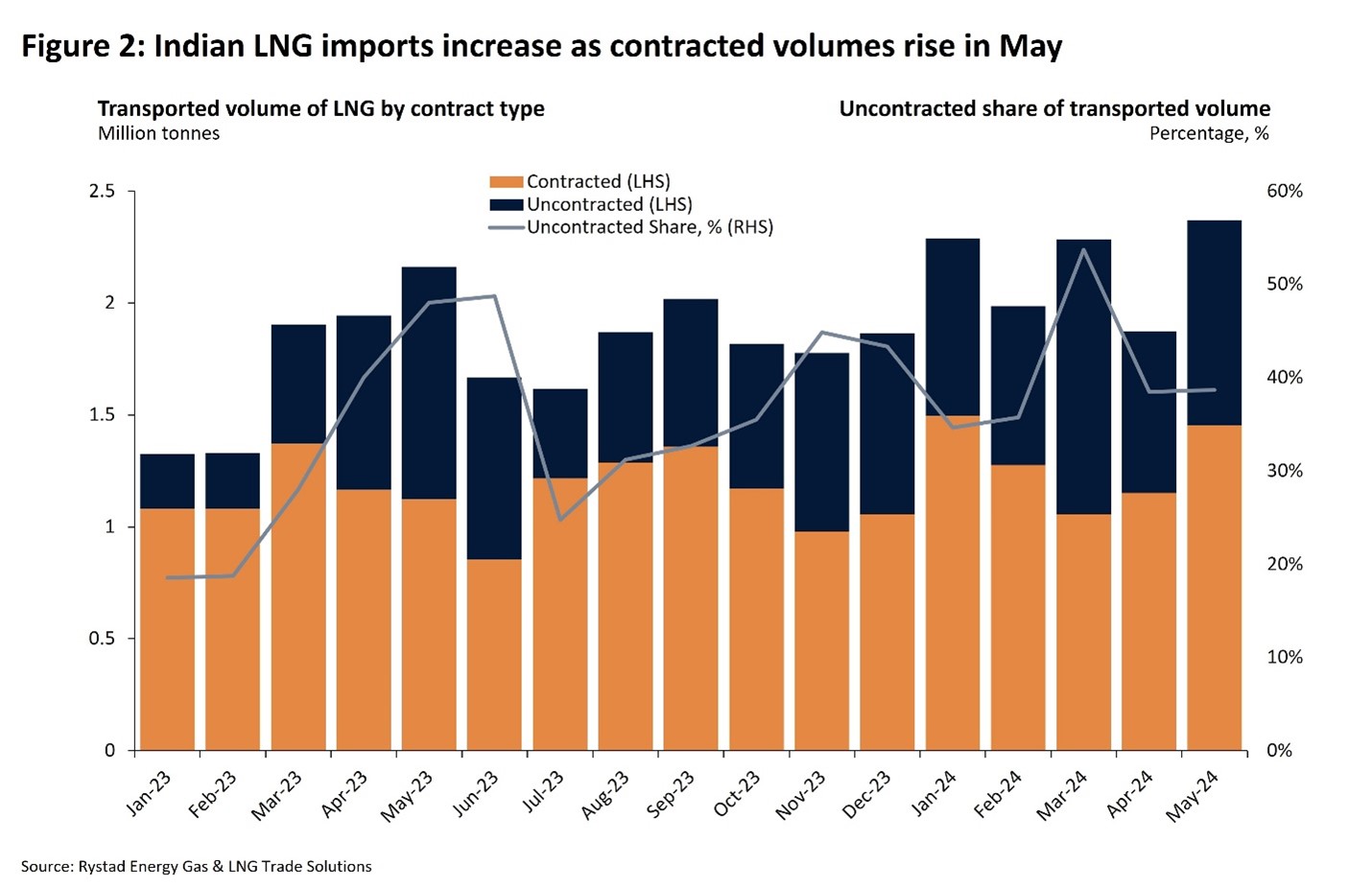

Driven by a heatwave in India, which have pushed temperatures in the north of the country over 50 degrees Celsius, gas-for-power demand surged last month, with overall power demand reaching a record 250 gigawatts (GW) on 30 May.

India’s LNG imports also hit a record 2.41 Mt in May, up from 1.87 Mt the prior month, with spot and contracted contributions rising equivalently. When 2.29 Mt was delivered in March this year, the share of spot deliveries amounted to 53.7%. However, increased contracting reduced the share of uncontracted volumes in May to 38.7%. While India’s LNG imports were largely supplied by Qatar, the month-on-month supply increase originated mainly from the US and Oman.

Heating demand in East Asia also remains elevated, with a 50% probability for above-average temperatures in South Korea between 3 and 23 June. Similarly, for Japan, the Japan Meteorological Agency foresees a 50.6% probability for an above-normal temperature occurrence between June and August, with the potential to drive up gas-for-power demand.

However, the agency’s short-term outlook until mid-June predicts mild temperatures. The International Monetary Fund (IMF) raised its GDP growth forecast for Asia to 5% for 2024, up from the 4.6% projected in April, driven by a strong first quarter and implemented policy measures. While supporting the industrial demand outlook, we also expect elevated temperatures for China in mid-June driving gas-for-power demand.

Downstream markets

In the downstream market, Japan's gas-fired Kimitsu Kyodo combined cycle power plant unit 6, with around 150 megawatts (MW) of capacity and co-owned by Japanese companies Jera and Nippon Steel, experienced an equipment failure on 31 May, limiting fuel usage from 4 to 5 June.

Jera's 420 MW Kashima Thermal Power Station Unit 7-3 had an equipment failure on 30 May but restarted later the same day.

Meanwhile, Chevron’s 5.2 million tonne per annum (Mtpa) capacity Gorgon LNG Train 2 in Western Australia resumed full production on 29 May.

In Brunei, LNG terminal operator Brunei LNG revealed on 28 May that work had started to restart compressor plants at its 7.2 Mtpa LNG facility following an outage earlier last month.

Thailand’s PTT and Philippines' First Gen issued tenders seeking July deliveries, while Japan's Tohoku Electric was seeking a late-August delivery cargo via a buy-tender with offers due 5 June, as manageable near-term temperatures do not drive much spot demand.

Meanwhile, Taiwan (China)'s CPC signed a 27-year contract with Qatar Energy for 5 Mtpa. French supermajor TotalEnergies signed a sales and purchase agreement (SPA) with Indian Oil Corporation (IOCL) for 0.8 Mtpa of LNG for ten years from 2026. TotalEnergies also signed a SPA with Korea South-East Power for the delivery of up to 0.5 Mtpa for five years from 2027.

The US situation

In May, dry gas production in the US decreased by 3.3% compared to the previous year, dropping to 100.1 billion cubic feet per day (Bcfd) from 103.56 Bcfd in May 2023. The decline followed low prices in February and March, however, increased prices observed over May are expected to attract drilling and boost production to 101.68 Bcfd in June, marking a 1.6% increase.

Meanwhile, US underground gas storage stands at nearly 2.8 trillion cubic feet (Tcf). This represents a 3.1% week-over-week increase, a 15.7% year-over-year increase, and is 26.5% above the five-year average. Gas consumption for power reached 36.94 Bcf on 3 June, an increase of 1.4% from 36.44 Bcf the previous week for the lower 48 states.

This rise is attributed to high temperatures and elevated demand for cooling. The heat dome, previously standing over Central America and large parts of Mexico, is moving north into Texas, California, Nevada, Utah, and Arizona, further increasing demand for gas-fired power generation.

In South America, Brazilian state-run giant Petrobras resold an LNG cargo to Argentina, alleviating gas shortages and allowing Argentina to restore regular supply. The proximity and existing agreements with Petrobras facilitated the quick resolution of the supply imbalance. Driven by decreasing production over elevated demand for power and after a week of elevated price volatility, Henry Hub futures climbed to $2.76 per MMBtu on 5 June, up 3.7% from previous week’s numbers.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.