Rystad: $20 billion to flow into European offshore substations this decade

Offshore wind installations are gathering pace worldwide leading to the need for reliable, accessible infrastructure to bring the generated power onshore and into the electricity grid. As a result, demand for offshore substations is booming, especially in Europe, according to Rystad Energy research and modeling.

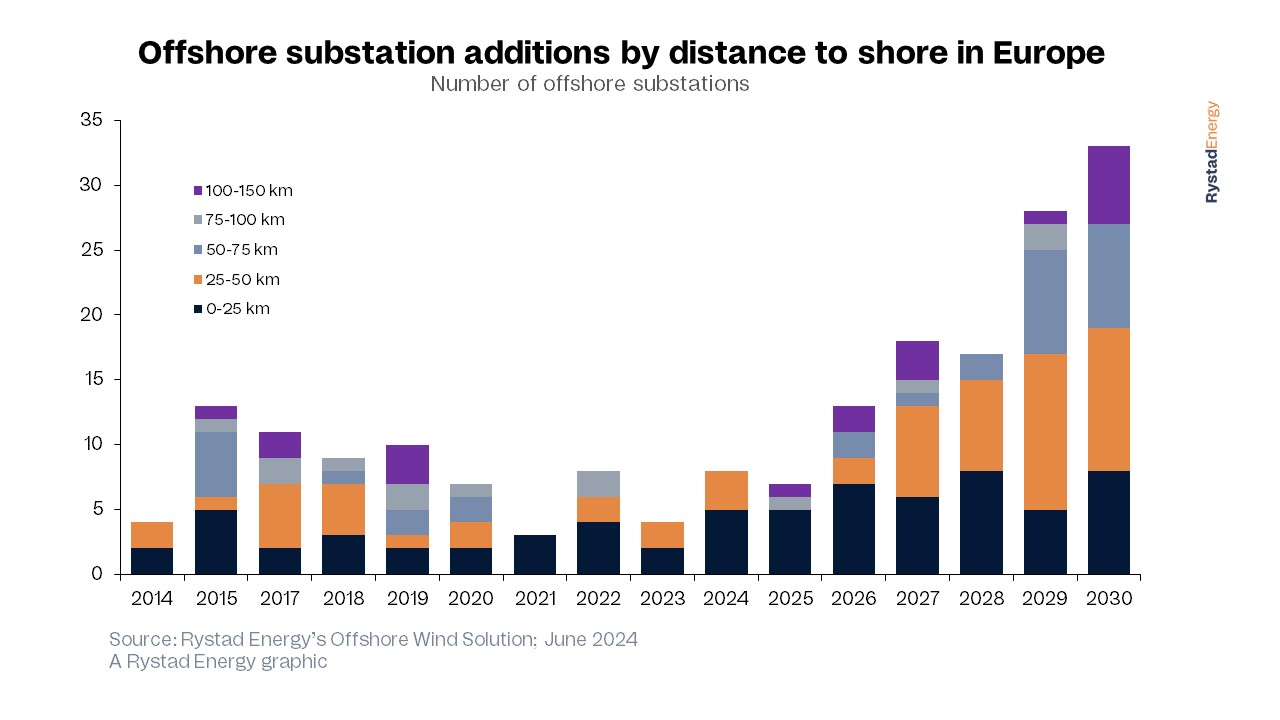

New research by Rystad Energy shows that 137 substations will be installed offshore continental Europe this decade, requiring $20 billion in total investment. More than 120 of these facilities will be installed between 2024 and 2030 at a cost of around $18 billion. As such, annual spending on offshore substations will increase steadily through 2030, rising from an average of $1.4 billion per year from 2015 to 2023, to a new high of $8.4 billion in 2030.

The benefits of offshore substations

Substations are crucial in the offshore wind industry as they collect power generated by wind turbines, increase the operating voltage and transmitting the power to shore. The primary electrical system of an offshore substation includes switchgears, transformers or converters, a reactive power compensation system and an earthing system. Offshore substations are particularly beneficial for projects over 200 megawatts (MW) in capacity and located more than 15 kilometers (km) from shore, as they help minimize power transmission losses. They are also valuable for other energy initiatives, such as electrifying offshore oil and gas production platforms.

The surge in substation developments is being fueled by the increased scale of offshore wind projects and their distance from shore, with projects exceeding 1 gigawatt (GW) of capacity requiring multiple substations. Many European countries have set ambitious offshore wind installation goals which are set to transform the continent into a hub for substation activity.

Europe set to double its capacity

Europe is set to install eight new offshore substations in 2024 alone, double last year’s number. This year, new offshore substations will be confined to wind projects located within 50 kms of the coast. However, in the latter half of this decade Rystad expects a notable uptick in offshore wind installations beyond the 50-km mark, driving more need for offshore substations.

According to Rystad Energy, the world will see a substantial increase in spending in the offshore substation market this decade. This is linked to growing installed capacity in Europe and will be further amplified when floating wind technology takes off. Floating wind turbines are situated far from shore, meaning we could see the first floating substations in the early 2030s.

Offshore substations can be divided into two sub-components: the topside, which contains the main electrical power system, auxiliary systems and the topside housing; and the foundation, which holds the weight of the topside structure. Jackets – fixed to the seabed with piles at each leg – have been the preferred foundation concept for most offshore substations since they can support wider and larger structures. However, some projects have also used monopiles driven directly into the seabed.

An offshore substation’s topside can be large in terms of length and width and is much heavier than a wind turbine. Of the nearly 100 offshore substations installed in Europe between 2014 and 2016, jackets held an almost a 70% share, with monopiles accounting for less than a quarter.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.