The changing dynamics of global oil markets: BRICS+ and the new energy order

The world of oil markets is witnessing a significant transformation, with Brent oil prices surging past the $90 per barrel mark with Saudi Arabia extending its voluntary production cuts until December. Historically, higher oil prices have spurred US tight oil production growth, making the United States a powerful swing producer, however, the dynamics are shifting in 2023. A lower growth rate from the US opens new opportunities for OPEC member nations, making it easier for this group to regulate the market. In short, OPEC is starting to take back control of the oil market. This article delves into the changing landscape of the oil industry, the reduces role of US tight oil as a swing producer, and the emergence of BRICS+ (Brazil, Russia, India, China, South Africa, Saudi Arabia, UAE, Iran, Egypt, Argentina, and Ethiopia) as a formidable player in global energy markets.

For years, US tight oil played a pivotal role in global oil markets, with production expanding during periods of high oil prices and declining during downturns. However, despite the rising oil prices since 2020, production growth has been subdued. The key reason behind this change is the shift in strategy among shale producers. Instead of prioritising production growth, companies now focus on value creation and returning profits to shareholders.

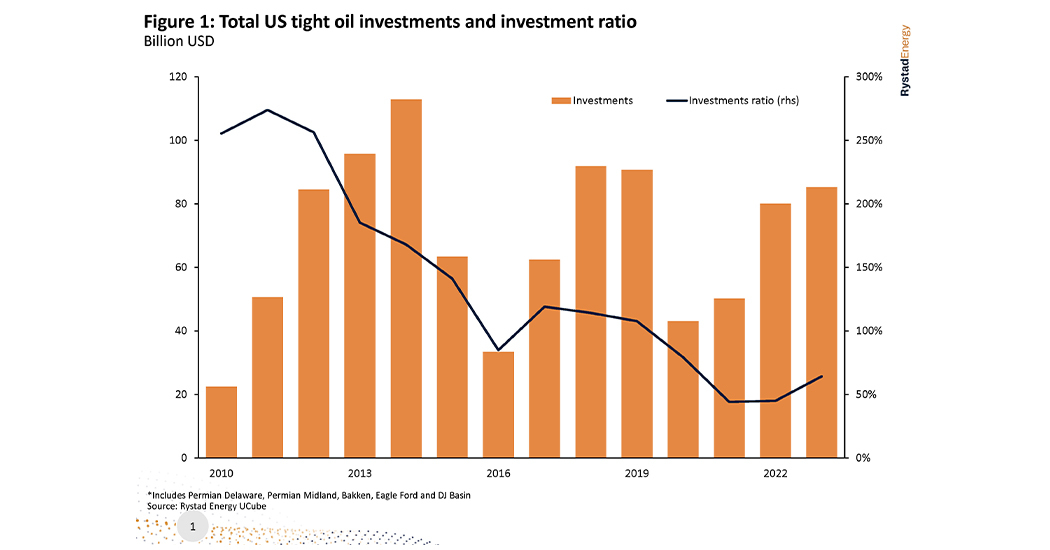

Examining the development of tight oil spending and investment ratios, we notice companies over investing between2010-2015, relying on external financing to support capital expenditure. From 2016-2020, most companies adopted a cash-neutral model, aligning investment with cash from operations. Following which the investment ratio dropped below 50% in 2021 and 2022, indicating a conservative approach. This conservative stance makes US tight oil less sensitive to oil price fluctuations, reducing its role as a swing producer, with Tight oil no longer responding rapidly to price increments, affecting its ability to balance global oil markets.

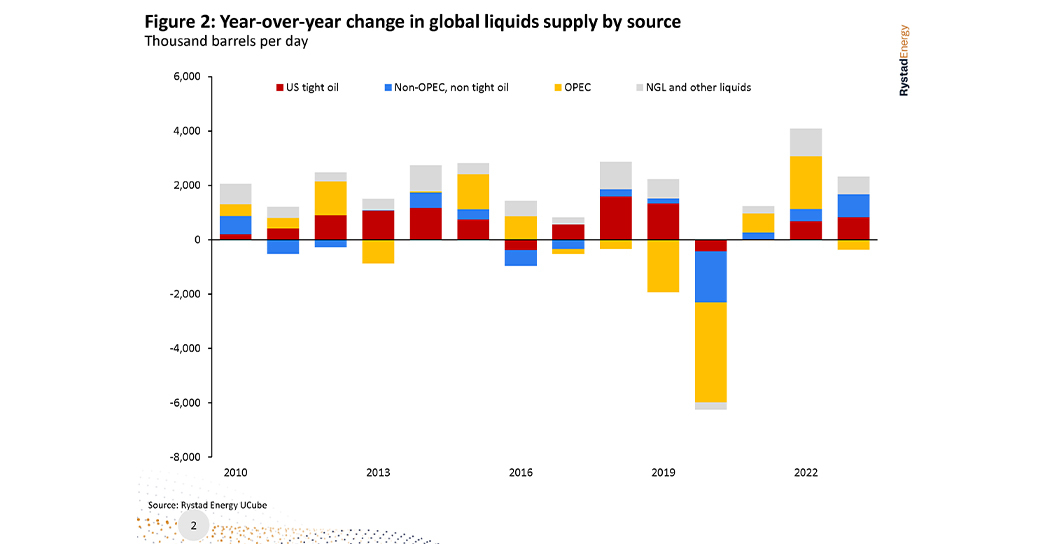

With tight oil producers changing their focus and becoming an insignificant swing producer, the key question now is – who, if any, will balance the oil market going forward? The natural answer to this will be the OPEC member countries. These nations saw US tight oil as their main competitor for market share and influence. OPEC members did start a volume war with tight oil back in 2015, when they pushed oil prices down by increasing output in an already oversupplied market. With oil prices collapsing in 2020, OPEC members came together, along with some other key producers and helped stabilize the market by voluntary supply cuts. This year, OPEC, particularly Saudi Arabia, has cut production to boost prices.

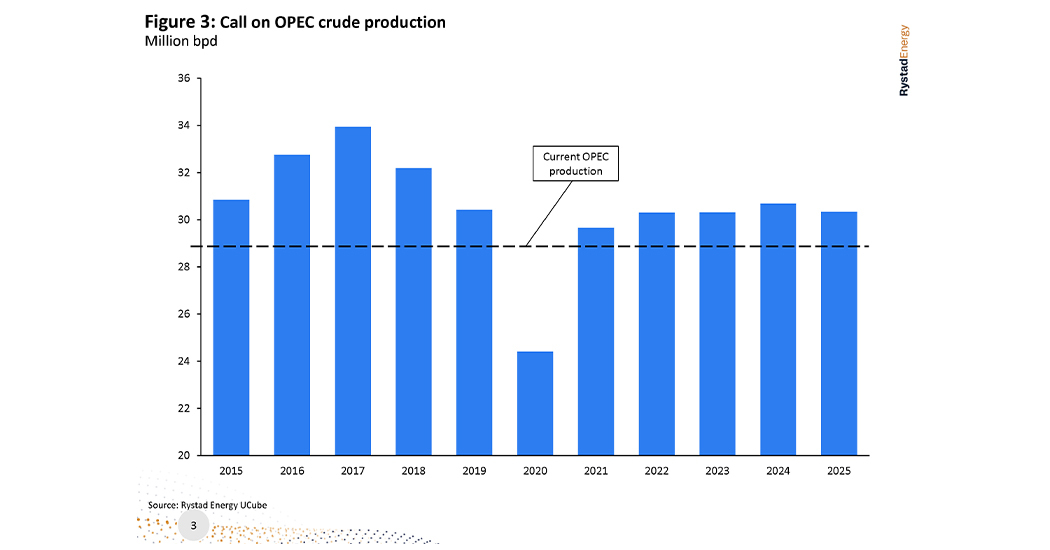

The above figure looks at the call on OPEC crude production and estimates the volume of crude production from OPEC countries to balance the global market. An increasing call on OPEC implies that its member nations need to increase their output, while a declining call means a reduction in supply from the group. Historically, a growing call on OPEC for future supply has been an indicator for higher prices. This year, the call on OPEC stands at around 30 million bpd, and it is expected to remain at almost the same level for 2024 and 2025. For comparison, current OPEC crude production is around 28.5 million bpd. This shows that OPEC members are producing less than the call, which is supporting the current high oil price environment. At the same time, Rystad Energy doesn’t expect other sources, like US tight oil, to increase supply. Hence, this illustrates that OPEC countries have increased their market power.

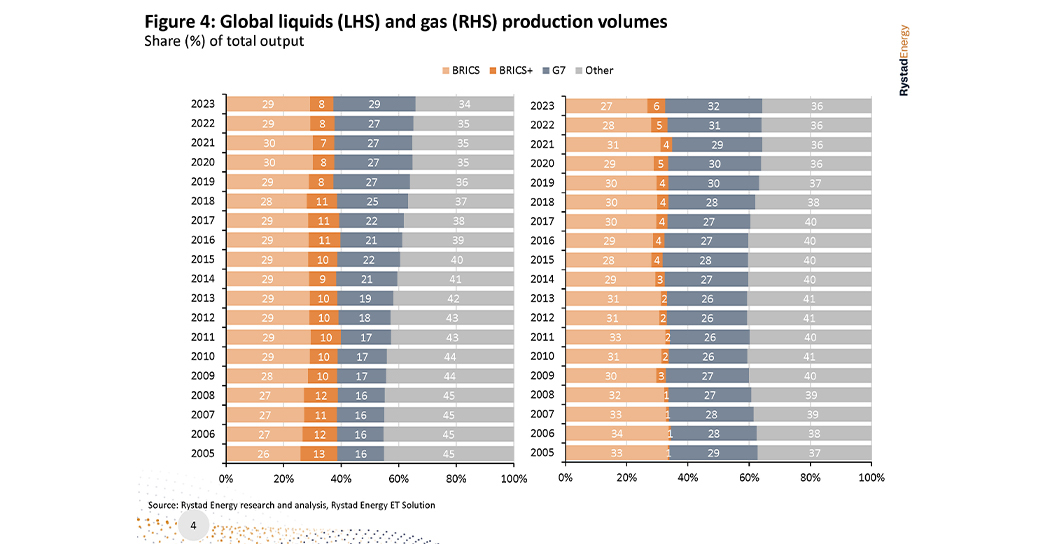

Additionally with the new inductees within the BRICS members, particularly the Middle Eastern nations consisting of, Saudi Arabia and UAE, the group emerges as a dominant force in global energy markets, with a potential to influence oil prices. On hydrocarbons front, BRICS+ is poised to play a pivotal role in global oil production, emphasizing the bloc’s growing influence. BRICS alone already accounts for 29% of global liquids production, and 27% of gas production. With the inclusion of the new members, BRICS+ would account for 37% of liquids and 33% of gas. This underscores the energy production focus of the new members and positions BRICS+ as a global leader, even when compared to G7's liquids production, which stands at 27% of the global total amid the rise in US production.

The changing dynamics of global oil markets, marked by the decline of US tight oil as a swing producer and the rise of BRICS+, are reshaping the energy landscape. As BRICS+ asserts itself as a dominant player in both oil and renewables, its influence on oil prices and the transition to clean energy will have profound implications for the world economy and energy markets. The rise of BRICS+ and resurgence of OPEC+ reinforces the notion that the world's energy order is undergoing a significant transformation, with new players at the forefront.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.