Middle East could play a key role in decarbonising global economy, says WoodMac

Large oil and gas reserves in the Middle East have resulted in especially low domestic energy prices and provide little incentive to transition to low carbon alternatives, according to Wood Mackenzie’s Middle East Energy Transition Outlook (ETO) report.

This report is part of Wood Mackenzie’s ETO research series, which explores three potential outcomes for the region’s energy and natural resources sector.

The region’s energy mix consists of 97% hydrocarbons today, with renewables share expected to grow to just 15% by 2050 in Wood Mackenzie’s base case. However, ambitious regional and global climate and renewable energy targets present an opportunity to companies in the Middle East. Decarbonising its energy export portfolio could help the region achieve its own net zero pledges by around mid-century.

“The Middle East could play a key role in decarbonising the global economy given its abundant natural resources, both fossil-based and renewable. It has the potential to carve out new niches, industrial manufacturing and generate hubs for emerging technologies. Saudi Arabia and the United Arab Emirates have set sights on becoming energy transition leaders as they look to carbon capture, utilisation and storage (CCUS), and low-emissions fuels such as hydrogen, ammonia and methanol, as well as green steel, cement and aluminium,” said Prakash Sharma, Vice President, Scenarios and Technologies Research at Wood Mackenzie.

“Countries importing oil and gas from the Middle East are seeking low carbon alternatives, so broad diversification is required to de-risk oil dependency. The region is fully aware of the challenge and is investing in the petrochemical industry, hydrogen production and CCUS projects. Several countries in the Middle East have announced Hydrogen and CCUS roadmaps and looking to develop projects. COP28, taking place in Dubai, could fast track the decision-making and invite foreign investments needed to secure a sustainable energy future,” Prakash added.

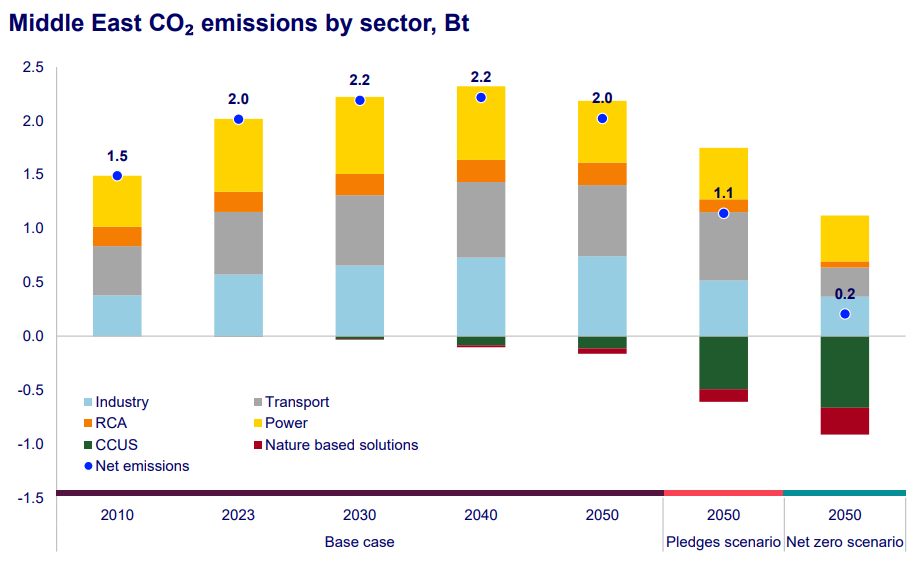

Despite many countries in the region setting ambitious targets, the region’s emissions are still forecasted to remain at current levels of 2 billion tonnes (Bt) CO2 through to 2050 in Wood Mackenzie’s base case, with the Middle East expected to reach net zero by 2065 in the pledges scenario.

Despite electricity demand doubling in 2050 from current levels, largely due to wind and solar penetration increasing from 5% to 49% in the same period, power sector emissions fall by just 16%. These reductions are offset by industrial and transport emissions growing by 30% and 13% respectively.

Electric vehicle (EV) penetration is also expected to reach only 6% by 2050, due to a lack of policy support in the region and low cost of petrol.

To reach net zero, the Middle East must electrify and deploy new technologies in its industrial sector, electrify 75% of its road transport fleet, and meet this increased power demand through fully decarbonised supply, according to Wood Mackenzie’s latest report.

Baseload power and heavy industrial sectors will require widespread deployment of CCUS, with remaining emissions abated through nature-based solutions.

Source: Wood Mackenzie ‘Energy Transition Outlook: Middle East’

Diversification in progress across the Middle East

The Middle East produces around a third of the world’s oil supply, with much of the region’s wealth owed to fossil fuels. Hydrocarbon revenues for some of the region’s largest producers account for 30 - 60% of gross domestic product (GDP) and more than 80% of exports, according to latest Wood Mackenzie analysis.

Jom Madan, senior research analyst at Wood Mackenzie, said: “But this may soon change as supply security comes under question against the backdrop of Russia/Ukraine and Israel/Hamas conflicts. Policymakers are gradually settling on renewables as the solution, supported both by compelling economics and climate concerns.”

“Countries dependent on oil are aware of looming climate risks and are undergoing a series of reforms and diversifying investments, enabled by replenished coffers from volatile oil prices,” Madan added.

These range from mitigating scope 1 and 2 emissions, expanding petrochemical production to tap into the promise of energy demand growth in Africa and South Asia to producing low-carbon hydrogen for export to Europe and Northeast Asia.

Those investing into hydrogen are countries largely dependent upon oil revenues. But the hydrogen pivot is not without its challenges, few markets can accept the prices on offer – currently 2-4 times that of gas on an energy basis.

Europe, Japan and South Korea have announced targets and policy incentives to facilitate import of low-emissions fuels and the Middle East could be a potential supplier, alongside the US, Canada and Australia.

Breaking the mould

“Current and upcoming investments in carbon capture and blue hydrogen projects could lay the foundation for regional CCUS hubs, lowering costs and enabling adjacent industries to participate,” Madan said.

Large-scale hydrogen production further enables the region to carve out new niches in the global economy, expanding into adjacent areas such as the production of synthetic fuels, low-carbon chemicals, and emissions free smelting utilising hydrogen for direct reduced iron (H2 -DRI).

Robust carbon pricing is key to achieving this vision, reaching only US$64 per tonne in the Middle East in Wood Mackenzie’s base case but required to rise to US$146 per tonne in the net zero scenario.

Madan said: “We may also begin to see the emergence of energy super basins as the nexus of new energies investments may add up to more than the sum of its parts.”

Role of gas

Energy security concerns have accelerated the growth of the LNG trade in the region, as markets around the world grapple with domestic field depletion and look to import LNG to fill the supply gap.

Capacity expansions and new exploration are underway in Qatar and the United Arab Emirates (UAE), aimed at boosting their combined gas output 40% by 2030, supported in large part by investments from national oil companies in Asia.

“Natural gas will play a key role in the energy transition, especially in power generation where its flexibility is increasingly valuable and as feedstock for blue hydrogen production, with sustained demand even in Wood Mackenzie’s most ambitious climate scenarios,” Madan said.

By 2050, most gas-fired power capacity will need to be CCUS-equipped and/or combusting low-carbon fuels to provide dispatchable generation and support renewables-heavy power grid.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.