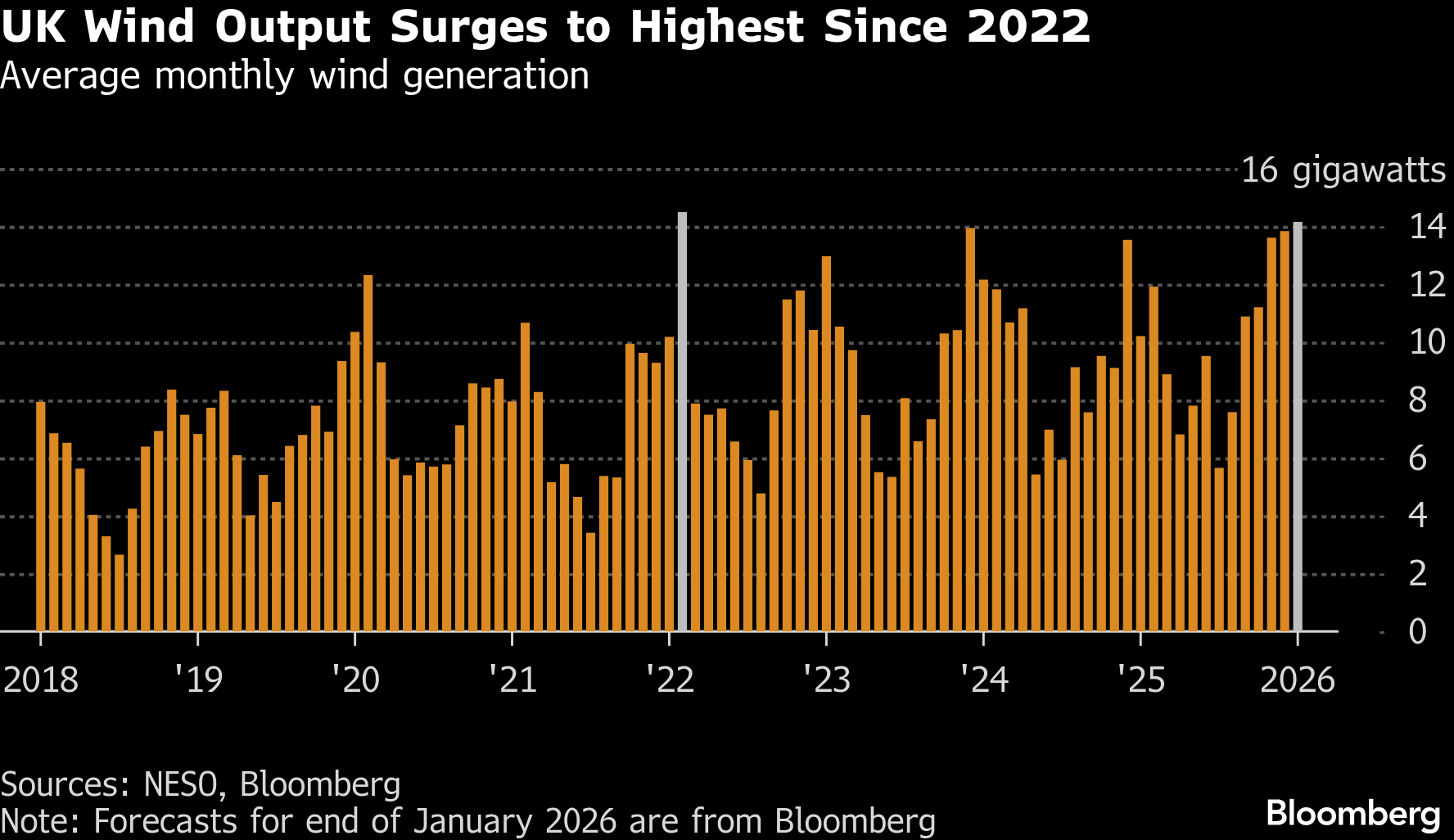

UK Wind Power Output at Four-Year High in January Curbs Prices

(Bloomberg) -- UK wind farms are expected to provide the most power in almost four years this month as more turbines and blustery conditions help the country pivot away from fossil fuels.

Output from the country’s thousands of wind turbines is on track to average more than 14 gigawatts in January, according to data from the National Energy System Operator and Bloomberg forecasts. The surge helped cap power prices even as the cost of wholesale natural gas climbed amid shrinking inventories.

European governments have accelerated the rollout of renewables to reduce reliance on gas for power generation since Russia’s invasion of Ukraine. The UK procured record amounts of new offshore wind capacity in a auction earlier this month, showing the government is still is working to bring down costs for consumers.

France has been partly shielded by its vast nuclear fleet, keeping its electricity prices below most other countries in Europe. The gap between UK and French spot power prices this month was the narrowest since February 2022 thanks to high renewables output.

UK day-ahead power prices have averaged about €109 a megawatt-hour so far in January on the Nord Pool exchange, about €7 higher than the equivalent French contract. That compares with an average difference of €33 over the same period last year.

Windy conditions are not consistent throughout Europe however, with Germany seeing calmer weather that curbed renewables output.

“In January, we had a weather pattern which brought storms into the UK, increasing wind speeds there,” said Jess Hicks from BloombergNEF. High pressure associated with an outbreak of cold air from Eastern Europe curbed German wind speeds, she said.

German onshore wind generation in January is on track to fall to its lowest since 2021, despite the country having added more than 10 gigawatts of installed capacity over that period, data from the Fraunhofer Institute for Solar Energy Systems show. Stronger offshore wind output partly offset the decline, helping keep overall renewable generation in the country broadly stable.

Wind power is Germany’s largest source of electricity, but shortfalls force greater reliance on costlier fossil fuels after the country shut its last nuclear reactors in 2023.

In February, a weather pattern known as a negative North Atlantic Oscillation could weigh on wind generation. The European Centre for Medium-Range Weather Forecasts sees a high likelihood of these conditions taking hold early in the month.

The shift would be particularly negative for Germany, as Atlantic storms are steered south toward Iberia rather than northwest Europe, leaving the country largely outside the main storm track, said Hicks. Spain is on track for record wind generation in January, data from the European Network of Transmission System Operators for Electricity show.

“The first half of February is likely to be expensive on the spot electricity market in Germany,” said Matthias Apel, an analyst at industry consultant Ispex AG. “There is little chance of relief until mid-February.”

©2026 Bloomberg L.P.