Soaring Industrial Shares Face Headwinds From Trump Trade Policy

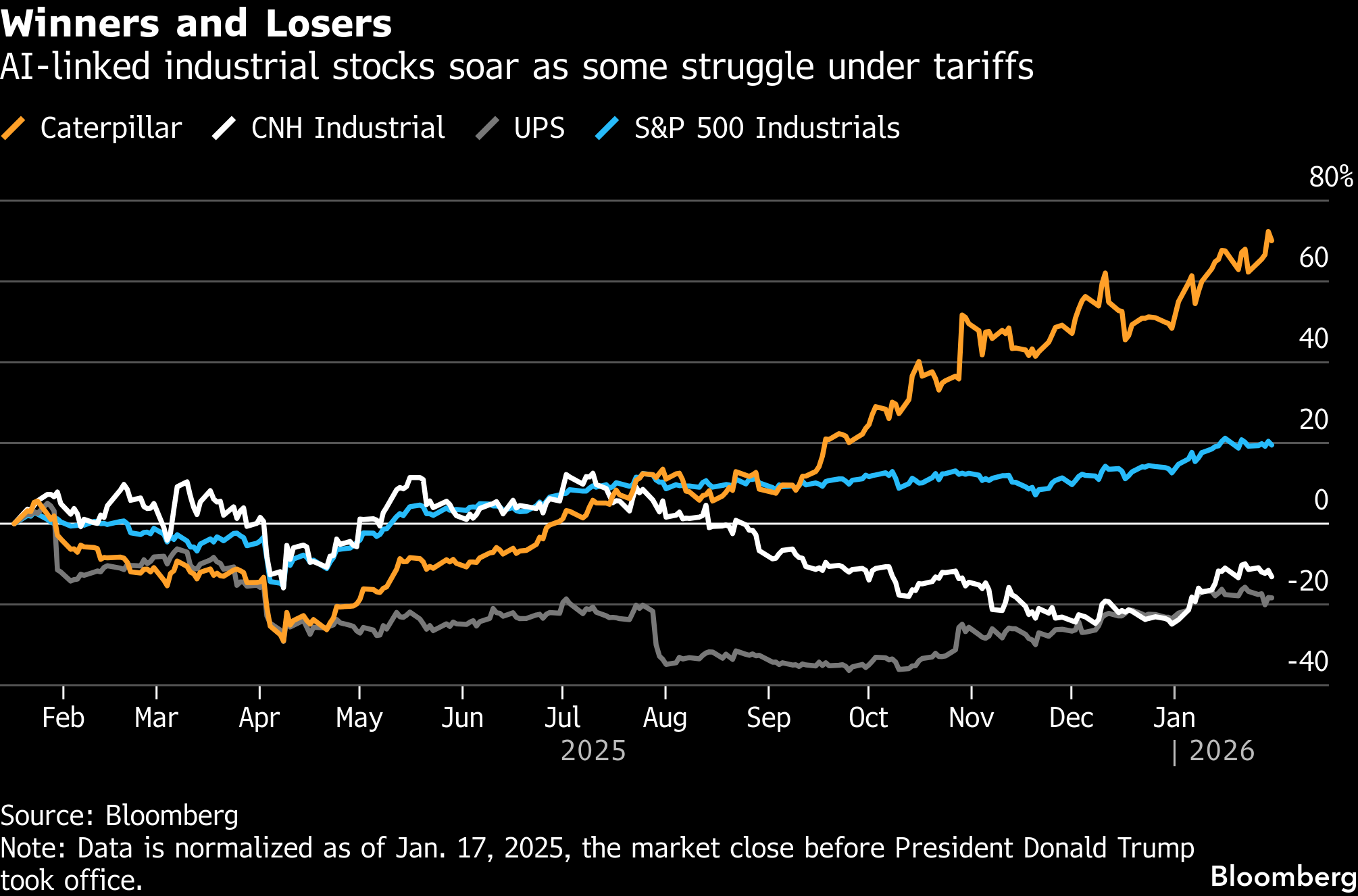

(Bloomberg) -- Earnings reports from some of the largest US manufacturers and transportation companies this week drove home how President Donald Trump’s policies on trade and energy are putting a squeeze on the sector’s profits.

Caterpillar Inc, which imports raw materials and parts for construction equipment, said it expects the president’s levies to cost about $2.6 billion this year. Railroad Norfolk Southern Corp. said trade policy is eroding demand for some of its business lines, and shipping giant United Parcel Service Inc. said trade flows are shifting in a way that’s pressuring margins.

Meanwhile, on the energy front, power-equipment company GE Vernova Inc. took a hit last month after the Trump administration required work to stop on a wind farm off the coast of Massachusetts. Its wind business recorded a wider-than-forecast $225 million loss last quarter.

The sector overall has been handily beating the broader stock market in the past two months as investors see it benefiting from the artificial-intelligence boom. However, the strains that were apparent in this week’s results show how Trump’s efforts to boost American manufacturing are cutting both ways for some producing headwinds for their business as they await more advantageous tax-related policies to kick in.

“The policy cadence has been more foe than friend for industrials in the near term,” said Joe Gilbert, a portfolio manager at Integrity Asset Management. “Industrials have taken their medicine first with tariffs and policy halts and the candy — tax expensing — will come later.”

Gilbert says he’s positive on transportation and machinery stocks, expecting them to benefit from growth in the industrial economy.

Industrial stocks have had the of wind at their back lately.

Some of that is thanks to Trump and Congress, led by his fellow Republicans: Last year’s tax and spending bill included immediate expensing for investments, a provision that favored the sector directly. Investors are also anticipating that higher refunds this tax season will buoy consumers and brighten the US economic outlook, helping these companies.

Another big catalyst: AI euphoria. Caterpillar and GE Vernova are seeing strong demand for their power-generation equipment, which drove up their stocks after this week’s reports. GE Vernova said it’s in frequent talks with the White House about ramping up production of its natural-gas turbines.

For investors, GE Vernova’s AI-driven strength has offset the pressure from a wind segment that it expects to keep losing money this year. To be sure, a federal judge ruled this week that a project off of Martha’s Vineyard could go forward.

Still, the unit’s “substantial headwinds” weighed on guidance for the year, Colin Rusch, an analyst at Oppenheimer, wrote in a note to clients. At the same time, he said demand in its power and electrification businesses is beating expectations.

Deeper Pain

Some stocks aren’t keeping up. UPS shares are still 4% below where they stood immediately before Trump’s April tariff announcement. Beyond his global levies, the end of a tariff exemption for small packages has hurt demand on the profitable US-China route.

Tariffs are the reason Caterpillar expects margins to contract in the first quarter compared to the same period last year. The company has worked to manage the costs by changing where it sources materials, as well as raising prices and cutting other expenses.

Levies on raw materials are a particular challenge to manage, given insufficient domestic steel production and aluminum mining, said Brian Mulberry, client portfolio manager at Zacks Investment Management.

“The increased supply of raw materials is a key goal of the administration, and it would significantly lower costs for many manufacturers,” said Mulberry, whose firm holds Caterpillar’s stock. “But it takes time to increase.”

February will give investors more tea leaves to read on the sectors.

For one thing, the Supreme Court may deliver its pending ruling on the legaility of Trump’s tariffs. Caterpillar and Deere & Co. are among the companies that would benefit the most from any refunds the court orders, even as levies on the metals sector aren’t included.

There are also more key earnings reports ahead, including from CNH Industrial NV, a maker of tractors and backhoes that’s heavily exposed to tariffs. Results from Deere will give Wall Street another read on the farm market, which has struggled amid trade tensions with China.

©2026 Bloomberg L.P.