Charting the Global Economy: Warsh Fed Pick Triggers Metals Selloff

(Bloomberg) -- President Donald Trump’s pick of Kevin Warsh for the next chair of the Federal Reserve triggered a rebound in the dollar and a subsequent plunge in precious metals.

The announcement of Warsh came after the central bank left interest rates unchanged as expected. Chair Jerome Powell talked up a “clear improvement” in the outlook while noting the job market is steadying. Futures markets expect no shift in rates before June.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

World

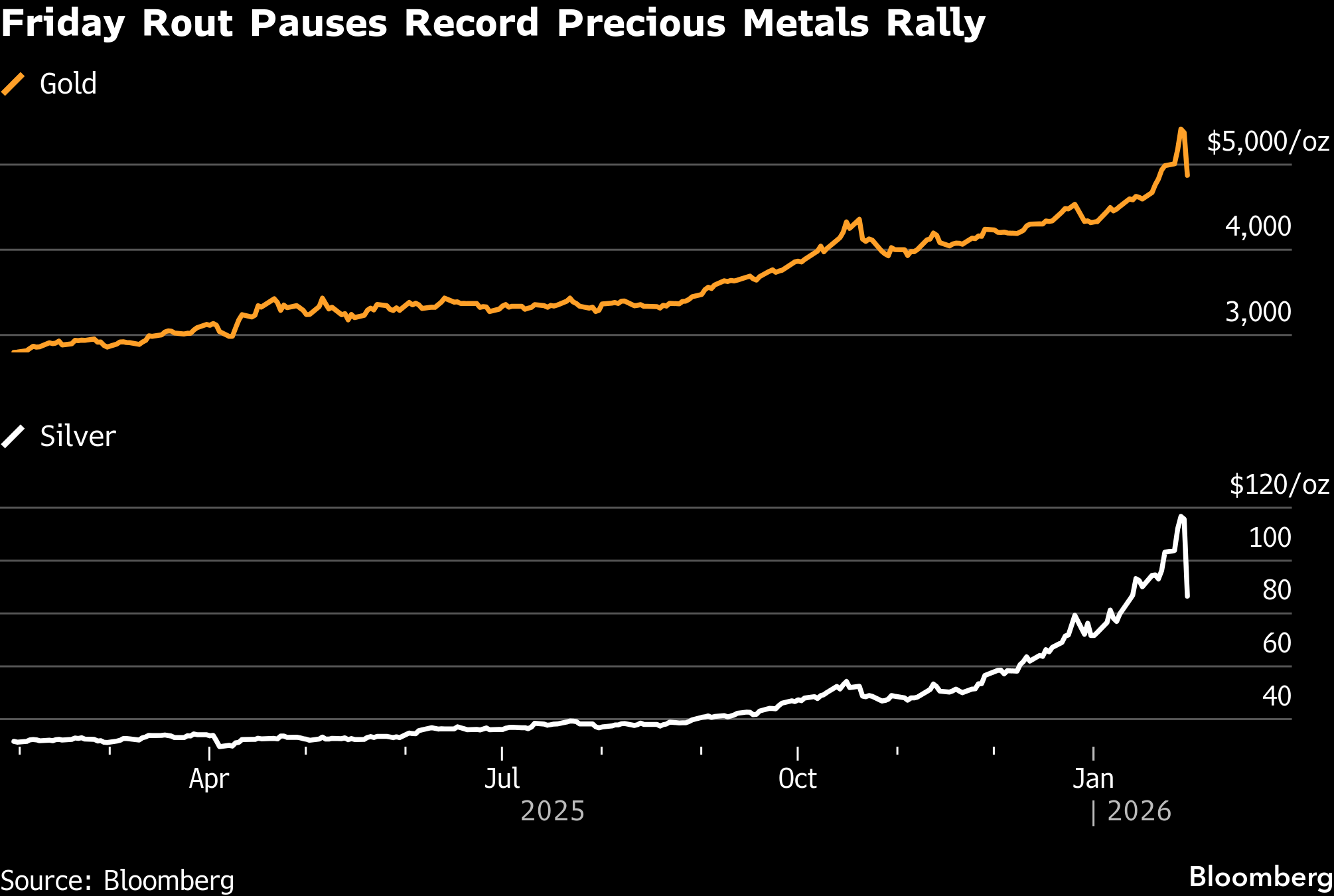

Gold and silver suffered their biggest slide in years, in a whipsawing reversal of a scorching rally that lifted prices to all-time highs. The selloffs were triggered by the dollar rebounding after a report that Trump was preparing to nominate Warsh for Fed chair, which was later confirmed.

In addition to the Fed, central banks in Canada, Sweden, Brazil, Chile, Hungary, Sri Lanka, Pakistan, Uzbekistan, Kyrgyzstan, South Africa, Lesotho and Eswatini kept interest rates unchanged. Officials in Ghana, Mozambique and Ukraine lowered borrowing costs. Colombia surprised all analysts with a full percentage-point hike.

US

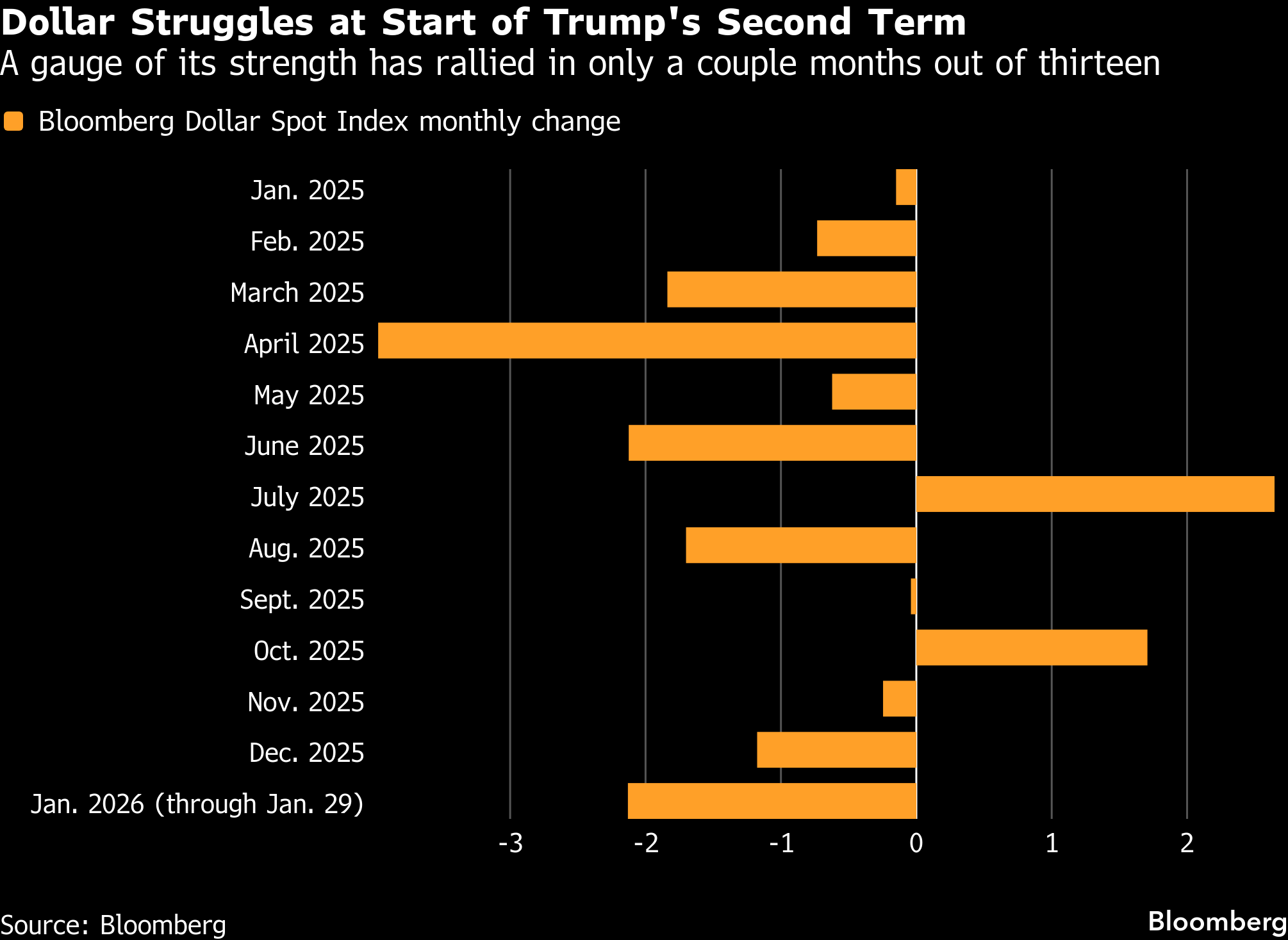

Currency traders from Tokyo to New York started piling back into a trade last week that unleashed a selloff and drove the US dollar into its deepest slide since Trump’s April trade-war salvos. While still down for the month, the greenback enjoyed its best day since July on Friday as Trump chose Warsh to become chair of the Fed. He’s viewed by markets as less likely to reduce rates than others in the race to replace Powell. Some reckon incoming economic data also may aid the dollar in coming days.

Across the US labor market, consumer spending, travel demand, industrial production, and credit availability, high-frequency data continue to point to an economy expanding at an above-trend pace, with few signs of near-term deterioration.

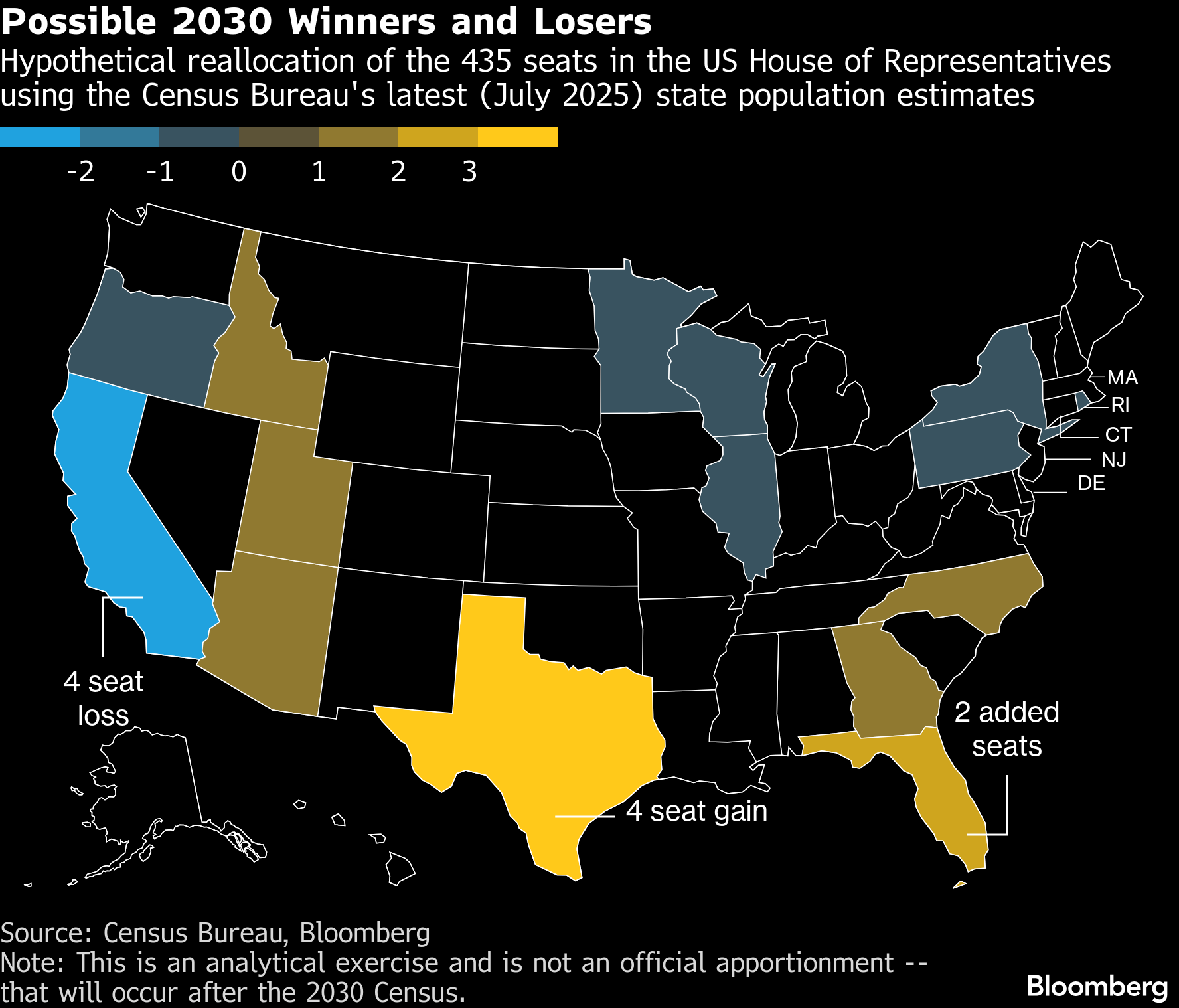

Halfway to the 2030 US census, population is shifting away from California, the upper Midwest, and New England, and moving toward the South and mountain states. If congressional seats were reapportioned today, Bloomberg Economics estimates California would lose two seats in the House of Representatives and New York, Illinois, Minnesota, Oregon, and Rhode Island would each lose one. Texas and Florida would each gain two seats, while Arizona, Utah, and Idaho would add one. Using population estimates for 2030 — a more speculative exercise — produces even more dramatic results.

Europe

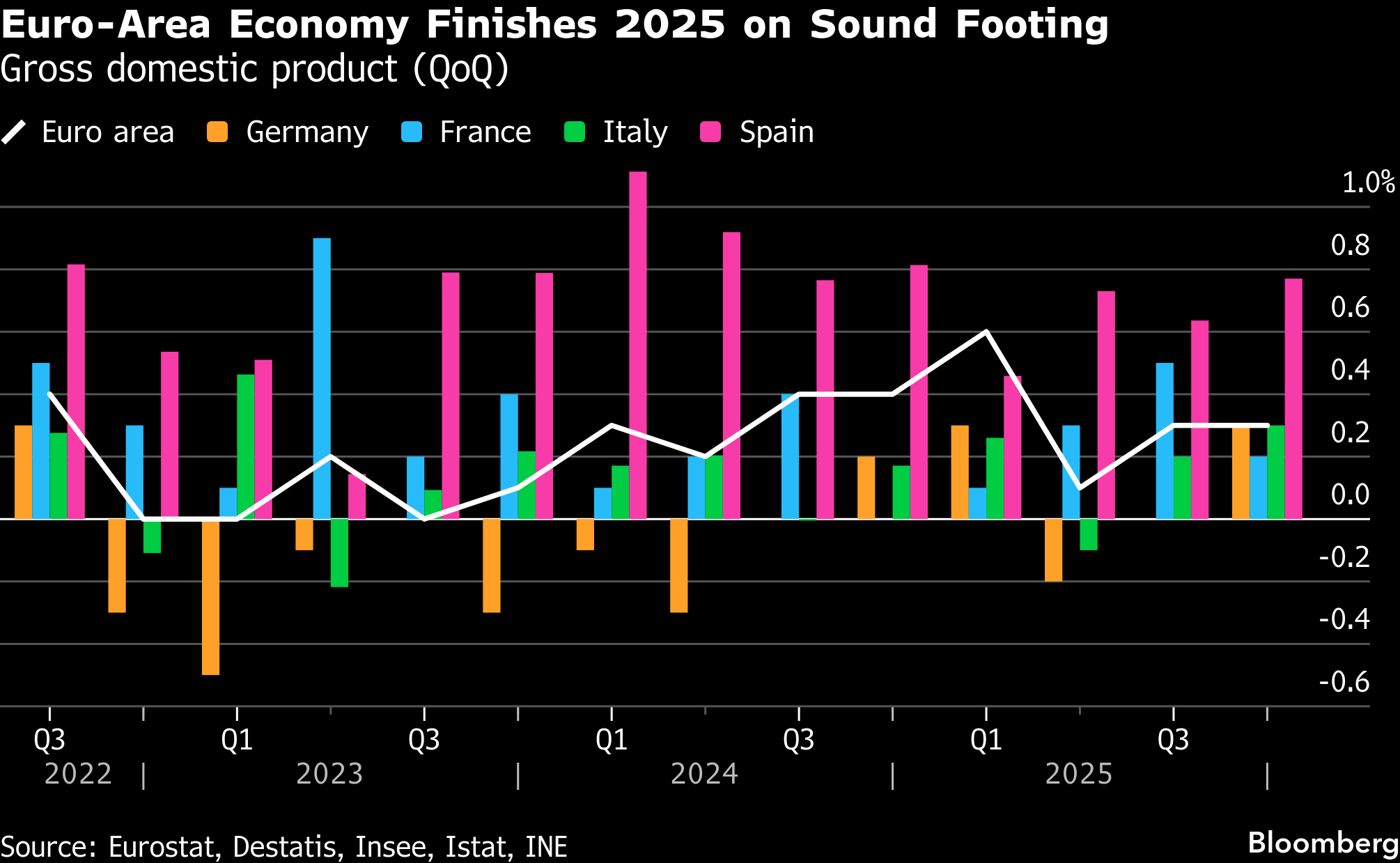

The euro-area economy grew more than expected at the end of last year, demonstrating resilience to trade turmoil. Germany, Italy and Spain all surpassed estimates, with the latter proving the standout performer.

The German government expects Europe’s biggest economy to emerge from three years of stagnation in 2026, but a heavy reliance on state spending shows fostering a broader-based recovery remains a work in progress.

Asia

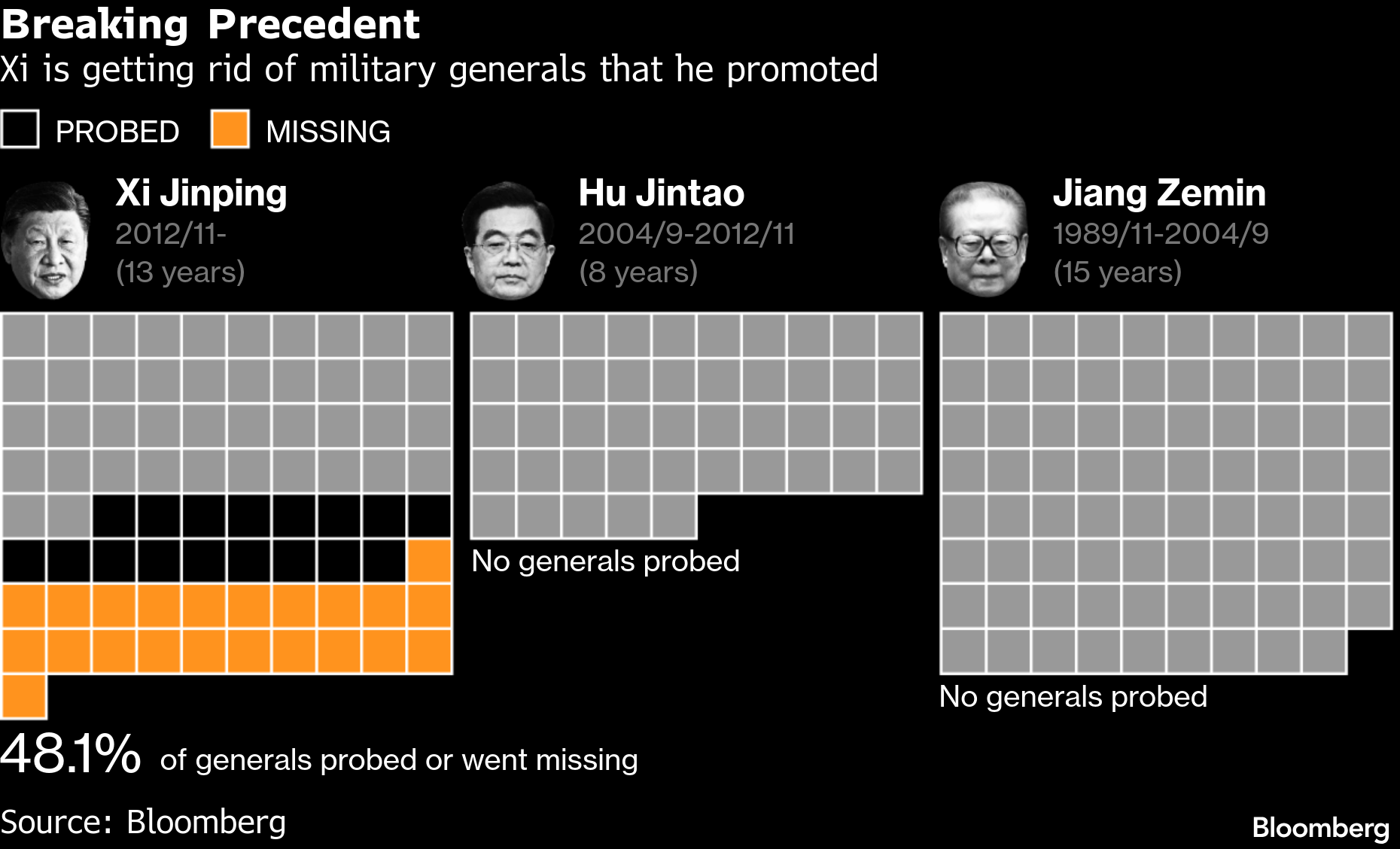

President Xi Jinping’s move to probe his top general and one-time ally Zhang Youxia is the most stunning development yet in China’s biggest military purge in roughly half a century. It also has implications for Taiwan, succession and further turmoil in the Communist Party ranks.

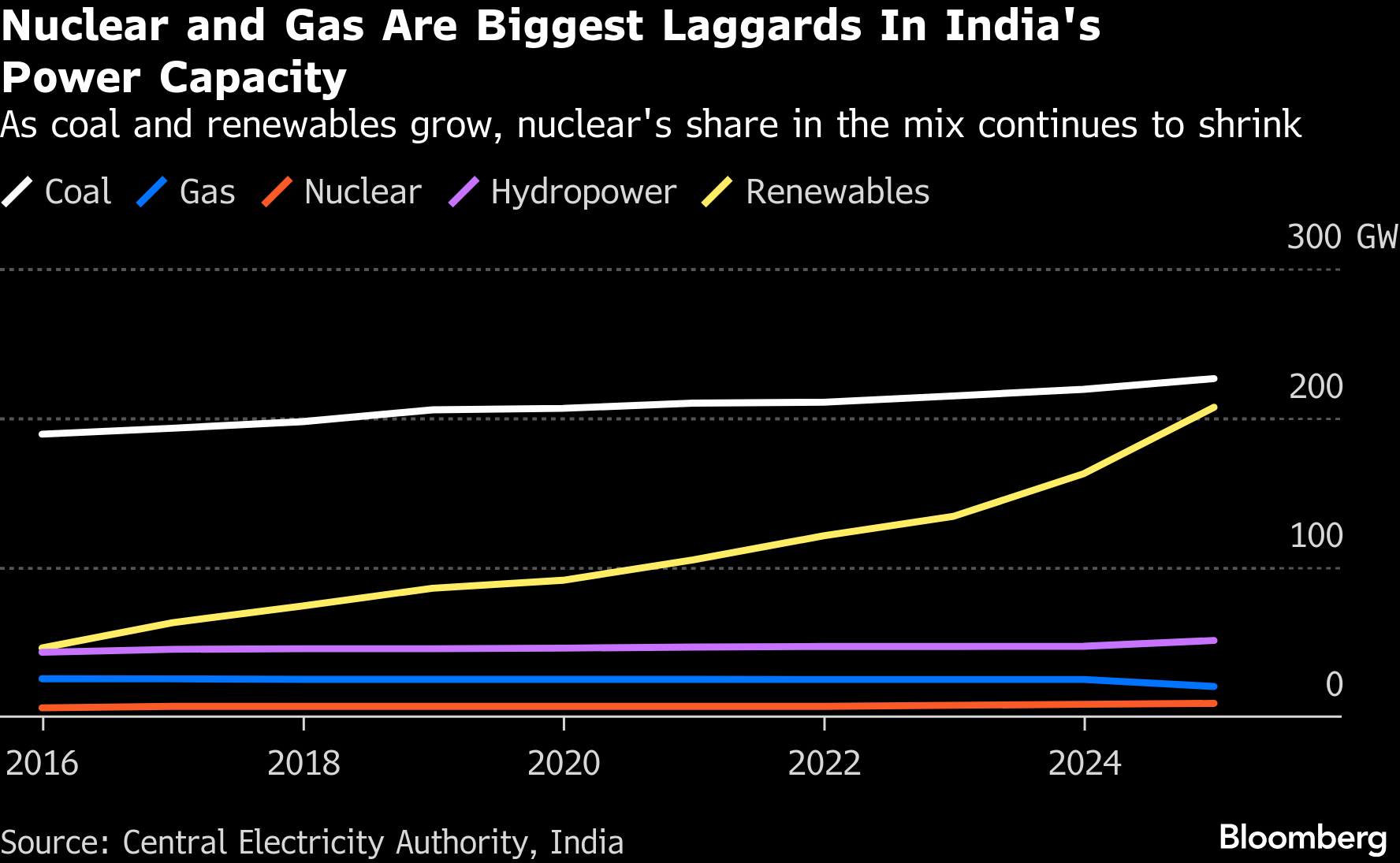

India is set to order a third fleet of locally designed reactors as part of an ambitious effort to expand nuclear power capacity at a manageable cost, according to people familiar with the plan. The government is considering seeking bids to build as many as 10 pressurized heavy water reactors with a capacity of 700 megawatts each — a third such bulk order, the people said, asking not to be named as the discussions are still private.

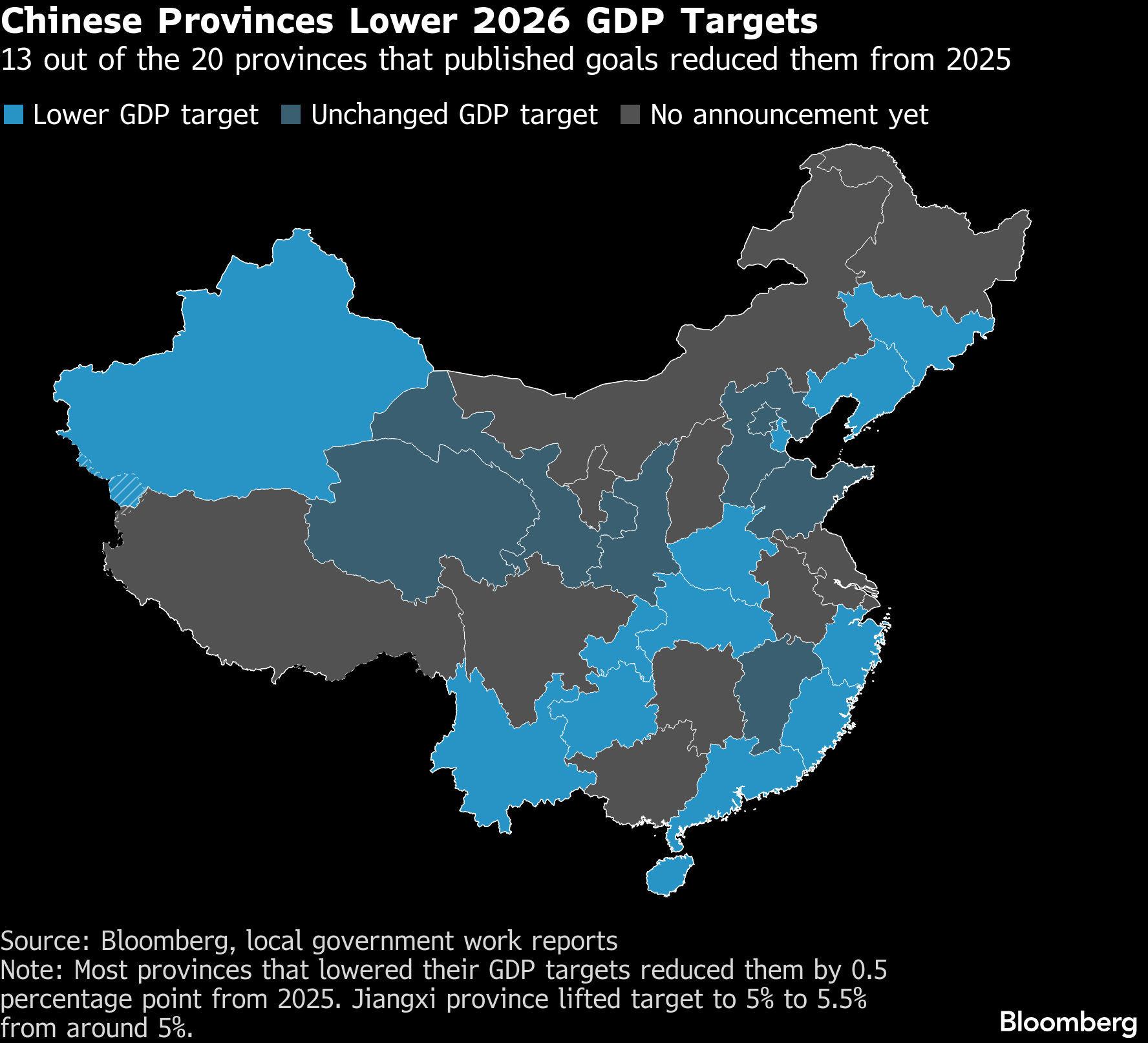

Over a dozen Chinese provinces have reduced their economic growth targets for 2026, pointing to a likely downgrade of the national goal for the first time in four years. Such a change would signal authorities are adopting a more pragmatic approach toward managing the economy in the face of challenges including sluggish consumer spending.

Emerging Markets

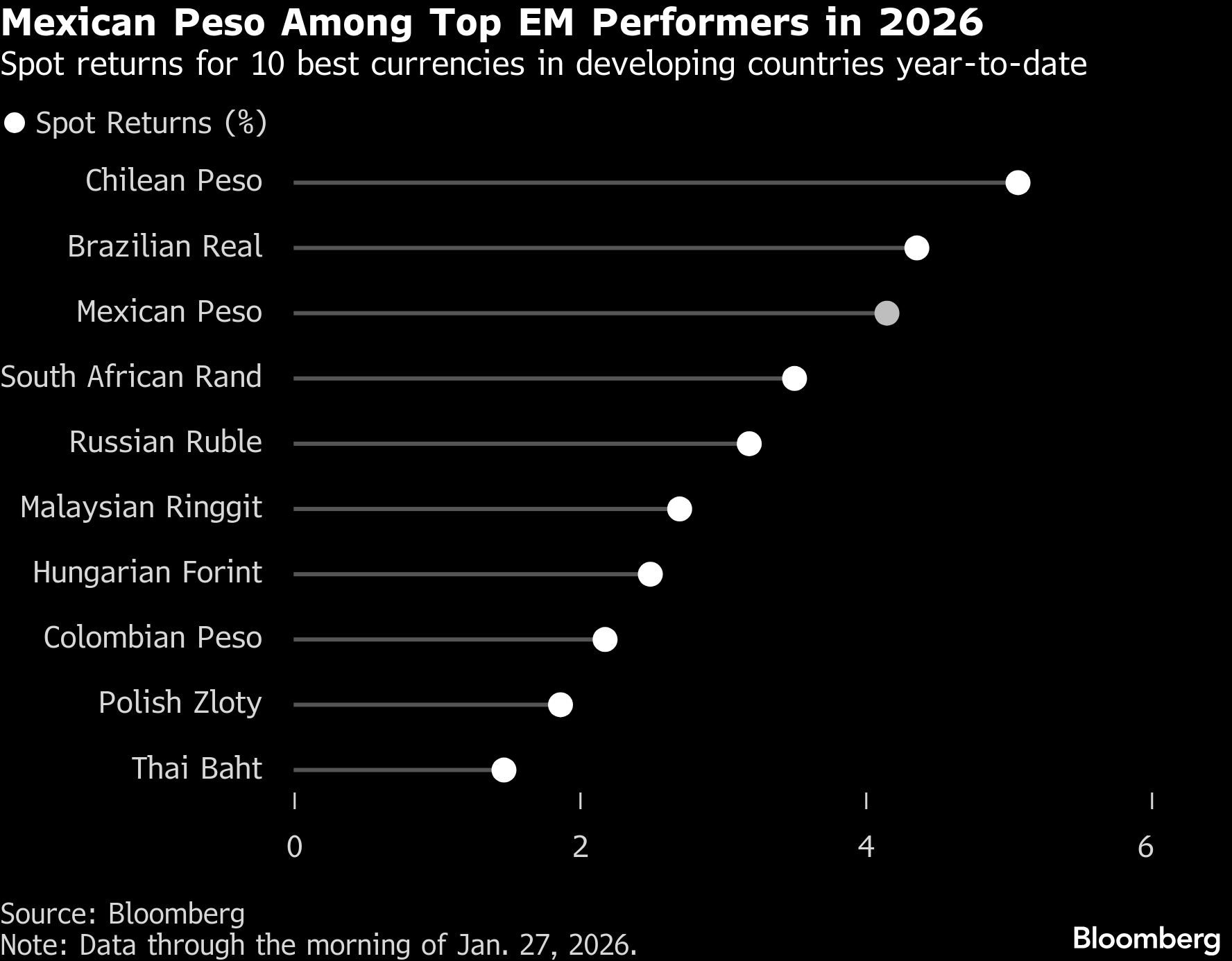

Investors are betting Mexican President Claudia Sheinbaum’s ability to defuse disputes with Donald Trump will help extend one of the best currency rallies in emerging markets this year.

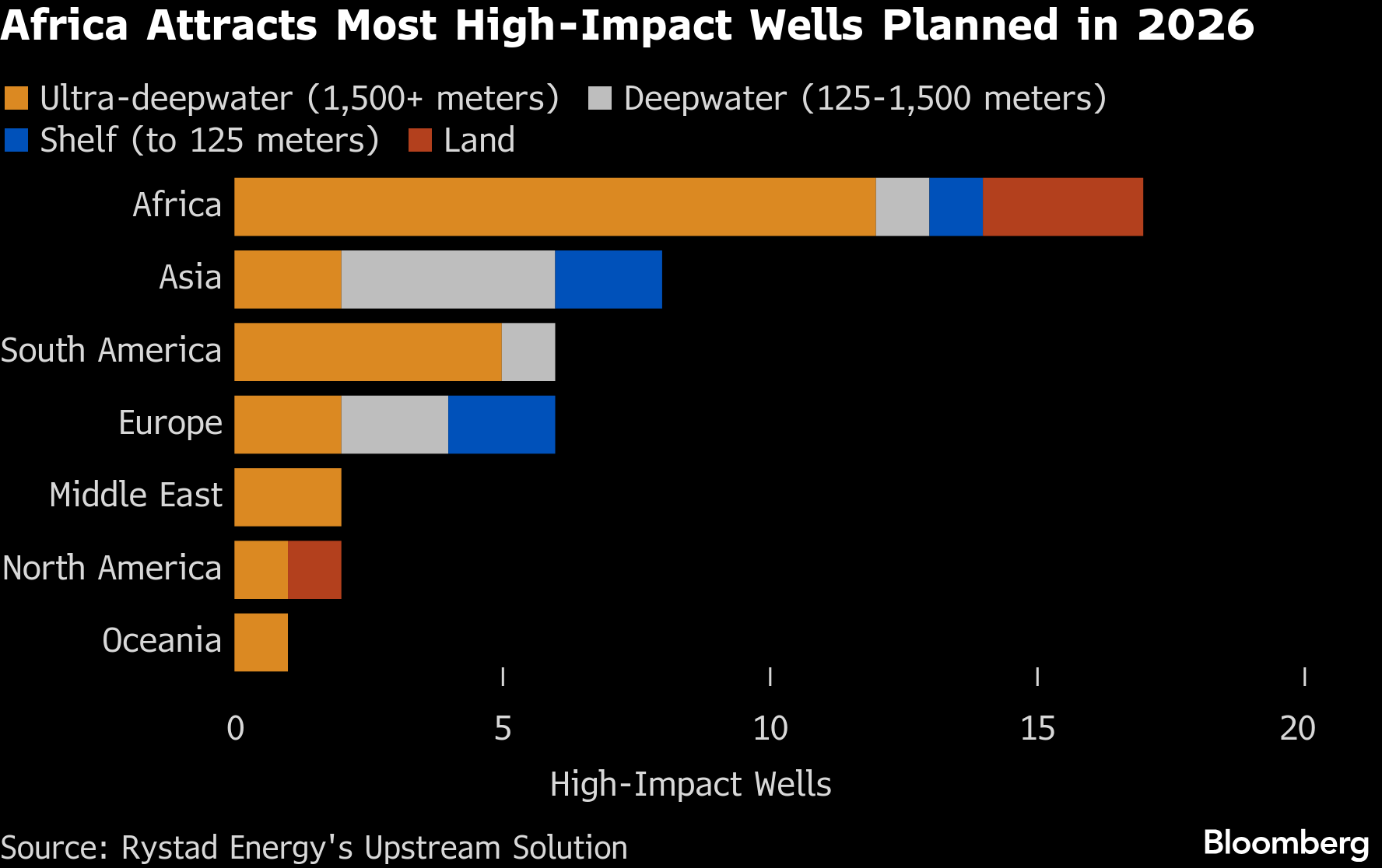

Africa is drawing marquee oil majors this year, with companies planning to drill more than twice as many high-impact exploration wells as any other region in the search for future reserves.

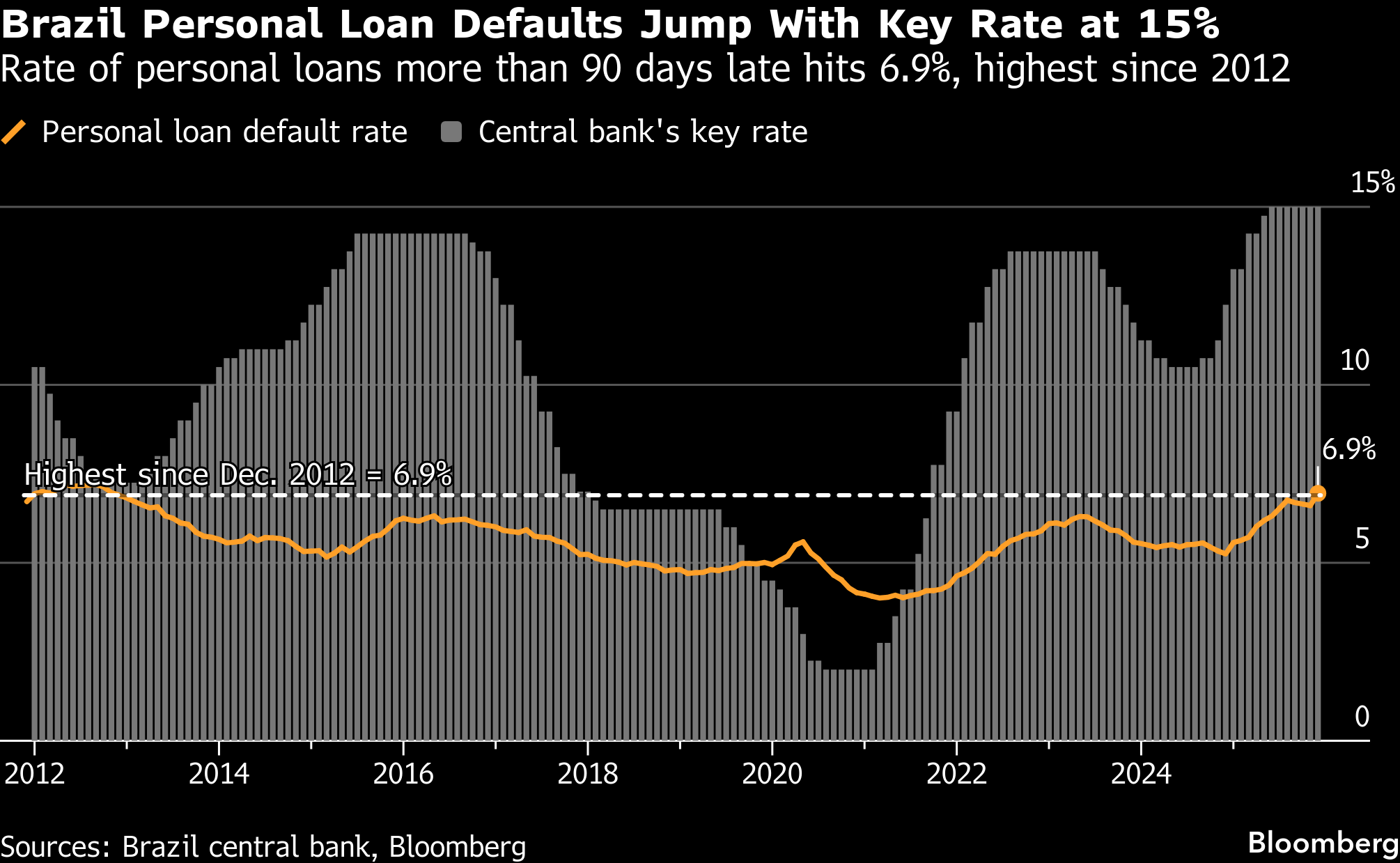

Brazil posted the biggest monthly job loss and the highest loan delinquency rates in years according to data published on Thursday, the latest sign that the slowdown in Latin America’s largest economy is deepening.

©2026 Bloomberg L.P.