Brazil Is Set for a Battery Boom. China Is Poised to Benefit

(Bloomberg) -- Brazil is set to hold its first electricity auction for grid-scale batteries in April, and Chinese companies — which have already invested heavily in the country’s power sector — are expected to be leading contenders, potentially bidding against the likes of Tesla Inc. and Petroleo Brasileiro SA.

It’s another opportunity for Chinese firms to expand their footprint in Brazil. Between 2007 and 2024, power-sector projects accounted for 45% of China’s investments in Latin America’s largest economy, totaling $35 billion, according to the nonprofit Brazil-China Business Council.

The auction comes after other countries in Latin America have begun contracting or building utility-scale battery projects, according to research firm BloombergNEF. Chile has been an early adopter and plans a significant battery expansion over the next five years. Argentina awarded 667 megawatts in its first-ever energy storage auction last September, with capacity expected to come online by 2027. Mexico’s state utility has announced at least 2.2 gigawatts of storage in its five-year expansion plan.

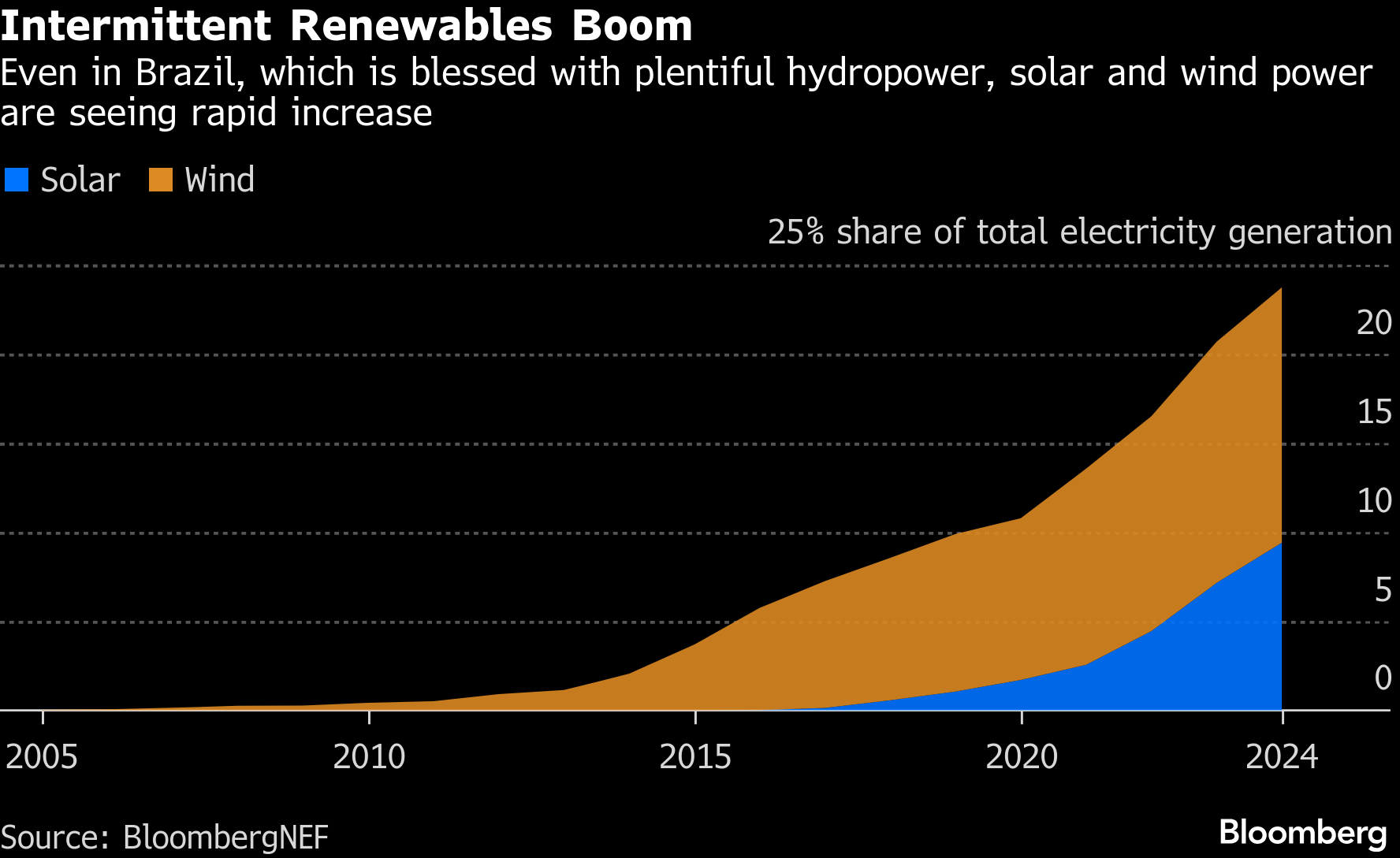

The global boom in solar and wind generation has led to the chronic problem of curtailment: Renewable plants are forced to shut down when there is not enough demand for power. Batteries can help absorb that cheap power and then inject it back into the grid when there is more demand.

In 2025, Brazil lost on average around 26% of its solar generation and 19% of its wind generation due to curtailment, according to Vinicius Nunes, a Sao Paulo-based associate at BNEF. That would amount to a loss of 7 billion Brazilian reais ($1.3 billion) by one estimate.

The Brazilian government has said it hopes the auction will secure 2 gigawatts of capacity. BNEF estimates that annual battery energy storage additions in Brazil could reach around 1.3 gigawatts by 2030.

Chinese companies bring some comparative advantages, according to Larissa Wachholz, a partner at Vallya, a consultancy focused on China. They lead global battery production and, as the world’s largest investors in renewable energy, they have dealt with the challenges of integrating batteries into power grids.

“There is already a large number of [Chinese] companies in Brazil that understand the electricity market and feel comfortable expanding their role to include operating storage systems,” she said.

However, they won’t have the playing field to themselves. Among the companies to submit comments during the public consultation ahead of the auction were Tesla, Petrobras and Axia Energia.

Firms hoping to act as system integrators — combining hardware, software and controls into a battery system — will submit their own bids in the auction. Those hoping to supply equipment will partner up with other companies. Chinese manufacturers are widely expected to dominate in equipment, regardless of who ultimately wins the contracts.

“China controls everything from [battery] cell manufacturing to the production of the inputs needed to make those cells,” said Markus Vlasits, head of Brazil’s energy storage association, known as Absae.

Among the dozens of affiliates of Absae is Chinese technology giant Huawei Technologies Co., which has operated in Brazil for nearly three decades and plans to participate in the auction as an equipment supplier.

“Our approach is to find partners to work together and win the auction,” said Roberto Valer, chief technology officer at Huawei Digital Power Brazil. “It’s not simply a matter of buying a battery in China and expecting it to arrive at the designated location with everything going smoothly.”

Best known for its telecommunications equipment, Huawei in recent years has made inroads in the global energy sector and across Latin America. The Chinese firm has supplied inverters for solar farms in Argentina, provided energy storage for hospitals in Peru and built charging infrastructure for heavy-duty electric trucks in Mexico. Last month, consultancy Wood Mackenzie ranked Huawei as the world’s leading manufacturer of inverters needed for solar farms. Sales from Huawei’s energy division contributed nearly 10% of its total revenue in 2024.

Huawei also operates as a manufacturer and systems integrator of grid-scale battery energy storage systems. While it does not produce battery cells — which are sourced from global partners — the company designs and manufactures system architecture, including battery packs, power conversion systems and management software.

Last April, the company hosted Brazil’s Mines and Energy Minister Alexandre Silveira in China to showcase its battery systems. It has also worked proactively on shaping regulations, holding workshops with Brazil’s power regulator ANEEL and energy planning agency EPE.

Other Chinese companies with a growing presence in Brazil have also shown interest in participating in the bid. These include State Power Investment Corp. Ltd., which owns solar and wind farms in the country; China Energy Engineering Corp. Ltd., which recently acquired three solar plants; and China Three Gorges Corp., which has a strong footprint in hydro and wind power generation.

Silveira has been personally engaged in attracting Chinese companies. He has spent this week in China, where the auction was a key topic in meetings with Huawei, Contemporary Amperex Technology Co. Ltd., Envision Energy and Sany Heavy Industry Co. Ltd., among others.

“I am clear about the importance of this strong relationship between the Ministry of Mines and Energy and representatives from China’s energy and mining sectors,” he said in a press statement Wednesday. The ministry did not respond to requests for comment.

Many Western countries consider critical equipment made in China or by Chinese firms as a national security risk. But Brazil “is unlikely to see Chinese companies with this kind of fear,” said Nunes of BNEF. And whatever the results of the auction, he added, “a lot of the battery equipment is surely going to be provided by Chinese companies.”

©2026 Bloomberg L.P.