BlackRock Nears $40 Billion Data Center Deal in Bet on AI

(Bloomberg) -- BlackRock Inc.’s Global Infrastructure Partners is in advanced talks to acquire Aligned Data Centers, targeting a major beneficiary of AI spending in one of the year’s biggest deals, according to people familiar with the matter.

Aligned, which is backed by Macquarie, could be valued at about $40 billion in a transaction, one of the people said. An agreement could be announced within days, the people added, asking not to be identified because the information is private.

MGX, an AI investment company established by sovereign wealth fund Mubadala Investment Co., is also involved in the talks and would invest independently as part of a transaction, one of the people said. Mubadala has separately already invested in Aligned.

GIP has also been eyeing other big takeovers, including a potential acquisition of power company AES Corp. on expectations that the sector will benefit from surging electricity demand from facilities running AI applications. AES has an enterprise value of about $38 billion, including debt.

GIP hasn’t reached a final agreement for Aligned Data Centers and some details might change or the talks could still end without a transaction, the people said.

A spokesperson for BlackRock declined to comment. Representatives for Aligned, Macquarie and Mubadala didn’t respond to requests for comment outside of regular business hours.

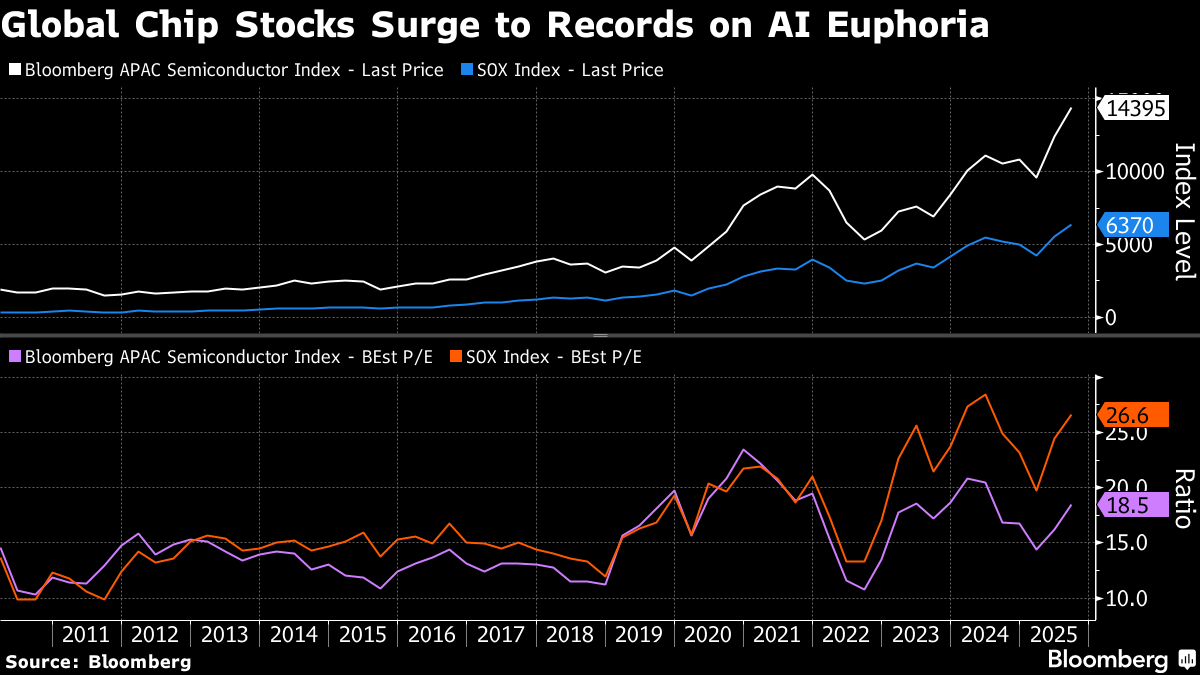

The envisioned acquisition marks the latest in a parade of eye-popping deals since ChatGPT emerged, as investors vie for exposure to the leaders of a technology with the potential to transform industries and economies. They’ve piled into infrastructure providers such as chip linchpins Nvidia Corp. and SK Hynix Inc., pushed up valuations of startups like OpenAI and Anthropic, and poured capital into all manner of gear suppliers to the AI boom.

The surge in valuations has worried some market observers who argue that, while data center spending and construction is accelerating, AI services have yet to go mainstream and earn the revenues needed to justify the near-unprecedented rally.

“If the technology doesn’t catch up and doesn’t deliver as per the high expectations that the market’s pricing in, then we’re in for a bubble,” GIC Pte group CIO Bryan Yeo told the Milken Institute Asia Summit in Singapore on Friday.

In recent years, digital infrastructure in particular has become a popular target for global investors looking for stable returns and growth. It’s also one of the busiest assets for dealmaking, despite concerns that the new capacity may eventually outstrip demand.

At $40 billion, GIP’s deal for Aligned would rank among the world’s five biggest transactions this year, according to data compiled by Bloomberg. GIP already owns Dallas-based data center company CyrusOne with KKR & Co. The two firms took CyrusOne private in a 2021 deal valuing the company at about $15 billion.

BlackRock acquired GIP last year for roughly $12.5 billion. Shares of BlackRock have gained about 13% this year, giving the company a market value of about $189 billion.

Aligned, operating throughout the US and South America and based in Plano, Texas, has 50 campuses and 78 data centers under management and future development, according to its website. In January, it landed more than $12 billion in equity and debt commitments from investors including funds managed by Macquarie Asset Management.

Last month, Aligned was one of the companies represented at a meeting with Trump administration officials on speeding the development of AI and the infrastructure it relies on.

The data center construction boom is galvanizing governments around the world. In the US, the White House has proposed streamlining environmental reviews for the construction of new facilities as investment pours into the industry.

Recent deals include Meta Platforms Inc. raising $29 billion in a financing package for a data center in Louisiana. Oracle Corp. raised $18 billion in bonds as it builds infrastructure for OpenAI.

MGX has been looking at raising up to $25 billion for its AI infrastructure effort, Bloomberg News has reported. Mubadala also maintains a strategic partnership with BlackRock, according to the fund’s website.

(Updates with GIP acquisition, BlackRock share move in 12th paragraph.)

©2025 Bloomberg L.P.