ADNOC Distribution achieves record Q1 performance with 16% profit growth

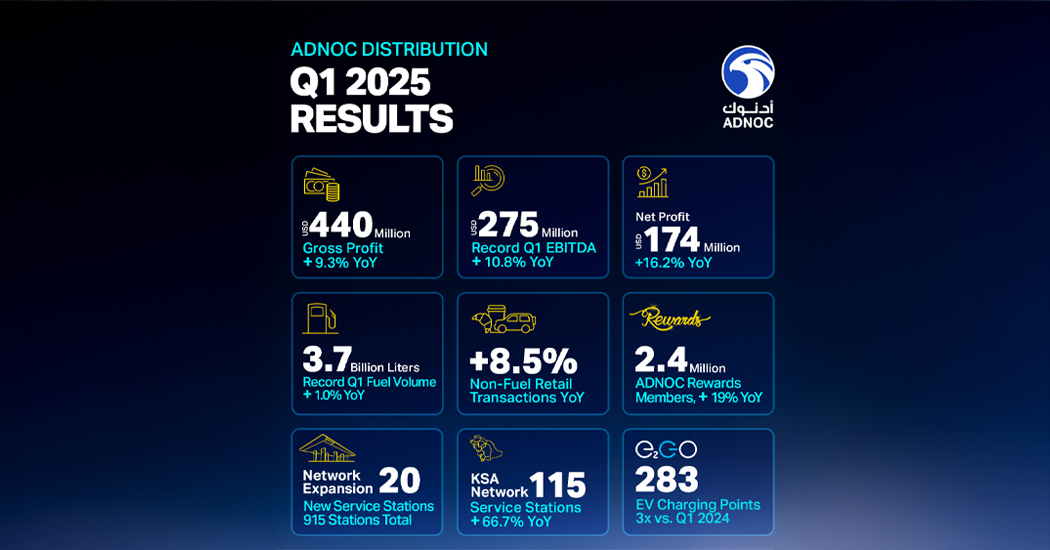

Abu Dhabi's ADNOC Distribution has announced its strongest first-quarter performance since going public in 2017, with EBITDA climbing 11% year-on-year to $275 million (AED1.01 billion).

The UAE's largest fuel and convenience retailer saw net profit surge 16% to $174 million (AED639 million) for the first three months of 2025, significantly exceeding analyst expectations.

The company attributed these robust results to growth across both fuel and non-fuel segments. First-quarter fuel volumes reached an all-time high of 3.7 billion litres, bolstered by market share growth and network expansion.

ADNOC Distribution added 20 new service stations during the quarter, bringing its total network to 915. The company remains on track to meet its target of 40-50 new stations by year-end.

Non-fuel retail continued to outpace fuel growth, with gross profit rising 14% year-on-year. This was driven by higher convenience store conversion rates and strong performance in ancillary services such as car wash, lube change and property management services.

The company has also substantially expanded its E2GO electric vehicle charging network, adding 63 new charging points in the first quarter alone. The total now stands at 283 installed across the UAE which is a 318% increase from last year.

Chief Executive Officer Eng. Bader Saeed Al Lamki said the results demonstrate the company's "commitment to growth and delivering sustainable and innovative solutions" while creating long-term value for shareholders.

ADNOC Distribution confirmed its commitment to an annual dividend payout of $700 million through 2028, representing a yield of approximately 6% at current share prices.