Iberdrola Starts €5 Billion Share Sale for Grid Investment

(Bloomberg) -- Iberdrola started a €5 billion ($5.9 billion) capital increase, the biggest share sale in Europe so far this year, to bolster investments in power networks and further its US and UK expansion.

The indicative price guidance for the Spanish energy giant’s accelerated bookbuild was €15.10 per share to market, according to terms seen by Bloomberg. Iberdrola’s closing price was €15.895 on Tuesday, bringing the stock’s gains to 20% this year.

Indicative investor interest exceeds of the size of the offer, with the company’s shares suspended in early Madrid trading.

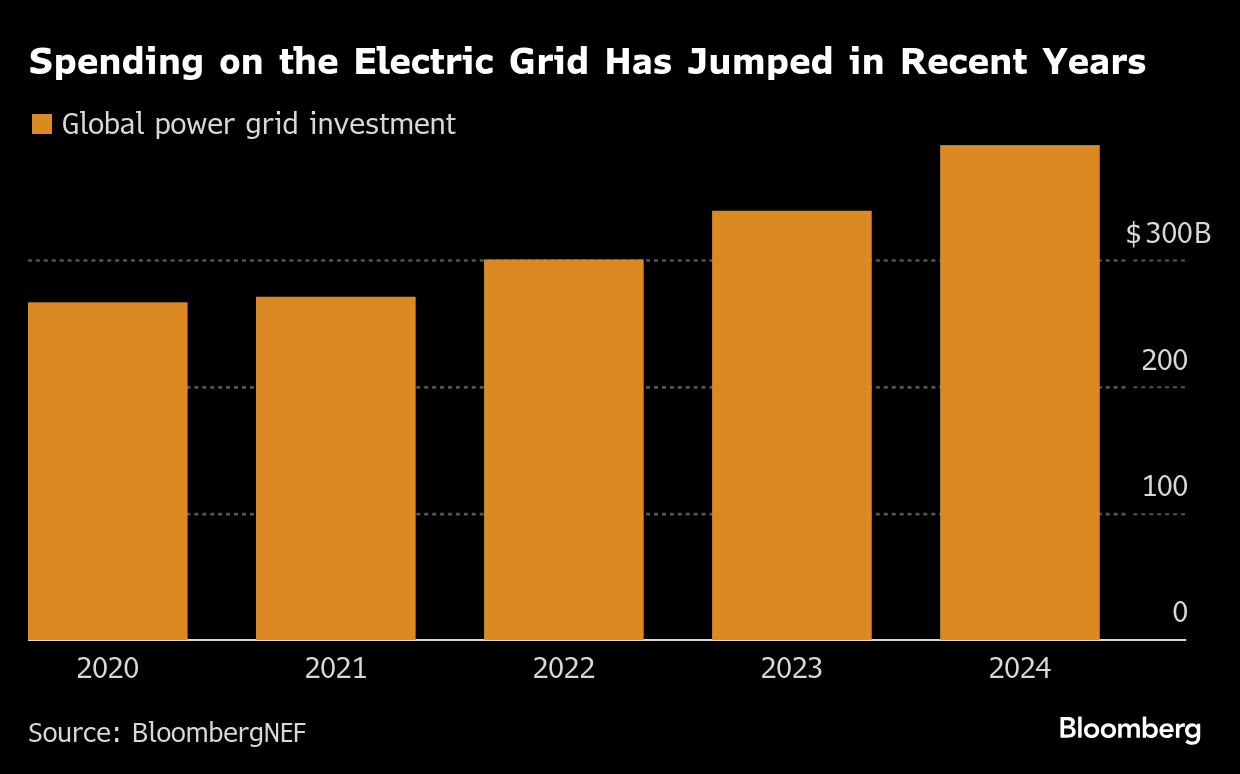

Iberdrola is one of a handful of companies cashing in on the unprecedented demand to build out power grids as countries work to decarbonize and meet rising electricity demand. The company expects to invest some €55 billion globally over the next six years, an increase of 75% compared with the previous six years.

The Spanish utility will maintain its focus on the US and UK, saying tariff frameworks for transmission and distribution activities in the two markets represent “an unprecedented investment opportunity.”

By contrast, Iberdrola sees little incentive to invest in its home market of Spain. Antitrust regulator CNMC has proposed increasing network returns to 6.46%, but that remains below the level of other European countries.

That proposal gives “a clearly negative signal to the market,” Iberdrola Chairman Ignacio Galan said Wednesday on an earnings call.

The reliability of the Spanish power network has also been questioned in the wake of the nationwide blackout that left millions of people without electricity at the end of April.

Iberdrola expects its regulated asset base to triple to more than €90 billion in 2031 from the level in 2020. While investments will grow almost fourfold in the UK and near double in the US, the company’s Spanish assets are projected to shrink by 10% to €3.5 billion.

(Updates with details throughout)

©2025 Bloomberg L.P.