Trade Deal Jitters Weigh on German Investor Confidence

(Bloomberg) -- Investor confidence in Germany’s economic prospects slumped in August after the risk of a costly European Union-US trade deal became a reality.

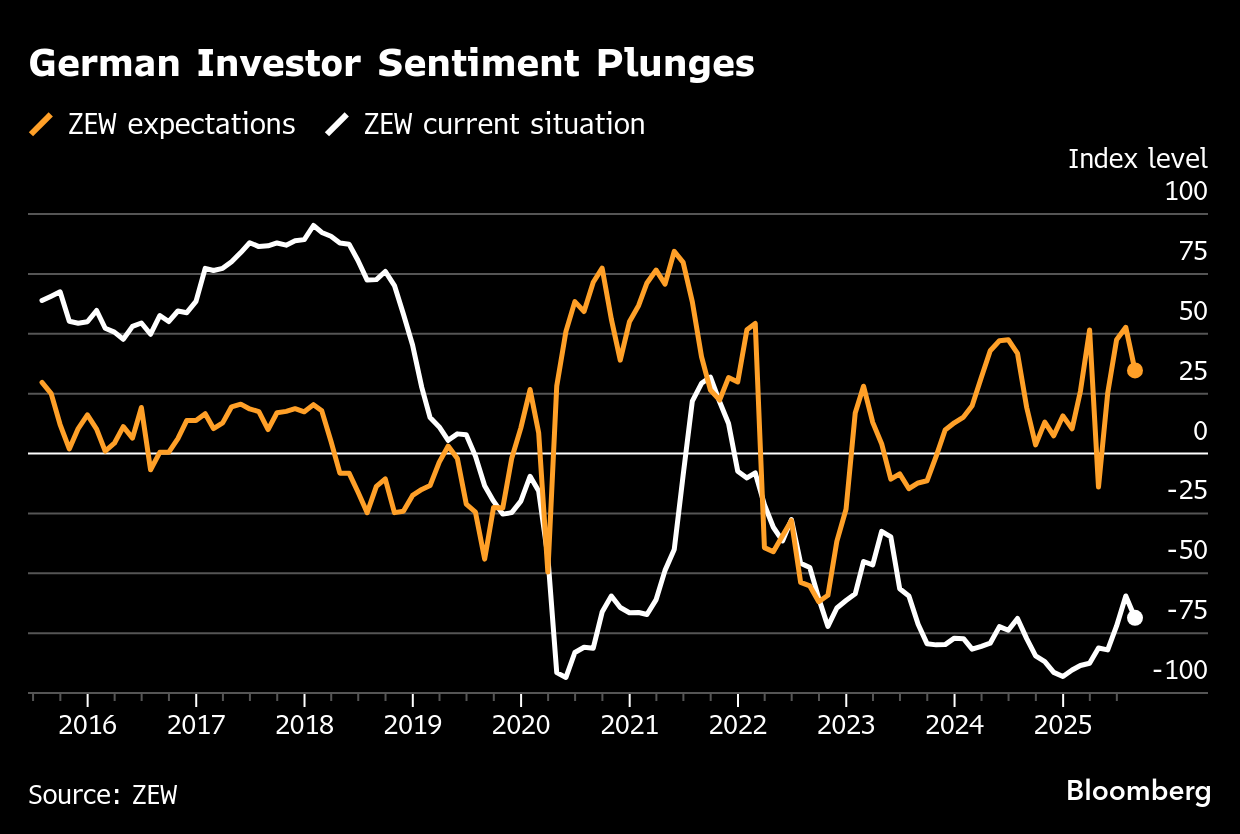

An expectations index by the ZEW institute dropped to 34.7 from 52.7 the previous month, less than the 39.5 that analysts in a Bloomberg survey had estimated. A measure of current conditions also retreated.

Europe’s largest economy is struggling after hopes for a quick recovery from two years of contraction were quashed when President Donald Trump slapped tariffs of 15% on nearly all of Germany’s exports to the US. The friction over trade is adding to a fragile political backdrop at home, where support for Chancellor Friedrich Merz is falling.

“Financial market experts are disappointed with the announced EU–US trade deal,” ZEW President Achim Wambach said in a statement, adding that “the poor performance of the German economy in the second quarter” also contributed.

He said that the outlook had especially worsened for the chemical and pharmaceutical industries, with mechanical engineering, metals and automotive “also severely affected.”

“The latest trade deal with the US clearly isn’t a lasting and viable solution in relations between Brussels and Washington,” said Valentin Jansen, an analyst at Nord LB. “Although the talks may have prevented worse from happening for the time being, the result is that both significantly higher US import tariffs and growing pressure on domestic markets threaten to place additional burdens on the German economy.”

Merz, who’s viewed by most Germans as incapable of guiding the nation through a crisis, faces a daunting list of challenges. The likelihood of output shrinking for another year has risen after major industrial firms trimmed their outlooks. Carmakers in particular are downbeat as they grapple with tepid demand for electric models, collapsing sales in China and Trump’s tariffs.

In addition, wars in Ukraine and Gaza are testing long-held political convictions, while there are doubts over the viability of Germany’s social-security system and disagreements over migration.

While hundreds of billions of euros of spending should bolster the economy down the line, the Bundesbank anticipates no growth at all this year. Underscoring the malaise, factory orders unexpectedly dropped for a second month in June, with industrial production suffering its biggest decline in almost a year.

(Updates with economist in sixth paragraph. An earlier version of the story corrected the month for factory orders)

©2025 Bloomberg L.P.