Wall Street Backers See Breakthrough Moment for Carbon Offsets

(Bloomberg) -- After more than three decades on Wall Street — first at Goldman Sachs Group Inc. and then at Bank of America Corp. — Tom Montag thought he’d seen most forms of financial wizardry. Then Hank Paulson asked him to tackle carbon offsets.

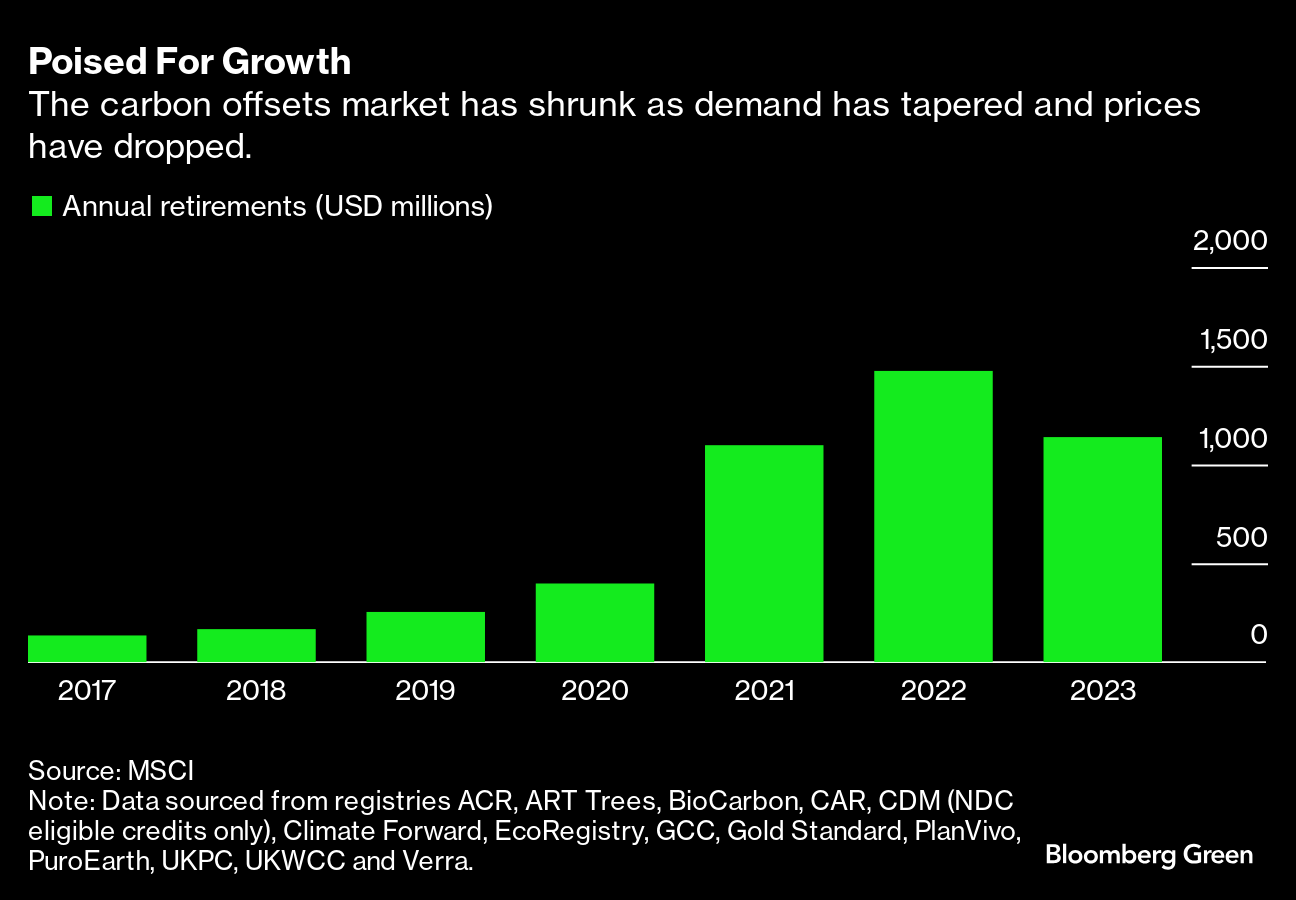

It was the summer of 2022, and the former US treasury secretary had recently taken the helm at TPG Inc.’s Rise Climate, the private-equity firm’s main green investment vehicle. Paulson wanted to build a new multimillion-dollar venture called Rubicon Carbon that buys up credits derived from funding forest projects or backing wind farms as a way to let polluters compensate for their own contributions to climate change. A burst of corporate pledges to address emissions had sent a niche market, still only worth about $1 billion today, into a full-fledged rally. TPG injected $300 million into Rubicon, Bank of America bought in, and JPMorgan Chase Co. joined as a strategic partner.

The goal was to “unleash as much carbon finance as possible,” Montag said in an interview.

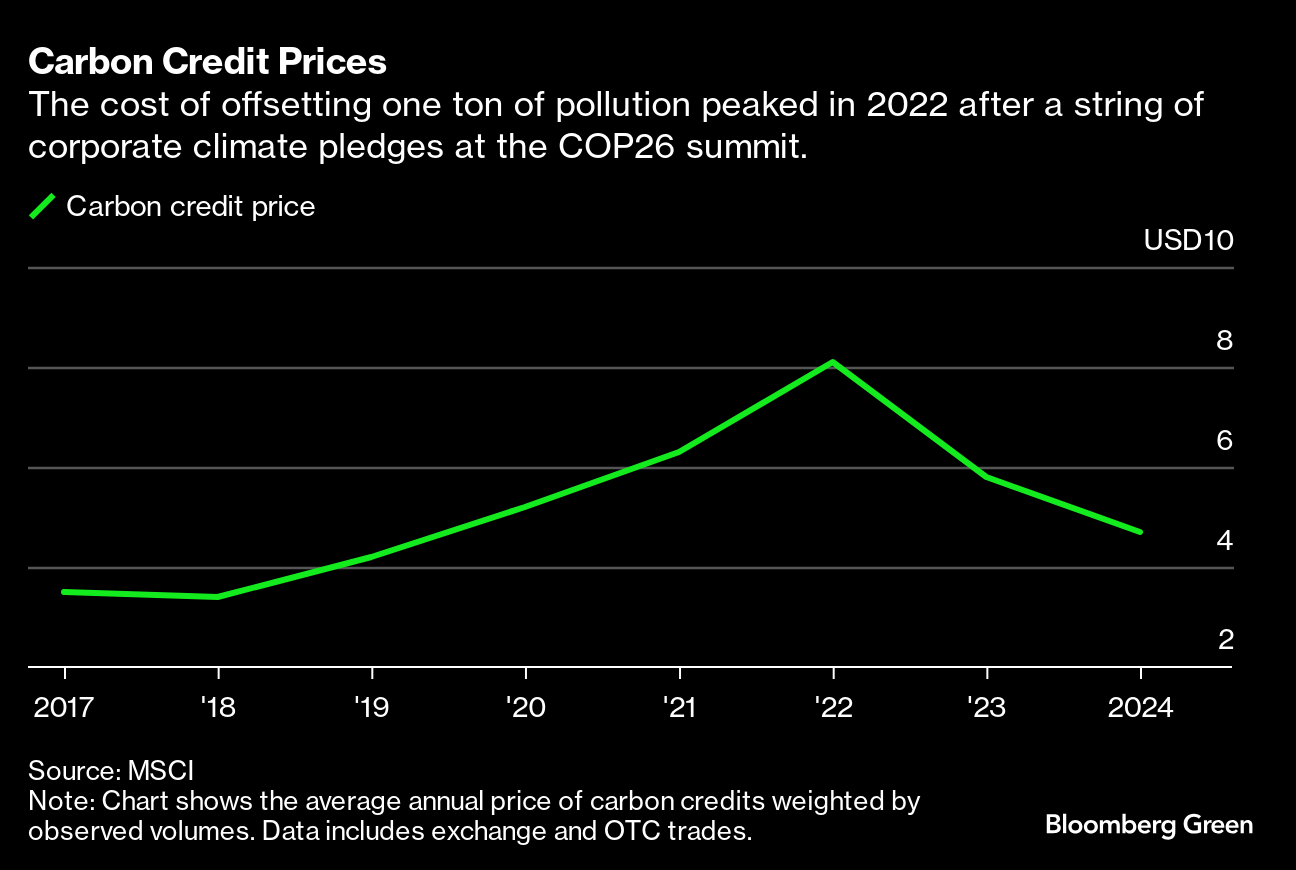

But a string of scandals threw the anticipated boom into question. There was the collapse of a giant forest-protection effort in Zimbabwe that had become one of the world’s largest sources of carbon offsets. High-profile lawsuits attacked companies such as Delta Air Lines Inc. and KLM for making false claims based on the credits, further spooking buyers. Prices for carbon offsets tracked by MSCI peaked in 2022, when Paulson recruited Montag, and have been on a downward trajectory since.

“The market has not grown as fast as I’d hoped,” Montag said. “There have been so many things up in the air that companies are wanting to see how it all lands.”

Montag and other backers on Wall Street haven’t blinked. They’ve remained convinced companies and governments will eventually embrace carbon offsets as an indispensable climate solution in a world racing to reach net zero emissions. And last month, Rubicon signed a deal with Microsoft Corp., one of the world’s largest offset buyers, to generate credits from a tree-planting project in Panama.

Offset bulls recently scored big wins. Top Biden administration officials just issued the US government’s first-ever official blessing of the credits, including for use against so-called Scope 3 emissions from a company’s customers and suppliers. That followed a similar acceptance from the board of the world’s most-respected arbiter of corporate climate goals, the Science Based Targets initiative, over objections from its staff.

“We’re a step closer to delivering a global carbon market,” said Bill Winters, chief executive of Standard Chartered Plc, which has built a special team that coordinates with bankers across trading, advisory, financing and risk management to grow its carbon credits business. The US announcement “must be taken as an invitation for others to lean in,” he said. “It’s an opportunity that cannot wait.”

Some of the biggest banks have been mobilizing. JPMorgan, Bank of America and Barclays Plc have built out carbon trading and finance desks. Citigroup Inc. is exploring how offsets could be used to reduce the risk of financing green projects in developing countries. Goldman Sachs and Mirova, an affiliate of Natixis Investment Managers, have set up funds that allow companies to invest in green projects and generate returns in offsets. Forecasters at BloombergNEF predict a market rising as high as $1 trillion market within three decades.

Montag likens the current moment for offsets to the history of derivatives market, which faced far more profound mistrust following the 2008 subprime mortgage crisis that wrecked the global economy. Establishing industry standards helped bring derivatives back to a multi-trillion-dollar trade.

To engineer a comeback for carbon offsets, Montag said, “you need to build trust.”

Stamp of Approval

Offsets have been around for more than three decades. In theory, they’re an elegant solution to a vexing climate problem: How can the wealthiest parts of the planet, with responsibility for the vast majority of historic emissions, rapidly channel hundreds of billions of dollars to green projects in developing economies?

But even with avid interest from Wall Street, the market for carbon offsets has struggled to take off. It’s proven difficult to reliably measure the climate impact of projects underpinning carbon credits, and skeptics worry that buying inexpensive offsets deters companies from investing in technologies to curb their own emissions.

There’s also been no consensus on how companies should factor the credits into their net-zero plans. Until recently, SBTi and others urged companies to limit the use of carbon credits to only the last 10% of their overall emissions. Critics pushed back against that approach as too restrictive, relegating carbon credits to little more than corporate philanthropy. The recent moves by both US Treasury Secretary Janet Yellen and SBTi to support the use of carbon offsets for Scope 3 emissions mark a victory for proponents. Emissions from suppliers and customers are often the hardest for companies to cut, they say, and for enormous polluters such as the fossil fuel industry Scope 3 accounts for the vast majority of their total.

This kind of policy uncertainty combined with years of greenwashing accusations to put buyers off. So proponents have been targeting a new driver for growth: government support.

For now, demand is reliant on companies choosing to buy carbon credits to boost their green credentials. But there are much larger regulated markets — worth almost $100 billion, according to estimates by the World Bank — where businesses are required to buy emissions permits or pay carbon taxes. Allowing offsets to be used in those structures would overcome a major stumbling block for the market.

“If governments put a stamp on them, you don't actually have to go and look at the project and whether these things work,” said Rosali Pretorius, a partner at law firm Simmons & Simmons who specializes in energy and commodities derivatives. They “can be freely traded, and whoever sells them is not responsible for the quality.”

Some countries, including Colombia and Australia, already let companies use credits produced at home to lower their carbon bills. China, the world’s largest source of emissions, is among those exploring the use of international offsets in their regulated schemes. South Korea, one of only three nations that allow foreign credits, is considering expanding its current 5% allowance, according to people familiar with the deliberations.

Meanwhile, debate is picking up around whether the European Union should allow offsets in its $47 billion Emissions Trading System. The United Nations is also in the process of setting up a system that would offer another quasi-regulated venue for trading.

“As long as this is purely voluntary, the market will always struggle with a strong demand signal,” said Brett Orlando, global head of commodity transition at Bank of America. “The more regulatory oversight bodies and compliance-oriented trading schemes that accept carbon credits, the more firm that demand will be.”

As a start, advocates want key regulators and policymakers to back guidance developed by prominent industry-led governance bodies like the Integrity Council for the Voluntary Carbon Market (ICVCM), which last week announced the first batch of carbon credits eligible for its quality label. The International Organization of Securities Commissions, an umbrella organization for national regulators around the world, and the US Commodity Futures Trading Commission have done so.

Commissioner Christy Goldsmith Romero said part of the desire to get the CFTC to weigh in was that there’s “no real way to determine” whether a credit corresponds to a good or bad project. “I’ve been a regulator in the United States for 21 years, and this is the first time that industry comes in and they ask for more regulation,” she said. “Companies were concerned that they could potentially get in trouble.”

Still, it’s a fine line between official guidance and legally enforceable standards. Dozens of companies, including Montag’s Rubicon, have written letters objecting to a proposed bill in California that would make it illegal to sell poor-quality credits.

“What industry is looking for in a lot of this is a legal shield,” said Danny Cullenward, senior fellow with the Kleinman Center for Energy Policy at the University of Pennsylvania. “The structure the industry's trying to create is: Industry chooses the good credits, governments bless the good credits and prevent accountability” for the bad ones, he said.

Risk Management

For those who see offsets as a money-making opportunity, quality issues are just another risk that can be managed with the right product.

Startups have already sprung up offering everything from insurance policies to protect buyers from wildfires that raze tree projects to cryptocurrencies designed to rid the market of useless offsets. Senior US officials have said the government is looking to enable financial innovation that can address such shortcomings in the market.

Rubicon has devised a new product to tackle the risk that a project is issuing too many — or too few — credits relative to the amount of real emissions that are saved on the ground.

Currently, the market uses a ton-for-ton approach. One credit represents one ton of CO2 emissions removed from or not added to the atmosphere; each of these credits can be used, or “retired,” by companies looking to compensate for one ton of pollution.

Rubicon doesn’t use this uniform approach because it doesn’t account for the variation in quality of the renewable facilities or tree-planting efforts that underpin each offset. Instead, the fund retires offsets in proportion to its view of the quality of the underlying projects.

In a simple example, for a project that's assessed to have issued 20% too many credits, the firm would retire 1.2 times the number of credits. Likewise, if the project is assessed to have issued 20% too few credits, the firm retires 0.8 times the credits their client needs. In practice, retirements are carried out at a portfolio level.

This process leaves Rubicon confident in the amount of carbon wiped off corporate ledgers. The calculations are based on inputs from the likes of BeZero, a carbon ratings firm run by Tommy Ricketts, a former Bank of America investment strategist. The company employs dozens of climate and data scientists as well as geospatial experts who analyze projects and rate their effectiveness.

Ricketts encourages buyers to use this diversified portfolio approach to hedge against risk. He described the current “pass-fail rule,” where a project is either considered good or bad, as inherently flawed. As long as the market sticks to that approach, “we're never going to come out of this cycle of boom [and] bust,” he said.

The debate over carbon offsets pits two theories of change against each other. Critics want to force companies to make hard choices to cut emissions by taking a cheap but high-risk option off the table. Supporters say it’s foolish to leave hundreds of billions of corporate dollars untapped when poor countries desperately need green finance. “It's just not constructive,” said Alexia Kelly, a former US climate negotiator and Netflix sustainability chief who now heads carbon market development at the High Tide Foundation, a philanthropy that funds the ICVCM. “We've lost three years of climate action because we can't agree on how to account for this stuff.”

“Much like money has a time value, so does carbon,” Montag said. “Action to reduce carbon today is more impactful than carbon reductions 15 years in the future.”

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods