European Gas Rises as Supply Risks Outweigh Disappointing Demand

(Bloomberg) -- European natural gas prices rose, signaling the market balance remains fragile even as demand for the fuel is persistently weak.

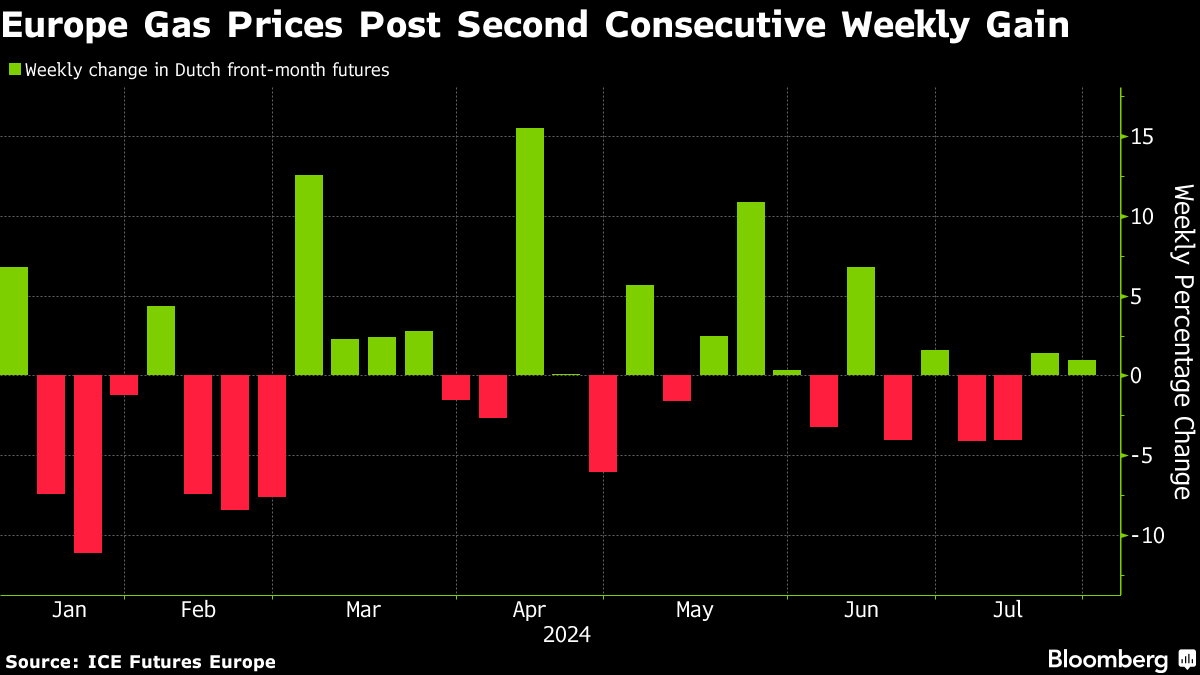

Benchmark futures settled 2.2% higher at €32.48 a megawatt-hour Friday after slumping a day earlier. The contract also posted a second straight weekly gain.

The zigzag in prices this week indicates the market remains sensitive to supply disruptions after Europe became more reliant on global markets as a result of the energy crisis. While traders began July relaxed about supply risks, sentiment has shifted recently amid unplanned outages, warmer weather and stronger competition with other parts of the world for cargoes.

The latest bullish factor impacting the market is an outage at a liquefied natural gas export plant in Australia. Ichthys LNG is repairing one of its two trains following an unplanned issue. That risks tightening global supplies even as flows closer to home, from top-supplier Norway, have rebounded. A key US liquefied natural gas plant is also resuming exports after Hurricane Beryl.

Analysts at Energy Aspects Ltd. said in a note this week they expect an “active hurricane season and Norwegian outage extensions” to support Europe’s gas prices until the heating season officially starts in October.

At the same time, demand for gas continues to disappoint, with Italy’s Eni SpA observing a 16% decline in consumption during the second quarter from a year earlier. It said the drop was partially linked the country’s industrial sector.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis