It Costs More to Buy Gas for Summer Than This Winter in Europe

(Bloomberg) -- European natural gas for summer delivery is more expensive than contracts for this winter, signaling that the region is well-stocked for the current season and will face its next challenge in rebuilding inventories.

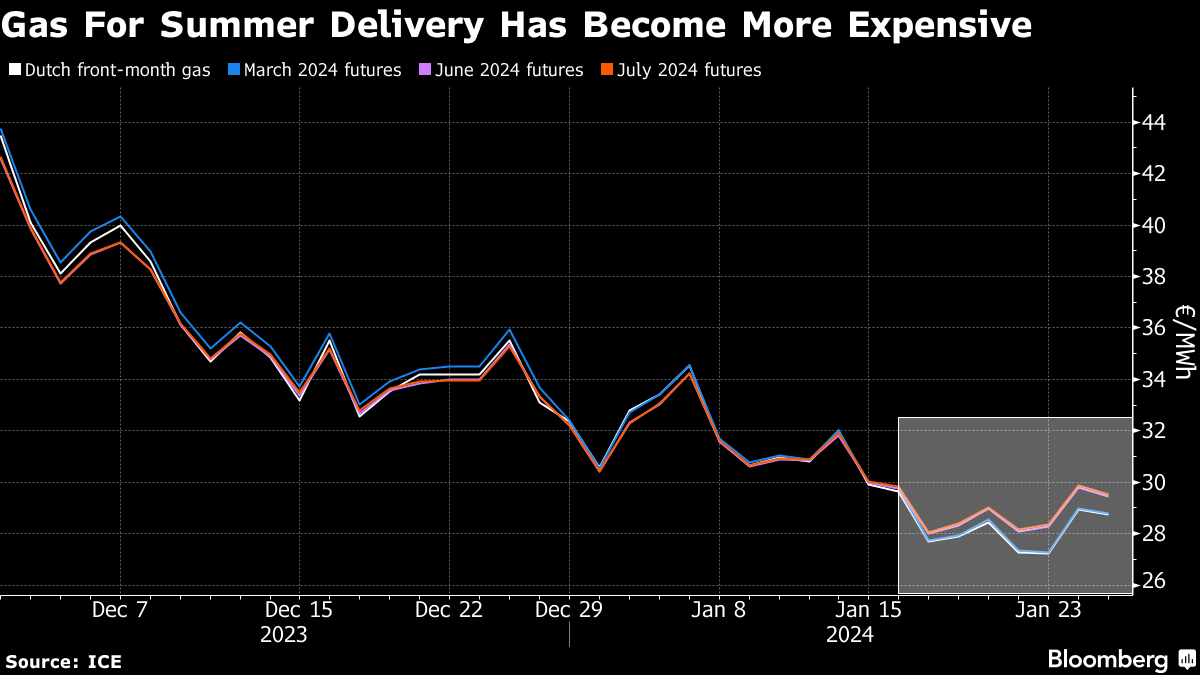

Benchmark futures for both February and March delivery are now trading almost €1 cheaper than those for June and July delivery, with the gap between the two contracts widening throughout January.

The difference indicates that traders have grown increasingly confident in recent weeks that Europe will face little-to-no supply challenges for the rest of the winter, despite the ongoing volatility still dominating the market. Contracts are trading below €30 per megawatt-hour, near the lowest since last summer.

Demand for gas in Europe has remained tepid amid a slow economic recovery, and the region is still benefiting from having amassed record fuel stockpiles last year. Above-average renewables output and a mostly mild winter have also helped.

Temperatures across the continent are set to remain above the average for the season throughout through the first week of February, according to forecaster Maxar Technologies Inc. That’s set to contribute to even lower demand for the fuel for heating.

Still, traders are monitoring the developments surrounding liquefied natural gas deliveries from major exporter Qatar after the Middle Eastern country informed some European buyers of rescheduled shipments. Circumnavigating Africa adds about two weeks to the journey to Europe.

Europe’s next challenge will be to fill storage sites in preparation for the following winter. The possibility of a scorching summer means that demand for cooling might increase. 2023 was already the hottest year on record.

There’s also uncertainty surrounding the renewal of a gas pipeline transit agreement between Russia and Ukraine that expires at the end of this year. While Europe has become more reliant on LNG imports since the energy crisis, large parts of new global capacity is only expected to come online starting in 2025.

Dutch front-month futures, Europe’s gas benchmark, was little changed at € a megawatt-hour at 9:28 a.m. in Amsterdam.

©2024 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost