UK Battery Capacity to Quadruple Even as Profits Squeezed

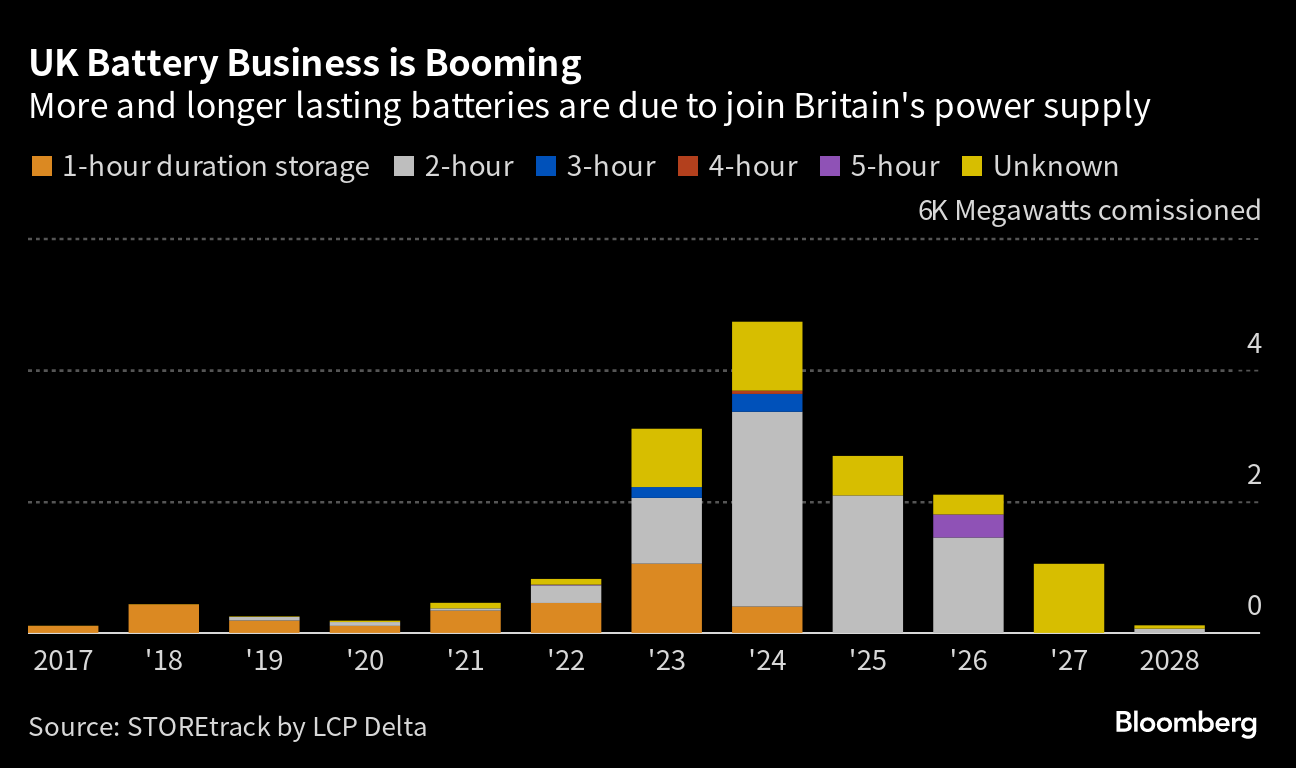

(Bloomberg) -- Investors piling billions of pounds into the UK grid-scale battery sector will drive a fourfold increase in capacity by 2030, even as profit margins are squeezed.

Less volatile power markets are likely to curb margins from the peaks witnessed in 2021 and 2022, but there will still be opportunities for long-term investors looking for sustained growth, according to report by consultancy LCP Delta. Batteries are key for storing cheap renewable power at times when the grid is over-supplied, while unleashing it when demand and prices are higher.

“Everyone is getting very, very excited about battery storage at the moment,” Matt Deitz, an author of the report, said in an interview. “There needs to be a level of realism about what is actually going to be captured going forwards.”

The capacity of grid-scale batteries is projected to climb from 4 gigawatts by the end of this year to as high as 18 gigawatts by 2030, according to LCP Delta. Investors from KKR & Co. to Abu Dhabi-based Masdar and Macquarie Group Ltd.’s Eku Energy are flocking to an industry that’s enjoyed bonanza returns during the energy crisis.

The availability of data and a more mature trading market means the UK industry is more advanced than European neighbors.

As the importance of intermittent power sources like wind and solar increases in Britain’s energy mix, more storage solutions like batteries and hydropower will be needed to ensure power is available at all times.

While facing long wait times for grid connections, there are opportunities for operators that optimize the location of their assets and deploy sophisticated trading strategies to help balance the UK’s power system, LCP Delta said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally