Fund Managers See Water Risk in Semiconductor Bets Being Mispriced

(Bloomberg) -- Investors in semiconductor stocks face a growing threat to industry valuations: a chronic shortage of water.

For Abrdn Plc, there are now few issues as pressing as water for the sector, according to David Smith, a senior investment director for Asian equities at the asset manager.

“Water management has been one of our top engagement areas with our semiconductor companies,” he said in an interview. “Water has the potential to be far more material in terms of operational costs, but also a threat to continuation as a going concern.”

Yet as a risk category, it “doesn’t get the attention it deserves,” Smith said. And it’s bigger than just a “niche” ESG concern, he said. “This is a material risk.”

Abrdn, which holds stakes in Taiwan Semiconductor Manufacturing Co. and ASML Holding NV, isn’t alone in its view. Morgan Stanley analysts warn of shortages and tensions ahead with technologies like artificial intelligence requiring vast amounts of water, while climate change and extreme heat are making access more precarious than ever.

Making semiconductors is among the most water-intensive undertakings out there, using about 1,869 cubic meters per dollar. Though it’s a lot less water than utilities use, it’s considerably more than is consumed for textiles and data centers, Morgan Stanley notes.

TSMC, whose home market of Taiwan is the world’s biggest producer of semiconductors, has set targets but fell short of its 2019 water consumption goal. It’s now working toward a 30% cut in unit water consumption by 2030 relative to 2010.

Achieving such goals is becoming increasingly challenging as the planet heats up. Bloomberg Intelligence estimates that Taiwan is facing “abnormal climate patterns” due to global heating and weather patterns such as El Nino, which has the potential to impact “the stability of its water supply.”

TSMC Freshwater Use Intensity vs. Peers

Last year, TSMC’s water per wafer mask layer rose 14.5%, hurting its efforts to meet a 16% savings goal, BI analysts Charles Shum and Sean Chen wrote in an August note. That growing reliance on a scarce resource “could increase its risk of production disruption from droughts,” they said.

In a statement, TSMC said it takes water management “very seriously.” The company has won awards in Taiwan after investing “considerable effort” in the issue so that it now recycles close to 90% of its water, it said. Similar efforts are underway at its Arizona operations, TSMC said. Increasing its “resilience against natural events — such as a drought — is a regular focus,” the company said.

TSMC remains a hugely popular company among investors targeting environmental, social and governance metrics, with 780 ESG funds directly holding the stock, representing just over 6% of the outstanding shares, or $27.3 billion, according to data compiled by Bloomberg based on the latest disclosures. Among ESG funds, TSMC’s biggest holders include Swedbank AB, Fidelity International Ltd., Schroders Plc and JPMorgan Chase & Co., the data show.

But there are some notable exceptions. One of the world’s biggest climate funds, which is managed by Nordea Asset Management and adheres to the European Union’s strictest ESG rules, didn’t hold TSMC at the end of July, according to the latest available data compiled by Bloomberg.

Vicki Chi, a portfolio manager at Robeco in Hong Kong, says she and her team have already adjusted the valuations of semiconductor assets to reflect water scarcity.

Screening for such risks means “actually getting a head start” as an investor, Chi said.

The goal is to try to catch everything from the rising cost of maintaining access to water as a basic resource, to the potential for litigation if local communities fight corporations tapping their water supply.

Meanwhile, investors are often being kept in the dark. A recent analysis by Morgan Stanley found that many semiconductor companies aren’t publishing quantifiable water targets, including ASML, Nvidia Corp. and Broadcom Inc.

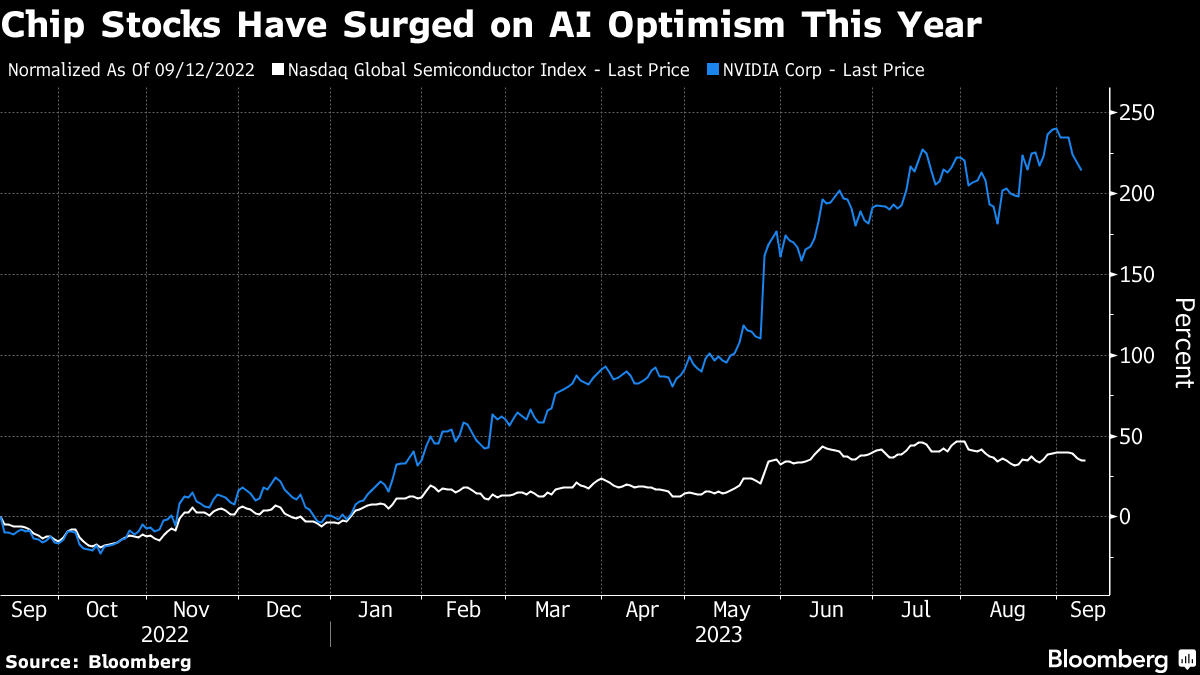

The sector has soared as semiconductors support everything from artificial intelligence to building 5G technology. Valuations also have been underpinned by supply concerns fanned by US-China tensions and the trade barriers that have ensued. But with the Nasdaq Global Semiconductor Index up about 40% year-to-date, some investors are starting to look for potential cracks. That’s particularly true for a few of the sector’s absolute top performers, with Nvidia up more than 200% this year.

High valuations have “set the stage” for more investors to dig into the issue of water, said Tim Chan, Morgan Stanley’s head of sustainability research for Asia-Pacific ex-Japan.

“There’s so much attention on semiconductors right now,” he said. “There’s more investors having a share of the industry, more analysts looking at it. They will ask more long-term questions related to ESG.”

Water is an issue that’s hitting the tech industry more broadly. In Spain, Meta Platforms Inc. is facing local opposition to a planned €1 billion ($1.07 billion) data center, as the country faces increasingly fierce droughts and fires that have turned water access into a politically explosive topic.

In the Netherlands, Microsoft Inc. found itself the target of local outrage last year after it was reported that one of the company’s local data center facilities was consuming more than four times the maximum amount of water than previously disclosed.

And when Taiwan faced its worst drought in more than half a century in 2021, officials shut off irrigation across tens of thousands of acres of farmland, directing water to its semiconductor industry and angering locals. In a comment to Bloomberg, TSMC said that by implementing its “detailed response procedures,” the company managed to keep operations running without any disruptions.

“When you’re operating in a region that has a degree of water scarcity, if you’re sucking up all that water for your own production, and that’s disadvantaging local residents, then that’s not going to make you terrifically popular,” Abrdn’s Smith said. “And so, this is a big part of our conversation with companies around how we manage that.”

Robeco’s Chi says the valuation adjustments she’s made to reflect water risk have so far been moderate. It’s a “bottom-up process on companies’ valuations, rather than putting some sort of discount for all of the semiconductor companies.” But managing water risks adds costs, and that eats into margins, she said.

Capital expenditures for water management are a key indicator to monitor, she said.

(Adds list of biggest ESG fund managers, in 12th paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost