Thames Water Can’t Get £2.5 Billion Needed Without Rule Changes

(Bloomberg) -- Thames Water Plc said its £18.7 billion ($22.7 billion) plan won’t get funding from investors unless the regulator changes its rules to allow fatter returns.

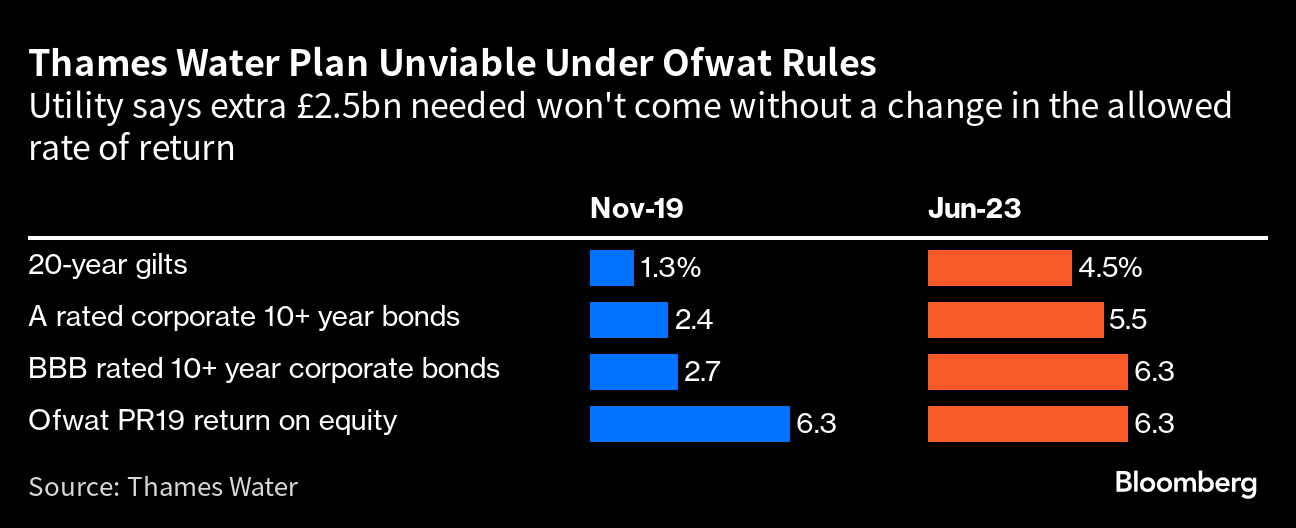

The utility said delivering on its full business plan, published Thursday, rests on getting £2.5 billion additional equity from shareholders for 2025 to 2030. However, investors can get better returns in UK gilts and investment grade corporate bonds. It called on Ofwat to make significant changes to the rate of returns allowed for regulated water companies.

Thames said shareholders have agreed to give an additional £750 million for its turnaround plan, and it’s seeking another £2.5 billion. Even with that money, it said it has scaled back its ambitions on cleaning up the environment for the second half of the decade.

The company called for a “material move up in the allowed rate of return” set by Ofwat in its initial guidance. In addition, it said no external dividends would be paid until at least 2030. Almost 70% of its planned expenditure will come from bill payers who will shell out about 40% more for services from the utility up until the end of 2030.

The utility has been at the center of a crisis that’s roiled the industry this year as calls from the public and politicians to stop releasing sewage into waterways coincided with soaring debt costs.

Ofwat, the water regulator, issued early guidance for estimating the cost of capital in December 2022 and asked water companies to use this framework when calculating the allowed return for the period 2025–30.

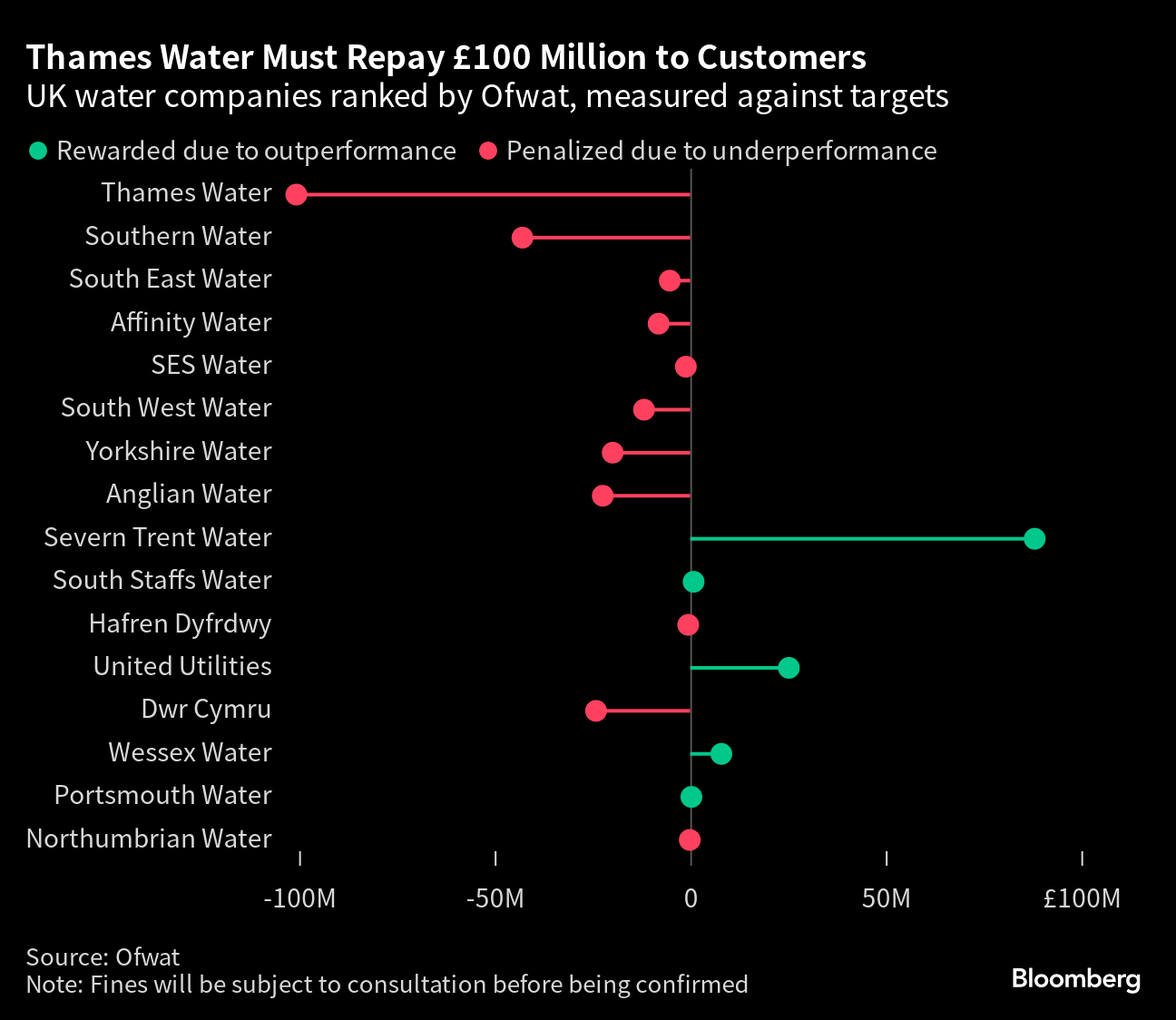

The company called on Ofwat to soften rules around penalties, which sees customers reimbursed for poor performance by water providers, including pollution spills. Thames and Southern Water Ltd. were named last week as the industry’s worst performers by Ofwat, which imposed penalties on both because of a failure to meet delivery targets.

(updates with details.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost