UK Extends Energy Bills Support for a Further Three Months

(Bloomberg) -- The UK has kept its energy price guarantee at current levels for a further three months, easing pressure on households as the government works to ensure bills reflect falling natural gas costs.

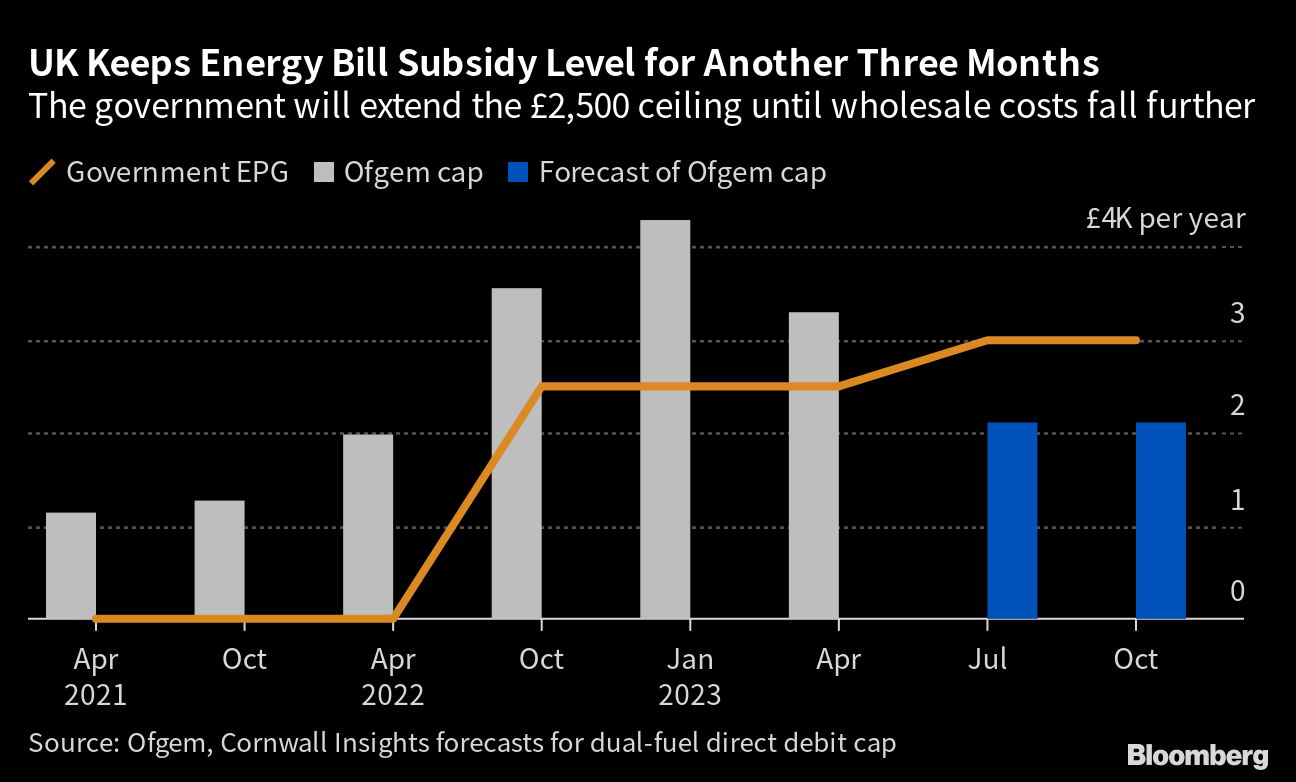

The EPG will remain set at £2,500 ($3,037), the Treasury said Wednesday. That means dual-fuel tariffs will stay stable until July, though customers will still be paying almost double what they were charged two years ago.

The government moved to prevent an expected £500 increase in annual energy costs for consumers in April. Goldman Sachs Group Inc. has said keeping the EPG unchanged will help UK inflation ease to 1.8% later this year from more than 10% now.

“With energy bills set to fall from July onwards, this temporary change will bridge the gap and ease the pressure on families, while also helping to lower inflation too,” said Chancellor Jeremy Hunt. The Treasury said the extension of support will save households £160.

A more than 80% drop in gas prices since last August is yet to show up as a reduction in bills as energy firms pay for supply months in advance and charge customers according to costs at the time of purchase. But consumer advocacy groups have urged policymakers to ensure bills don’t rise when real-time prices are falling.

“The Energy Price Guarantee may only be relevant for another three months,” said Richard Neudegg, director of regulation for price-comparison website Uswitch. “If wholesale prices continue to drop, the next price cap in July could be cheaper, meaning we’ll go back to Ofgem dictating default tariff prices every quarter.”

The EPG means the government limits the maximum price per unit of power and gas, paying any cost of a bill above that level. The Treasury says that the next three months of support will be £4 billion, only a third of the estimated costs of the support which were calculated last autumn.

The chancellor “has been lucky over the course of the winter because of course, when he budgeted in November, he was expecting energy prices to be higher than they have been,” Harriett Baldwin, Tory chair of the Treasury Select Committee, told Sky News.

Soaring gas costs drove UK inflation to a 40-year high last year, pushing up the cost of everything from goods to energy bills. Although prices are expected to ease over the next 18 months, factors beyond fuel prices could continue to keep inflation elevated, according to Bloomberg Economics.

UK PREVIEW: Hunt’s Budget To Keep Powder Dry Until Election

The EPG staying at current levels and a drop in wholesale prices has led Goldman Sachs to forecast that inflation will fall from 10.1% now to below Bank of England’s 2% target by the end of the year. This would help to ease the strain on household budgets after months of the worst cost of living squeeze in decades.

Still, Britons will continue to pay far more for their energy bills than they did before Russia’s invasion of Ukraine. The average annual household energy bill from April will be £285 more than a year earlier, according to the Energy and Climate Intelligence Unit, an independent nonprofit. An energy bill support program — a £400 subsidy given over the winter — is also set to end next month.

Read more: UK Energy Bills to Rise Despite Government Support, Study Shows

Charities such as Citizens Advice and National Energy Action have repeatedly called for long-term support for households. NEA expects an estimated 7.5 million people to be in fuel poverty, even with the EPG remaining at current levels.

Suppliers could begin to help customers cut costs by offering fixed deals, according to Uswitch. Fixed annual contracts below £2,500 would help reintroduce market competition and meet demand for stable pricing, it said.

“The focus now should be on bringing back both price certainty and choice for consumers before they have to get on the price cap rollercoaster again,” said Neudegg.

How Europe Is Muddling Through Putin’s Energy War: QuickTake

--With assistance from .

(Updates with UK inflation data in ninth paragraph.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says