Hedge Funds Pile Into Bullish Oil Wagers Amid Saudi’s Surprise Oil Cut

(Bloomberg) -- Saudi Arabia’s surprise move to cut 1 million barrels a day of its own output has emboldened markets bulls, while the kingdom’s ominous warning on short-selling seems to have sent some bears into hiding.

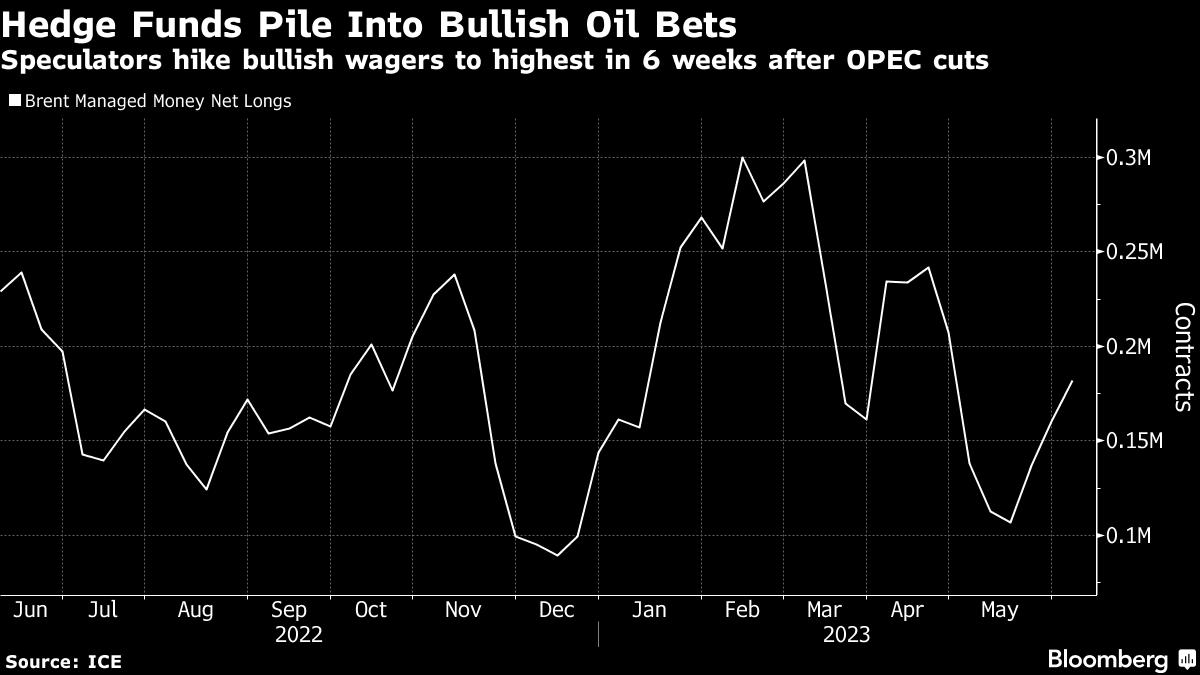

Hedge funds boosted bullish bets on Brent and WTI crude in the week ended June 6, with long positions on the global benchmark reaching a six-week high. At the same time, money managers unwound bearish bets. The shift comes as Saudi Arabia pledged to cut output to “stabilize” the market, shorthand for halting a price slump. Prior to that, Saudi Energy Minister Prince Abdulaziz bin Salman warned that speculators betting on falling prices better “watch out.”

In the lead up to last weekend’s OPEC+ meeting, non-commercial players such as hedge funds had amassed the most bearish stance in over a decade across major oil contracts such as crude, diesel and gasoline. Despite the output cuts, oil prices have failed to rally as investors remain focused on the global economic outlook.

(Adds CFTC data on US crude positioning)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances