GQG Group Said to Invest $1 Billion in Adani Flagship, Green Arm

(Bloomberg) -- GQG Partners LLC and other investors bought stakes worth about $1 billion in two Adani Group companies from the family trust, according to people with knowledge of the matter.

The investors bought shares in billionaire Gautam Adani’s flagship company and its green arm Adani Green Energy Ltd., said the people, who asked not to be named as they’re not authorized to speak on the matter. Large block trades were seen in both companies in early Mumbai trading on Wednesday.

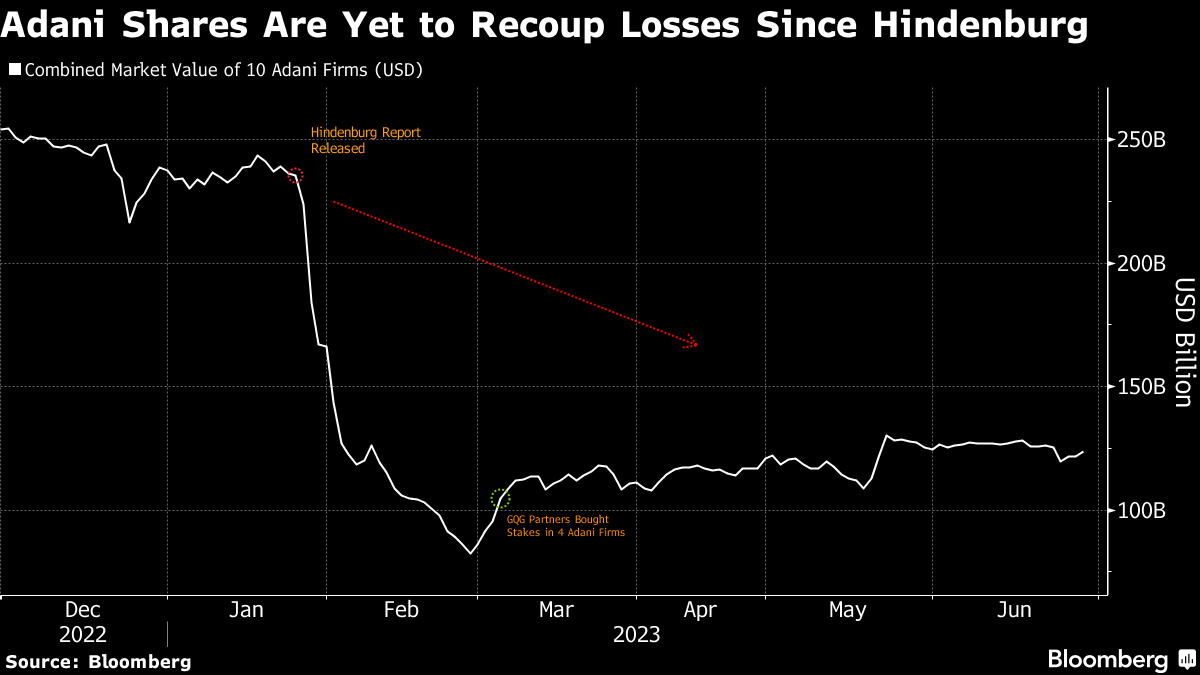

Adani has been seeking to rebuild market confidence since accusations of fraud by US short-seller Hindenburg Research wiped out more than $150 billion in the value of his companies at one point. GQG’s Rajiv Jain said in May he wants to be one of the largest investors in the group, arguing that the infrastructure assets, from ports to coal mines and power transmission, are valuable given India’s ambitious growth plans.

Adani Enterprises Ltd. saw 18 million shares traded in a single block Wednesday, or about 1.6% of its outstanding stock, according to data compiled by Bloomberg. Adani Green had a total 35.2 million shares change hands.

In March, GQG acquired almost $2 billion worth of shares in four of Adani’s firms. Two months later, emerging market veteran investor Jain said his firm had raised its stake in the Adani Group by about 10% and may take part in any future fund raising by the conglomerate.

His initial purchase of shares, including in the flagship and green energy arm, was from the founding family’s trust. The investments anchored the group’s recovery from the losses sparked by Hindenburg, though all 10 companies are still trading below the levels before the report.

The Adani Group didn’t immediately reply to an email request for comments. Bloomberg News couldn’t immediately contact GQG Partners for a comment. ET Now television channel reported the name of the investors earlier.

Premium Purchase

The block trade for Adani Enterprises was transacted at 2,300 rupees ($28), a premium to its previous closing price of 2,284.45 rupees. For Adani Green, the trades were priced at 920 rupees to 924.75 rupees, a discount to Tuesday’s close, and accounted for about 2.2% of its outstanding stock.

Adani Enterprises gained 5.2% to 2,402.00 rupees, its biggest rally since May 23. Adani Green fell as much as 6.8% but erased most of its losses to close 0.3% lower at 956.65 rupees in Mumbai. Shares of other group companies also rallied, with Adani Transmission Ltd. gaining 5.9%. The rally in Adani stocks was in line with broader market as key benchmarks surged to their new record highs.

“It seems like the concerns that some had around the group are dissipating,” said Deven Choksey, managing director of KRChoksey Shares & Securities Pvt. in Mumbai. “The replacement value of a lot of the group’s assets is much more than their current market value,” he added.

The Adani group has scrapped acquisitions and prepaid debt in an attempt to address concerns about its cash flow and borrowings. In May, Adani Enterprises and Adani Transmission Ltd. announced plans to raise a total of $2.6 billion, without committing to a time frame.

(Updates closing prices; adds analyst comment in 10th paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods