Europe Gas Trims Weekly Loss as Heat Waves Create Demand Risks

(Bloomberg) -- European natural gas prices trimmed their weekly drop on Friday as heat blankets the continent’s south and risks raising cooling needs.

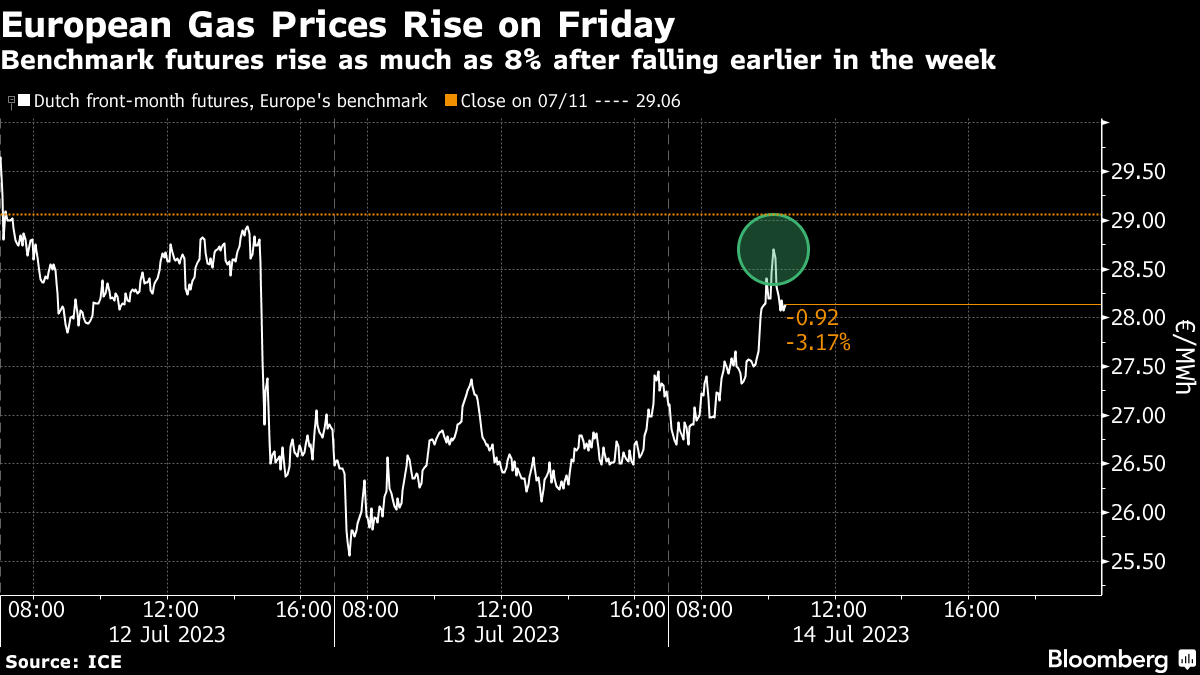

Benchmark front-month contracts traded as much as 8% higher, reversing some of the week’s losses. Higher-than-usual inventories and lackluster demand had kept a lid on prices so far, which are still on course to end the week over 15% lower.

Extreme heat is ripping through southern Europe and parts of Germany, with the next blast from the Sahara lifting temperatures toward record highs in parts of Italy this weekend. Electricite de France SA warned it will curtail production at one nuclear reactor as a heat wave restricts the amount of water that can be discharged into the Rhone River. That could raise demand for other sources of electricity generation.

Still, gas flows from Norway, Europe’s top supplier, are picking up again after works have affected some of the country’s facilities. The market is anticipating the start-up of the Nyhamna gas processing plant on July 15, which would support supply, and the Troll field is also returning to full capacity after lengthy seasonal work, grid data show.

Traders are watching closely for possible updates, given that some works had previously been extended amid technical issues. Further disruptions by large producers, as well as maintenance works affecting global liquefied natural gas supplies, could still strain the market later in the year even though storage facilities are already more than 80% full, analysts at Energy Aspects Ltd. said in a note.

Scientists at the Copernicus Climate Change Service, meanwhile, see strong odds that above-average temperatures in Europe will last into the later months of the year, according to their latest seasonal outlook.

A mild winter could see natural gas prices slump to around €15 — about half the current level, according to Morgan Stanley, though it acknowledged it’s a tricky period to forecast.

Dutch front-month gas, Europe’s benchmark, traded 5.4% higher at €28.05 per megawatt-hour at 11:36 a.m. in Amsterdam. The UK equivalent futures rose 6.8%.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods