EU’s Gas Buyer’s Club Racks Up Demand Ahead of Next Winter

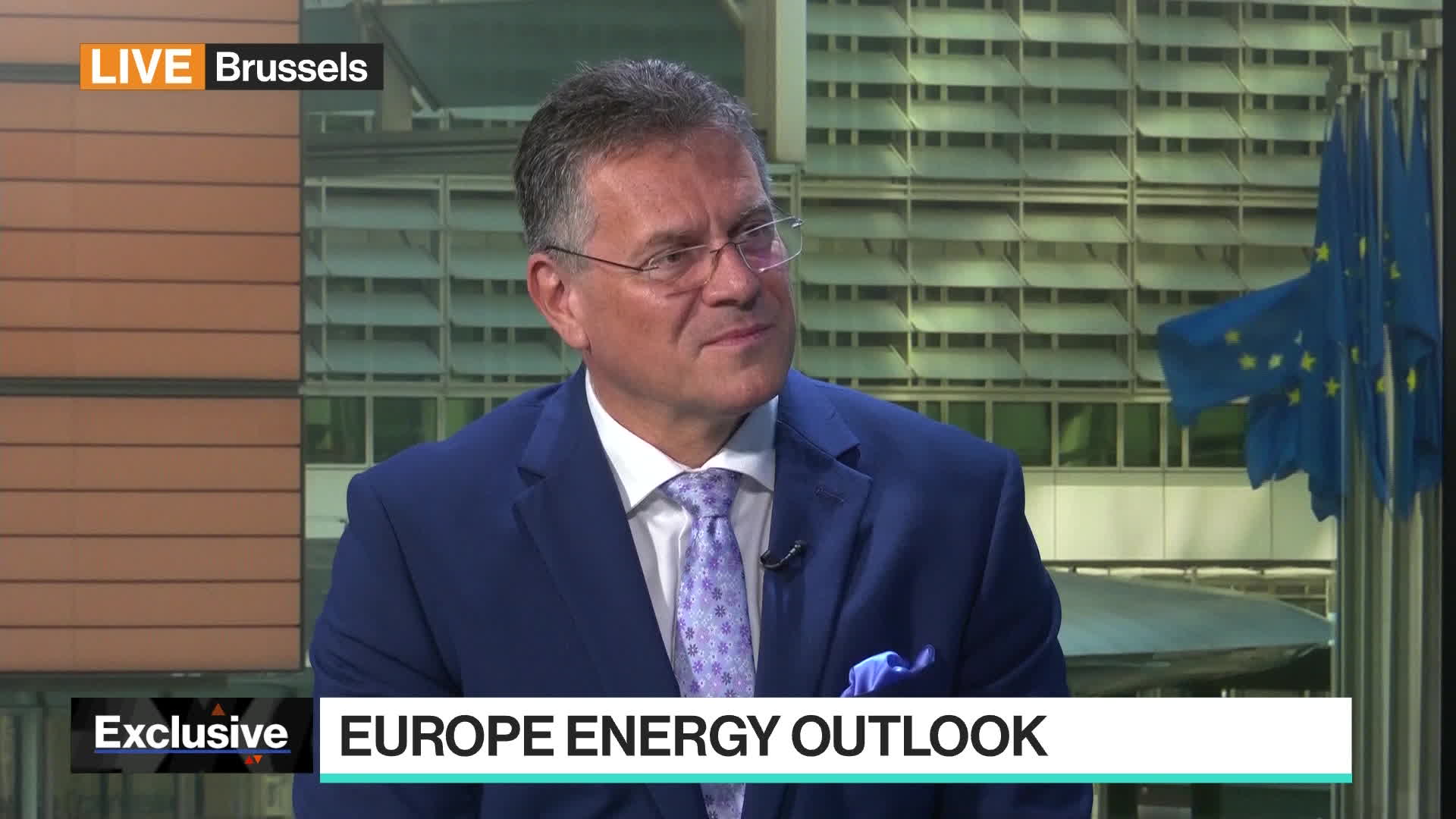

(Bloomberg) -- The European Union’s joint gas buyer’s club is attracting increasing demand as the region prepares for the new heating season, and should provide a blueprint for how the region will secure the raw materials needed for the green transition, according to Commission Vice President Maros Sefcovic.

The joint purchase facility — which emerged as an emergency measure during the energy crisis last year and matches companies looking to buy gas with international sellers — received demand for around 16 billion cubic meters for its second tender, Sefcovic said in an interview with Bloomberg Television. The EU had set a goal of aggregating enough demand to fill 15% of its gas storage sites across the bloc, equivalent to around 13.5 billion cubic meters.

Those are already nearly 80% full, while benchmark gas prices have moderated considerably since last year.

Attention will now turn to the potential for the platform to be used as a model for buying hydrogen and critical raw materials. While the measure was first put in place to help wean the EU off Russian fossil fuels, concerns have grown over China’s dominance in providing the key minerals needed for the clean transition — in producing batteries for electric cars, for example.

“We have to invest much more in critical raw materials to have the strategic supplies we need,” Sefcovic said. “We need to diversify the suppliers.”

The results show continued support for the gas facility, which initially faced skepticism over whether large companies would participate for fear that they might jeopardize their competitive advantage. Non-EU countries like Ukraine and Moldova can also participate.

International suppliers can place bids to match the demand by Monday, Sefcovic said. A total of 10.9 billion cubic meters of natural gas demand were matched with best sellers’ offers during the first round in May.

“Last year was the year of survival,” Sefcovic said. “You never know what will happen in our volatile world, therefore we want to be fully covered for the next winter.”

Sefcovic said the Commission’s new estimate of bigger investments needed to green up the economy and shift away from Russian fossil fuels was mainly due to rising prices on global markets and the EU’s drive to accelerate the green transition.

The bloc must invest €700 billion per year to meet its emissions-reduction goals, according to a draft report to be unveiled later on Thursday. That’s higher than the €470 billion Commission President Ursula von der Leyen forecast in 2021.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost