European Gas Swings as Warm Winter Continues to Dominate Market

(Bloomberg) -- European natural gas fluctuated as traders tried to balance the effects of a warm winter with the need to keep prices high enough to maintain LNG imports.

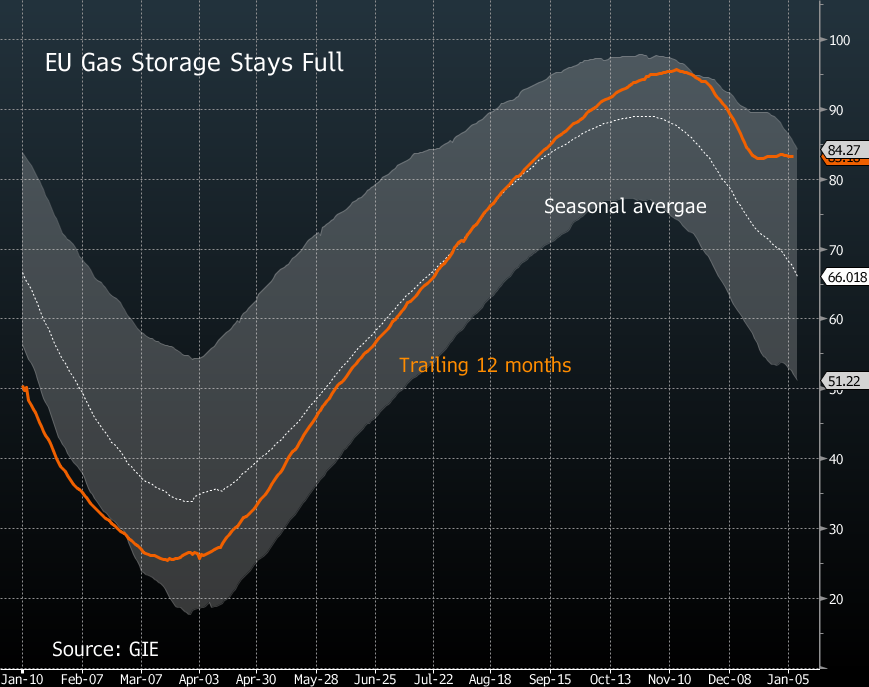

Benchmark futures erased earlier gains of as much as 7.9%. The prolonged unseasonably high temperatures have curbed heating demand and ensured stockpiles remain fuller than normal. But with prices halving over the past month, some in the market are concerned that falling too low could send liquefied natural gas to Asia instead.

While Europe has got through the worst of its unprecedented energy crisis that sent inflation spiraling and consumer bills swelling, much of the winter remains. LNG imports have been critical in replacing some of the lost Russian gas supply, but lower prices mean it is already more profitable for US sellers to send cargoes to Asia in February and March, a risk if there’s a late winter cold snap.

“In case cargoes are diverted, substantial amount of baseload volumes are missing, setting a natural floor to price levels,” said Simone Turri, head of western European structured trading at Swiss energy trader MET International. “Eventually Europe has to attract LNG cargoes during the year to replace Russian supply.”

Also read: Putin’s Energy Gambit Fizzles as Warm Winter Saves Europe

Cheap gas could also boost demand again in Europe, a situation politicians are seeking to avoid. For European industries, lower prices mean some factories can start operations again, Turri said. But a looming recession could “will limit demand picking up,” he added.

“Market participants believe that the European gas balance is not comfortable enough to afford a significant boost in gas demand for power generation, particularly as the price decline could also trigger a restart of some industrial demand,” EnergyScan, an analysis platform of Engie SA, said in a daily note.

For now, supply is plentiful. Norwegian gas flows to Europe increased to the highest since April as nations such as Germany relied on the Nordic nation to fill in the gaps left by squeezed Russian supplies. Above-average temperatures are forecast through at least the middle of February.

Dutch front-month futures, the European benchmark, was 1.3% lower at €68.61 a megawatt-hour at 10:04 a.m. in Amsterdam. The UK equivalent contract fell 0.6%.

Prices also gave up earlier gains after a ship grounded in the Suez Canal was refloated. It only briefly disrupted traffic in the waterway that’s vital for LNG trade from Qatar to Europe, with just minor delays now expected.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost