European Gas Declines as Persistent Mild Weather Curbs Demand

(Bloomberg) -- European natural gas prices declined as persistent warmer-than-normal winter weather reduces demand and eases stress of the region’s energy systems.

Benchmark futures fell as much as 6.5%. Unseasonably mild temperatures are set to remain across continental Europe next week, forecasts show.

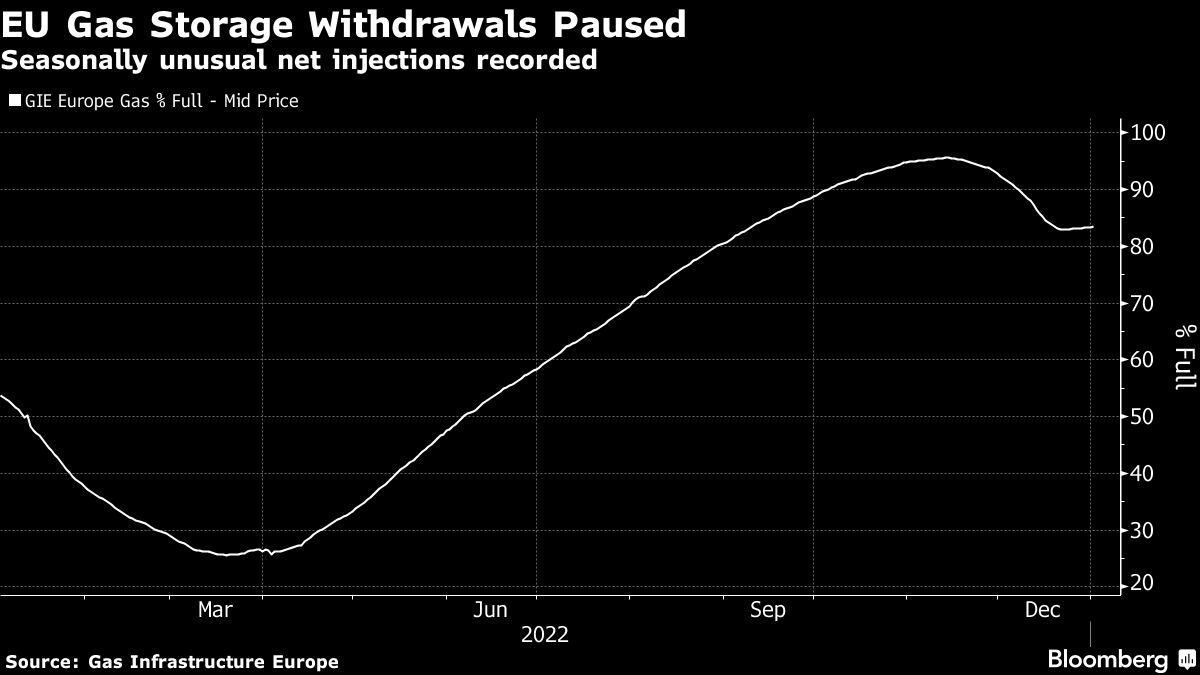

The weather has eased concerns about blackouts and rationing as stockpiles remain fuller than average, and there are less risks they will be depleted to dangerous levels over the winter. In fact, Europe has been able to add more gas into storage in the last few days amid a mix of curbed heating needs and typically lower consumption during the holiday season.

A return of stronger winds in parts of Europe is also helping reduce the need for gas to generate electricity. Germany is expected to produce near record wind power on Wednesday, according to a Bloomberg model.

“Relatively weak demand and comfortable supply have made European gas stocks switch to net injection mode,” EnergyScan, an Engie SA analysis platform, said in a note. They have “helped ease fears for the coming weeks.”

Dutch front-month gas futures were 4.2% lower at €73.80 a megawatt-hour as of 10:23 a.m. in Amsterdam. The UK equivalent contract fell as much as 4.3%.

European prices had a record monthly decline in December, bringing relief to consumers and governments after a brutal year when they rose to record levels over the summer. Still, they’re much higher than the typical levels for the time of year, and any disruption in supplies could tighten the market again.

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost