Thailand to Boost Gas Production in Bid to Avoid New Price Shock

(Bloomberg) -- Thailand’s largest natural gas producer is ramping up output to avoid a renewed power crisis.

State-controlled PTT Exploration & Production Pcl plans to double gas production at Erawan, its biggest field, to 800 million cubic feet a day in early 2024, said Chief Executive Officer Montri Rawanchaikul. Output at Bongkok, its second-largest, will be raised by about 10% next year, he said.

That comes after PTTEP was among companies criticized for last year’s jump in domestic electricity bills by failing to sufficiently boost domestic gas extraction. Production from Erawan plummeted by 64% in 2022 after the company, the exploration unit of PTT Pcl, took over the field from US energy major Chevron Corp. and power producers were forced to buy more expensive LNG on international markets.

Thailand gets more than 60% of its power from natural gas and has been increasing imports to meet demand. A 40% spike in the European benchmark on Wednesday — the biggest jump since global markets were upended in the wake of Russia’s invasion of Ukraine — has renewed concern about containing politically sensitive electricity rates.

“The recent surge in LNG prices has caused my deepest fear for another repeat of the gas and power crisis,” Montri said Thursday in an interview at his office. “Our main priority is to expand reserves and production at domestic gas fields to boost the country’s energy security.”

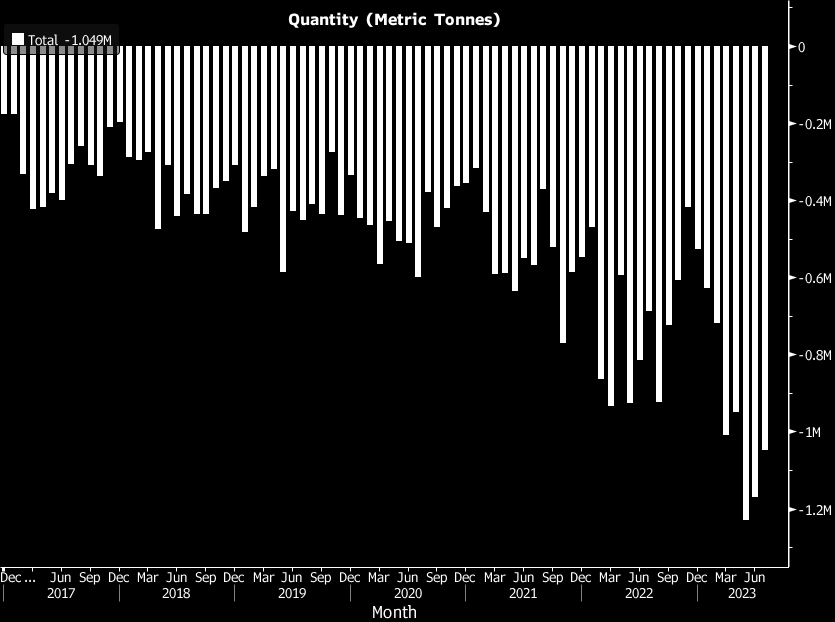

Thailand’s increasing LNG imports

Outgoing Prime Minister Prayuth Chan-Ocha spent several billion dollars on subsidies to cap electricity costs ahead of elections in May. Opposition leader Pita Limjaroenrat surprisingly won the most seats in that vote, partly on a platform to cut power bills, although there has been a political stalemate since.

Imported LNG accounted for about 29% of the gas used in power generation in 2022, more than double the share in 2018, according to data from the Energy Regulatory Commission, the industry’s regulator. That has been a huge financial burden, with the state-owned power utility — Electricity Generating Authority of Thailand — racking up about 135 billion baht ($3.8 billion) of debt to help subsidize the imports.

The power price increases have also boosted the nation’s ambitions to increase renewable generation.

Meanwhile, PTTEP is focusing on investments in Southeast Asia, Oman, the United Arab Emirates and Algeria after expansion in regions including Canada and Australia failed, Montri said. The company has built up about $3 billion of cash and other liquid assets but potential targets have demanded much higher prices after oil’s recent rally, he said.

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says