Euro Bears Warn Market Is Ignoring Risk of Another Energy Crisis

(Bloomberg) -- A growing body of contrarians has a warning for the market majority betting on a continued euro rally: the energy crisis that sent the common currency tumbling last year is far from over.

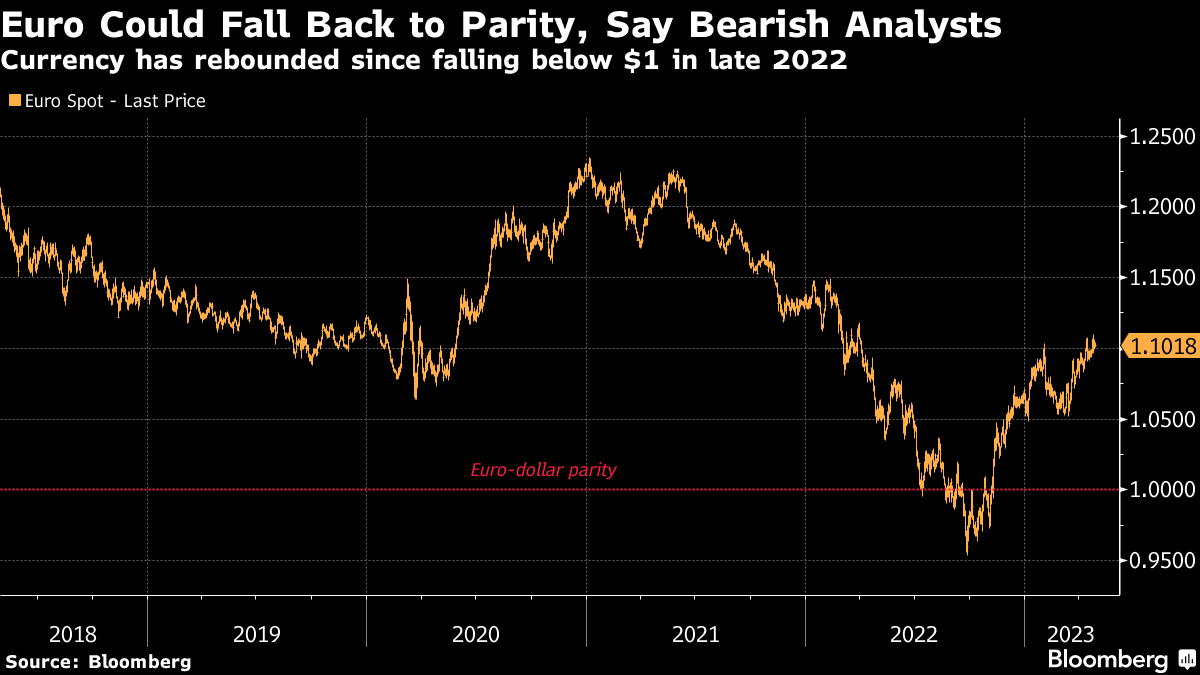

Investors and analysts at Vanguard Group Inc. and BlueBay Asset Management LLP argue that high gas prices will continue to put pressure on the euro-area trade balance. Others forecast that the currency could fall back toward parity with the dollar from $1.10 currently. The bloc is a net energy importer and natural gas accounts for a quarter of its power mix.

The call goes against the consensus view that the European Central Bank’s interest-rate hikes will lead the currency to extend its 16% rally since September, when it last reached parity. The median forecast in a Bloomberg survey is $1.12 by the end of the year and the most bullish analysts see it approaching $1.20.

“The huge spike in gas prices last summer has distorted market perception, making it seem like recent declines took Europe back to normal. They did not.” said Robin Brooks, chief economist at the Institute of International Finance in Washington D.C.

Brooks, a former chief currency strategist at Goldman Sachs Group Inc., estimates the euro’s fair value at $0.90, about 19% weaker than current levels.

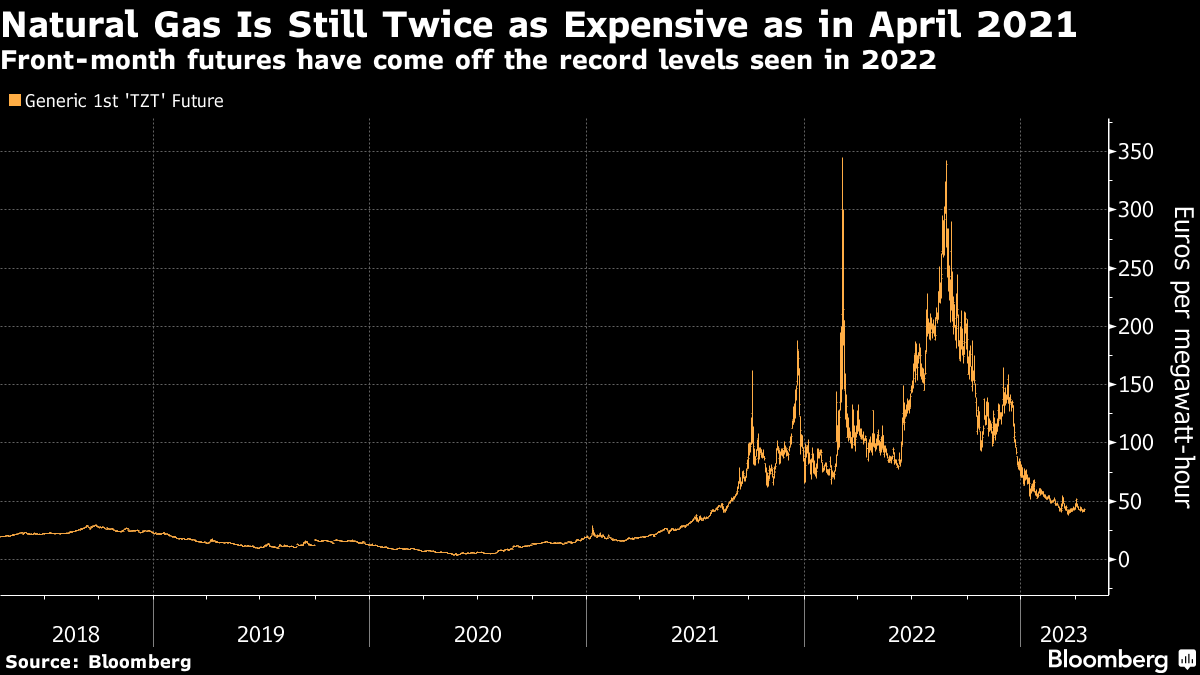

European natural gas prices have come off the record highs reached last year, but are still double the levels seen two years ago. Front-month futures hovered around €39 a megawatt-hour and Energy Aspects Ltd. forecasts them to climb to €47.20 in the coming months and €71.80 later in the year.

“I think there’s a degree of complacency in the forward price for natural gas,” said Robert Lambert, a portfolio manager at BlueBay Asset Management LLP. Possible risks to supply include a drought that hinders German waterways used for transporting coal or a pipeline shutdown, he said.

A relatively mild winter and fuel-saving measures helped prevent some of the more dire scenarios that analysts had predicted late last year and gas storage sites in Europe are about 59% full — far above seasonal averages. But the structural shift in the continent’s energy situation is still huge and has some observers looking to the historical precedent set by Japan in the wake of the 2011 Fukushima disaster.

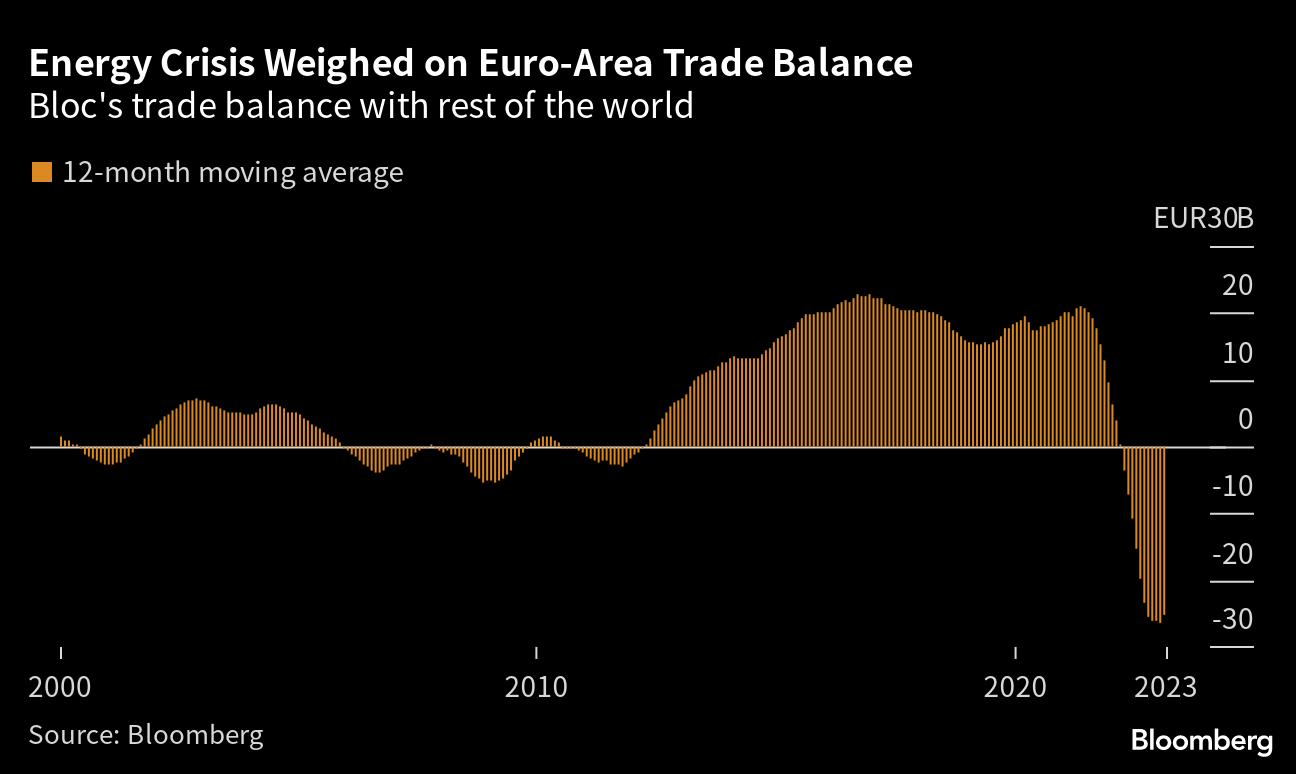

The large-scale transition that the Asian nation made away from nuclear power helped drive persistent trade deficits and significant currency depreciation, with the yen falling 40% since the end of 2010.

The euro-area hasn’t reported a single month of trade surplus since September 2021, the longest negative streak since the common currency was created. The deficit reached a record €46 billion in August and has since narrowed to €62 million in February, but the 12-month moving average is hovering around €25 billion since October, which euro bears say is a red flag.

Even if prices remain stable at current levels, the euro bloc will have much lower trade surpluses than it had before the war, according to Vanguard, the world’s second-largest asset manager. If prices increase again, the region could suffer “consistent“ deficits.

“The current account position will be worse off if Europe is paying a higher price for its energy imports than it was before the war and before the pandemic,” said Shaan Raithatha, a senior economist at the firm.

Mohamad Al-Saraf, a currency analyst at Danske Bank AS in Copenhagen, said such high gas prices will push the euro toward $1.06 in six months and $1.03 in 12 months, one of the most negative forecasts in a Bloomberg survey.

“The energy situation is far from resolved in the euro area and that’s one of the reasons why we stay bearish,” he said.

Against the Tide

Much of the market bullishness on the currency is being driven by an expectation that the ECB will raise interest rates by at least another 75 basis points in coming months. Unlike in the US, traders don’t forecast any rate cuts in the euro area this year.

But for euro bears, the energy crisis is a more relevant driver than monetary policy in the longer run, as Europe’s energy transition to reduce its reliance on cheap Russian gas will be costly. The European Union’s energy imports more than doubled last year, according to Eurostat data.

“There’s a recognized need for independence in energy” in Europe, said Tom Nakamura, a portfolio manager at AGF Investments Inc in Toronto. “And you need to invest to be able to survive the next 20 years.”

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods