China Rebuilds Australia Ties After Failing to Press Economy

(Bloomberg) -- Australia’s economic and diplomatic relations with China are in recovery mode, with tensions over issues ranging from foreign investment to security receding as Beijing tamps down its punitive efforts to bend one of its key commodity suppliers to its will.

In the strongest sign yet that years of frosty relations are warming again, more than a dozen companies including Rio Tinto Plc and Fortescue Metals Group Ltd. headed to China this week — the first such trip since the pandemic. Trade Minister Don Farrell is expected to visit as soon as May.

It’s part of a broader shift by Beijing to improve relations with certain US allies as President Xi Jinping looks to shore up the world’s second-biggest economy and resist efforts by the Biden administration to isolate China on the global stage.

On the Australian side, the election of a center-left Labor government has seen a change in tone from the more confrontational approach taken by its predecessor.

“China’s re-opening comes at a time of renewed optimism for Australia and China’s relations,” said HSBC Australia head Antony Shaw, who is part of the delegation. “As Australia’s relations with China reignite, there is huge opportunity to support our businesses.”

The deterioration in Australia-China ties first began in 2017, just two years after a free-trade agreement between the two nations had come into effect. The trigger was then-Prime Minister Malcolm Turnbull announcing legislation to crack down on foreign interference, which Beijing interpreted as targeting China.

Shortly afterward, Australia became the first country in the world to ban Chinese technology giant Huawei Technologies Co. Ltd. from its 5G network over what China said were “unfounded” security concerns. The US and UK soon followed.

Relations ruptured when then-Prime Minister Scott Morrison in April 2020 called for an international investigation into the origins of Covid-19.

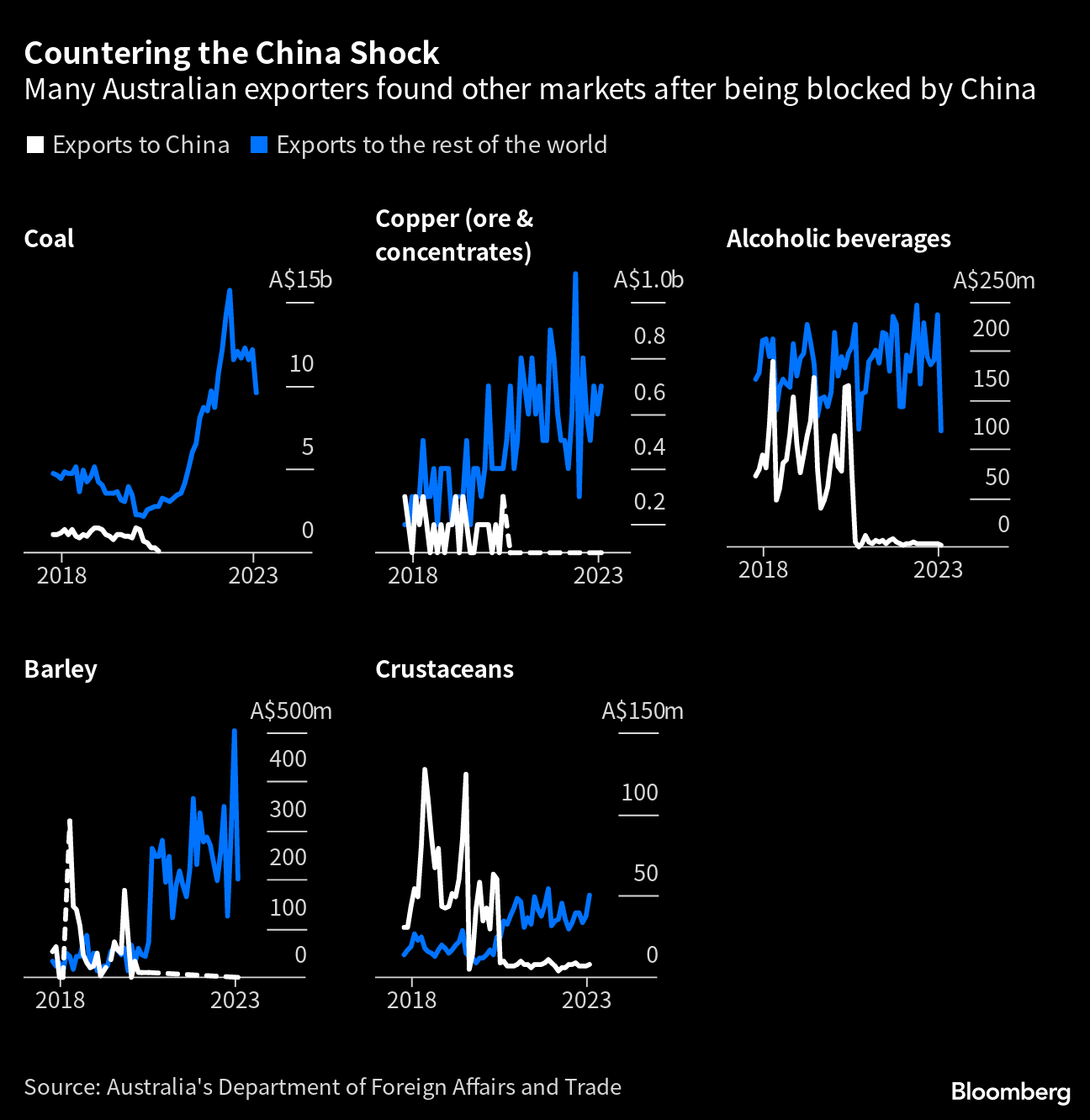

China responded by targeting Australia’s exports of coal, wine, barley and lobsters and one if its diplomats issued a list of 14 grievances, including complaints that Australia was “doing the bidding of the US.”

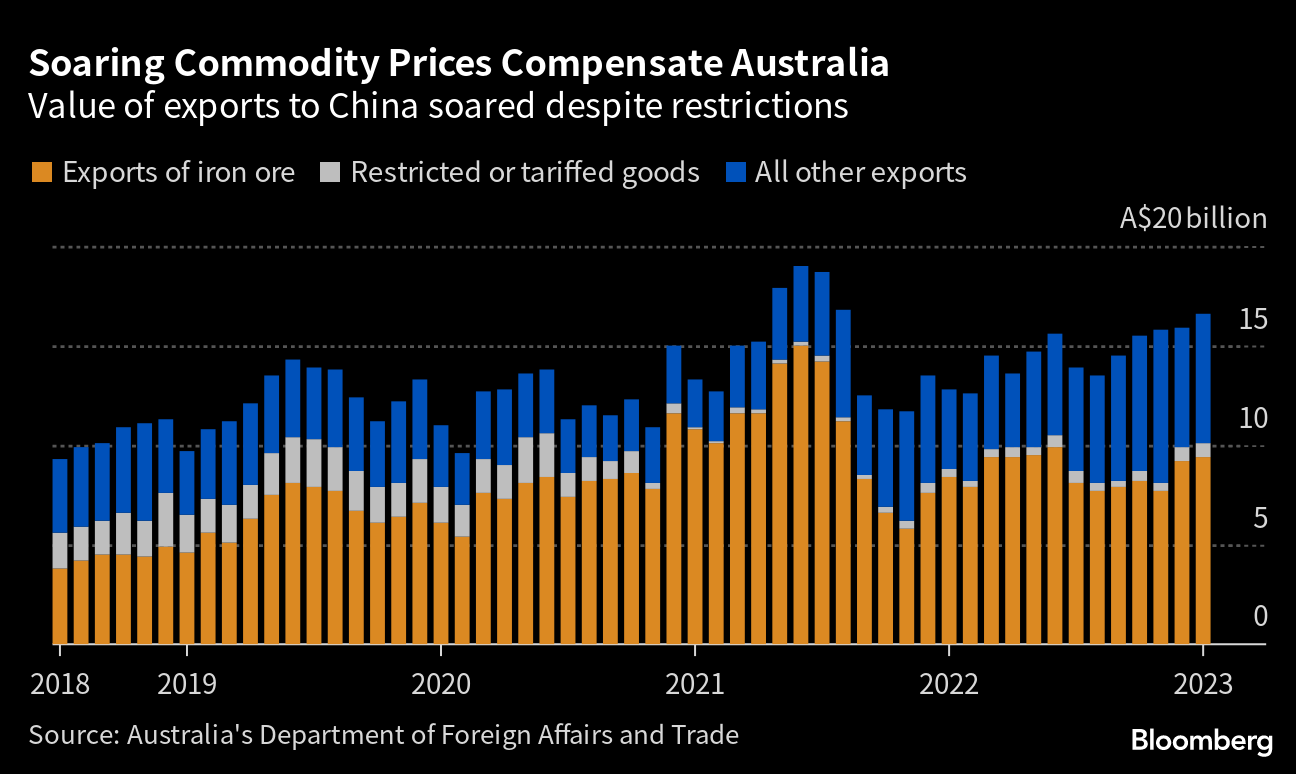

Needing the steady flow of iron ore to keep its steel mills supplied and its construction industry afloat, Australia’s biggest export was left untouched. Meantime, firms in affected industries scurried to find new markets, blunting the impact of the attempted economic coercion.

In targeting these industries, China may have done Australian firms a favor by forcing them to seek out new opportunities, said James McIntyre, economist for Australia at Bloomberg Economics.

“Australia’s exporters were able to pivot in response to China’s measures, and growth prospects look more favorable in other markets — especially India,” he said. “The real benefit from China’s trade restrictions may have been that it prompted Australian businesses to focus on brighter export opportunities.”

Throughout the dispute, China remained Australia’s biggest export market and helped fuel six years of trade surpluses. That’s bolstered Australia’s fiscal coffers and allowed Canberra to finance a defense expansion to counter China’s regional military buildup, while reporting one of the best budget positions in the developed world.

China resumed taking Australian coal in February and is undertaking a review that’s expected to end sanctions on barley in coming months. Australian officials say they’re hopeful of a similar process for wine by year’s end.

Then there’s the key services of tourism and education that have been powered by Chinese visitors and students. Diana Mousina, deputy chief economist at AMP Capital Markets, reckons that by June Australia will see a lot more people arriving from China.

“When the tensions were the highest, there were reports in China that Australia was not the best place to study or live for Chinese,” she said. “So the thawing is definitely positive from the point of view of tourists wanting to visit.”

In the face of growing hawkishness from the US, China is also trying to improve ties with other Asian nations and making overtures to Europe to try and revive an investment treaty that was shelved.

While there’s been a shift on tone, Labor Prime Minister Anthony Albanese hasn’t undone or watered down any of his center-right predecessor’s key security policies. Australia remains committed to the Quad security partnership with the US, Japan and India and the Aukus agreement that will see Australia deploy nuclear submarines.

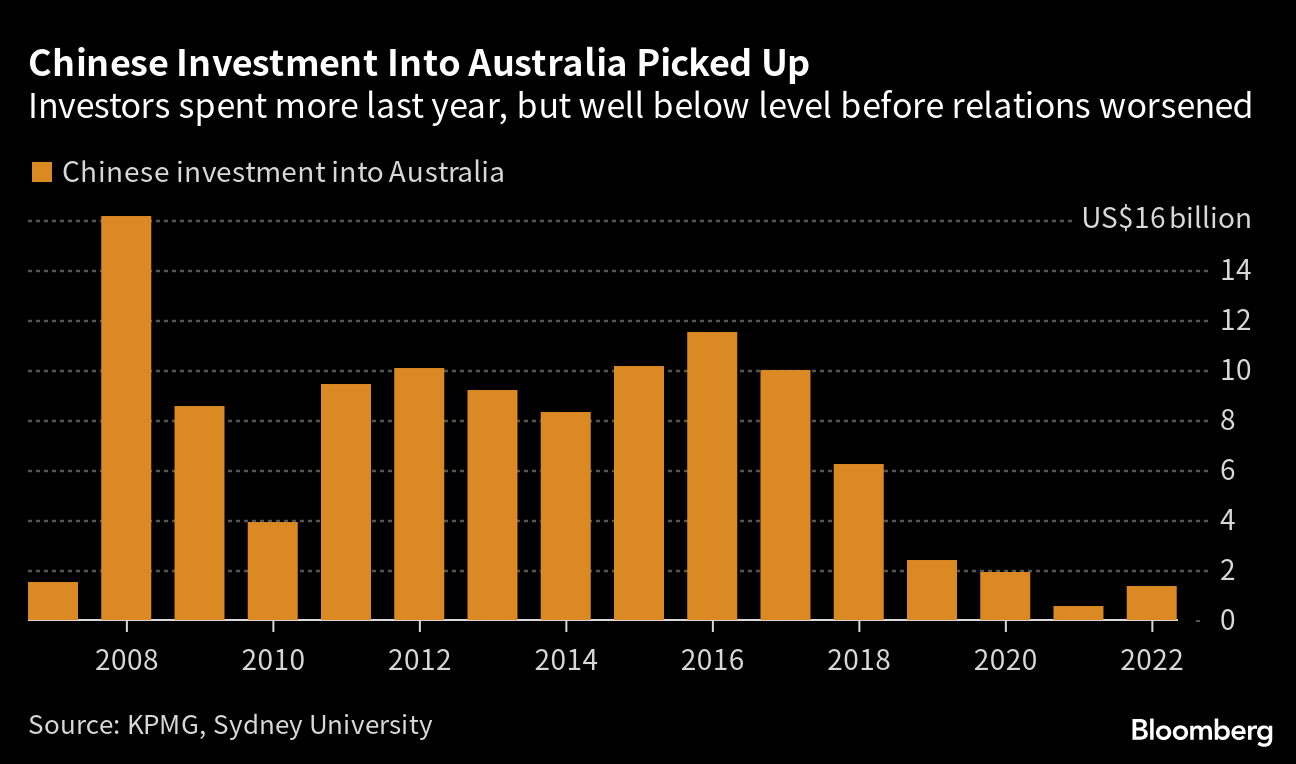

Beijing has highlighted its desire for a relaxation of foreign investment restrictions, but there’s been no change there either. Instead, Canberra announced this year it would knock back a China-linked investment offer in a strategically-significant domestic rare earths supplier.

Another unresolved issue is China’s detention of Australians Yang Hengjun and Cheng Lei, who were arrested in 2019 and 2020 respectively and are still being held.

The 14 points highlighted the “politicization and stigmatization” of China-Australia relations and demanded Australia stop “wanton interference” on topics of human rights, including Xinjiang, Hong Kong and Taiwan. Since coming to office in May, Labor Foreign Minister Penny Wong has kept criticism of the Chinese government behind closed doors.

The Australian business delegation in China this week was scheduled to visit Hong Kong, Shenzhen, Tianjin and Beijing, providing opportunities to reconnect with colleagues and friends, the organizers said.

(Updates with details of continued detention of two Australians in China in third-last paragraph.)

©2023 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis