European Energy Prices Rise as US LNG Plant Set to Stay Offline

(Bloomberg) -- European energy prices advanced amid concerns about liquefied natural gas imports from a key US facility and the first signs of cold weather.

Benchmark gas futures jumped as much as 13%, following an increase of 16% on Monday. Freeport LNG in Texas will likely extend an outage that began in June, increasing global competition for much-needed supplies right before the winter.

Temperatures on the continent are set to dip below average toward the end of the week, which could lift power and gas prices as heating demand increases. The combination of a cold snap and supply woes is a reminder that the European system will be fragile during the first winter in recent memory without significant Russian flows.

“This increase may seem excessive. But unfortunately it is completely in line with the level of market volatility,” analysts at EnergyScan, the market analysis platform of Engie SA, said in a note. “We will rather have to worry if prices tend to go back above their 1-year average, currently at €133 a megawatt-hour, because it would mean that the uptrend would be back.”

Dutch front-month gas, Europe’s benchmark, traded 11% higher at €126.65 a megawatt-hour by 11:35 a.m. in Amsterdam. the UK equivalent rose 13%.

Prices had been falling in recent weeks amid mild weather, delaying the start of the heating season, and strong liquefied natural gas flows that helped to fill stocks. But even with the buffer, the crisis is far from over. Futures are trading at about four times the five-year average.

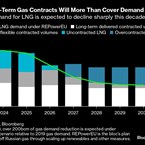

Freeport LNG told buyers it will likely cancel shipments scheduled for November and December as work continues on repairs and regulatory approvals before a restart, according to people with knowledge of the matter.

The plant previously accounted for about 15% of US shipments of the fuel, and the outage extension is set to increase the competition for cargoes in Europe and Asia.

Power prices rose along with the cost of fueling Europe’s gas-fired power stations. German power for next year, a benchmark for the continent, rose as much as 7.4% to €324 per megawatt-hour.

--With assistance from .

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Japan’s Top Power Producer Jera Considers IPO to Fund Green Push

Apr 15, 2024

MOL inaugurates central Europe’s largest green hydrogen plant

Apr 15, 2024

India Invokes Emergency Rules to Run Gas Power Plants for Summer

Apr 13, 2024

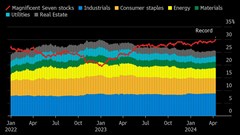

Magnificent Seven Influence Over S&P 500 Has Never Been Greater

Apr 12, 2024

China’s CGN New Energy’s Parent Said to Revive Take-Private Plan

Apr 11, 2024

Enel Hydro-Power Plant Blast in Italy Leaves at Least 3 Dead

Apr 09, 2024

Atos to Present Debt Plan as Onepoint Bolsters Rescue Coalition

Apr 08, 2024

Xcel Energy to Cut Power in Parts of Colorado Amid High Winds

Apr 06, 2024

Naturgy Said to Shelve $2.6 Billion Sale of Australia Assets

Apr 06, 2024

High Insurance Premiums Are the Latest Thing Weighing on China’s EV Market

Apr 05, 2024

Energy Workforce helps bridge the gender gap in the industry

Mar 08, 2024

EGYPES Climatech champion on a mission to combat climate change

Mar 04, 2024

Fertiglobe’s sustainability journey

Feb 29, 2024

Neway sees strong growth in Africa

Feb 27, 2024

P&O Maritime Logistics pushing for greater decarbonisation

Feb 27, 2024

India’s energy sector presents lucrative opportunities for global companies

Jan 31, 2024

Oil India charts the course to ambitious energy growth

Jan 25, 2024

Maritime sector is stepping up to the challenges of decarbonisation

Jan 08, 2024

COP28: turning transition challenges into clean energy opportunities

Dec 08, 2023

Why 2030 is a pivotal year in the race to net zero

Oct 26, 2023Partner content

Ebara Elliott Energy offers a range of products for a sustainable energy economy

Essar outlines how its CBM contribution is bolstering for India’s energy landscape

Positioning petrochemicals market in the emerging circular economy

Navigating markets and creating significant regional opportunities with Spectrum