Top Lithium Miner Albemarle Boosts Outlook With Battery Demand Surging

(Bloomberg) -- Albemarle Corp., the world’s largest producer of lithium, raised its outlook for the second time this month as tight supply and growing electric-vehicle demand forces battery makers to pay up for the metal.

The Charlotte, North Carolina-based miner now expects sales from $5.8 billion to $6.2 billion this year, up from its previous estimate of $5.2 billion to $5.6 billion. to boosted profit forecasts for the year due to “additional index-referenced, variable-price contracts for battery grade lithium sales,” it said in a statement. Shares jumped as much as 5.3% in trading after normal exchange hours.

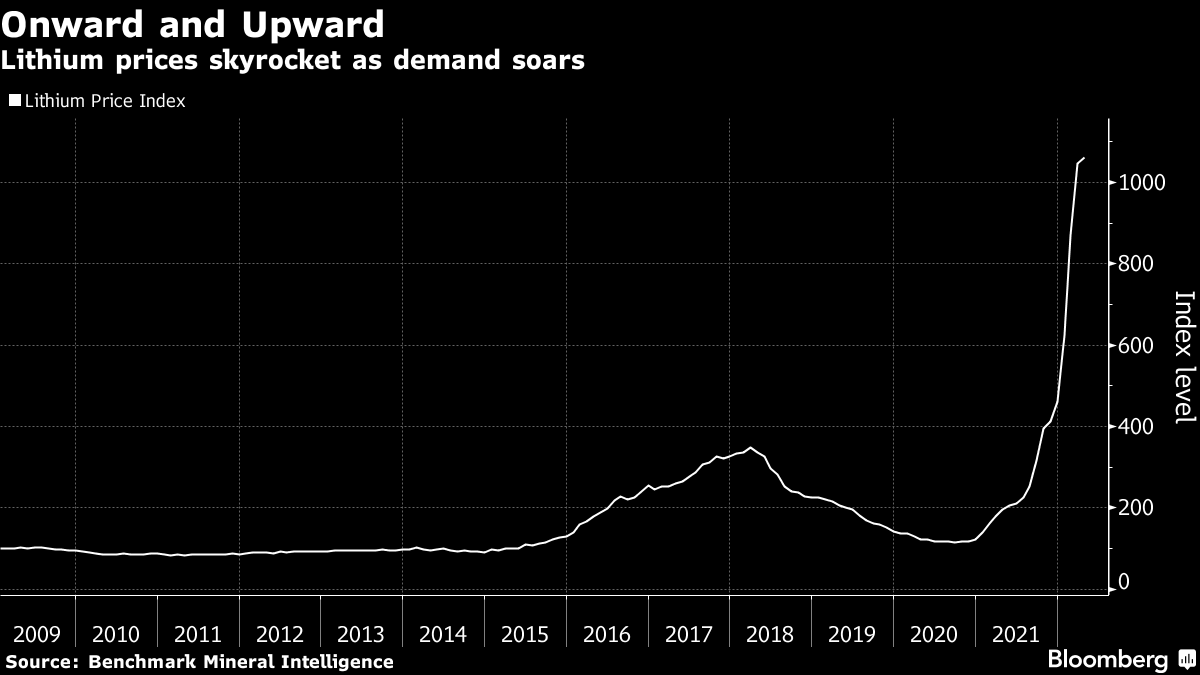

Demand for electric vehicles — and the batteries that power them -- has driven prices for key metals higher, even sparking fears of shortages of materials like lithium, cobalt and nickel. Lithium supplies are a concern in particular because there’s no substitute for it in electric vehicle batteries. A gauge of lithium prices more than doubled in the first four months of this year after surging 280% last year.

The company last increased its guidance on May 4 when it released first-quarter earnings. Overall, the midpoint of Albemarle’s 2022 sales estimate is 38% higher than just a few weeks ago.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says