There’s No Summer Break for European Power Prices This Year

(Bloomberg) European factories and households used to benefit from a summer lull in power prices. Not this year.

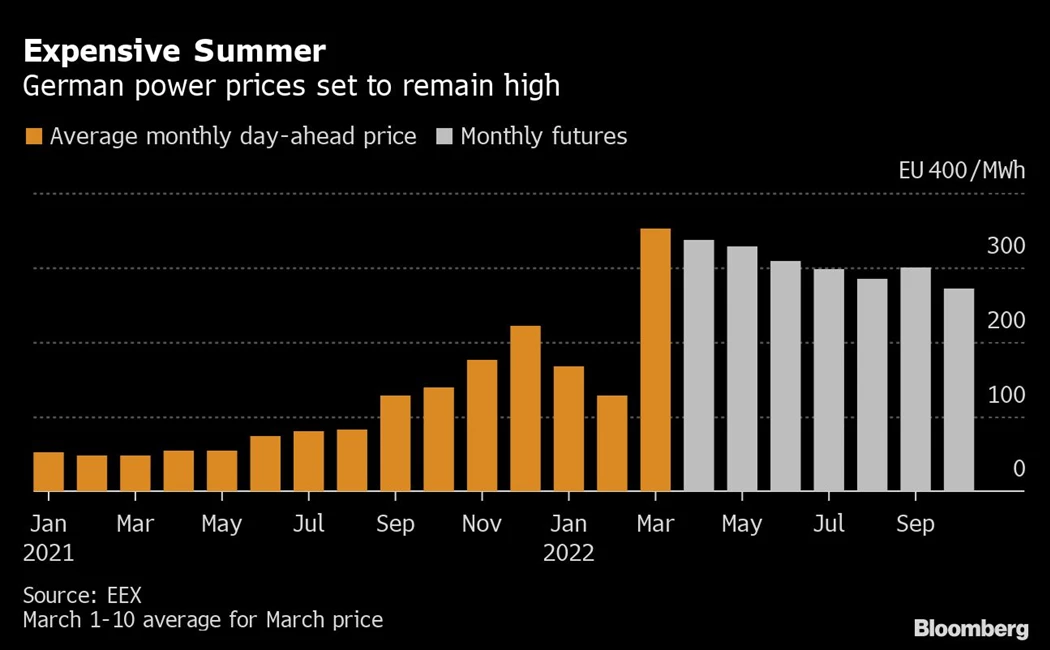

In one of the clearest signs of how the electricity market has been turned upside down as the war in Ukraine makes energy supplies more uncertain, German power futures for July are almost six times more expensive than the December average over the past ten years.

The unprecedented flip in market dynamics shows how interlinked the region's energy markets are becoming, with the cost of gas now deciding how much everyone from a factory in Germany to a home in Spain are paying for their electricity.

Even though gas prices have dropped by more than half since a Monday record, they remain at extreme levels. Europe will need to buy as much of the fuel as it can to top up reservoirs near historical lows, which will keep prices elevated.

"The expected mandate on gas storage filling over the summer adds upside to summer demand for gas and therefore power prices," said Glenn Rickson, an analyst at S&P Global in London.

If rates remain at these levels, industrial users may reduce their energy consumption significantly because it's just not financially viable to produce goods. Or they might turn traders and sell their electricity on the market if that's more profitable, which has been part of the playbook for paper makers in the Nordic region, for example.

Prices on the European Energy Exchange AG are the most volatile on record. The contract for 2023 is trading at almost half the level of the summer contracts. That shape of the curve, or prices in the future, could be driven by expectations of lower consumption from industry, according to consultant Rystad Energy AS.

European Industry Starts Shutting Down as Energy Prices Soar

"The demand destruction could also be on another scale than we have seen previously," said Fabian Ronningen, a power analyst at Rystad. "I think the impact of this will be massive," although difficult to quantify as some costs could just be added on the goods themselves, he said.

The high prices are also impacting the use of gas to generate electricity. This year's output from plants burning the fuel has plunged more than 50% in Germany compared with the same period last year, according to data from Fraunhofer ISE. Power from gas makes up about 10% of the nation's generation.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances