Germany Triggers Emergency Plan to Secure Energy Supplies

(Bloomberg) -- Germany triggered an emergency plan to brace for a potential Russian gas cut-off as President Vladimir Putin insists that the crucial fuel should be paid for in rubles.

Europe’s largest economy, which relies on Russia for more than 50% of its natural gas, initiated the first of three phases of the plan, signaling there are serious signs the supply situation may deteriorate, Economy Minister Robert Habeck said Wednesday. The announcement comes as the Kremlin plans to tell European energy companies by Thursday how to pay for fuel in the Russian currency, even if the process of switching won’t begin immediately.

European countries from Germany to Italy have labeled the request a breach of contract and the standoff between Europe and Russia is threatening to upend energy markets. European gas prices surged as much as 15% after the German announcement, before easing as the Kremlin said it would take time before companies need to pay in rubles. German industries from steel to chemicals would shut down within a matter of weeks if Russia supplies were cut off.

“This is about monitoring the situation,” Habeck said at a press conference. “There are two more steps, the alarm and the emergency phase, but we are not there yet. The situation would have to worsen dramatically before we reach those stages. We would then practically need a change in the supply lines and would have to react accordingly.”

Read: Russia Threatens to Demand Rubles for Grain, Oil, Other Exports

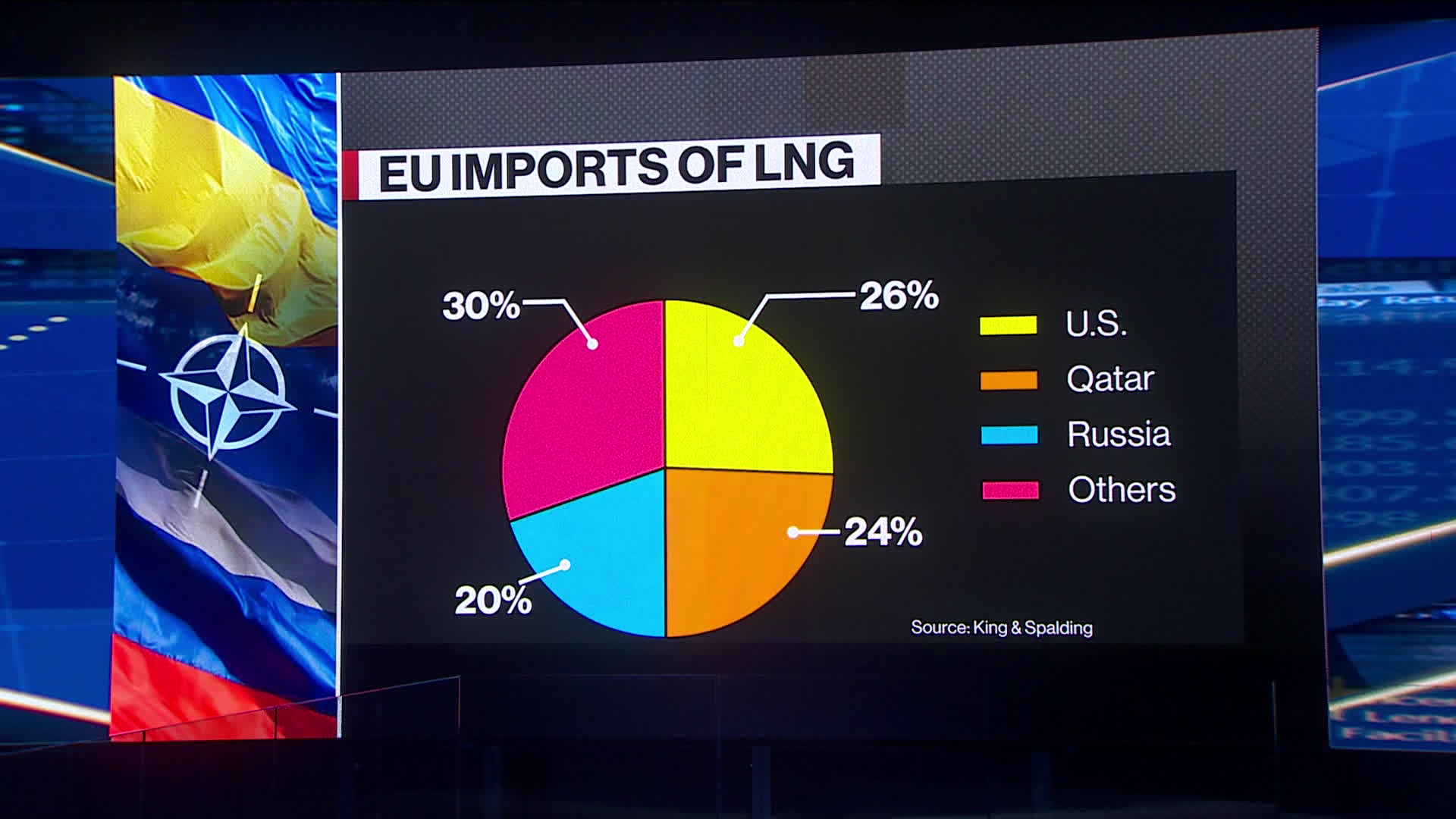

The European Union is trying to wean itself off Russian gas in a response to the war in Ukraine, with a plan to cut dependency by two thirds this year. That would mean buying less fuel than currently agreed under long-term contracts with Gazprom PJSC, a move that could also mean a breach of such deals.

Putin ordered his government, the central bank and Gazprom to prepare all necessary documents for the switch to rubles by Thursday, with Kremlin spokesman Dmitry Peskov saying that Russia would not supply gas for free. More than 50% of Russia’s long-term contracts are settled in euros.

“Each party is trying to punish the other,” said Anne-Sophie Corbeau, a research scholar at the Center on Global Energy Policy at Columbia University who previously worked for British oil major BP Plc. “This has been Russia’s way to counter Europe’s plan to cut dependency by two thirds, which would mean buying less than stipulated in long-term contracts.”

An energy group representing Germany’s main gas and electricity suppliers had already urged the government to trigger the emergency plan, saying it couldn’t rule out disruptions due to the rubles payment request. With Habeck’s move, a task force is now set to meet on a daily basis to monitor the state of gas consumption and inventories.

The minister urged companies and consumers to help by reducing energy usage wherever possible. Government officials will also talk to energy suppliers and major consumers to discuss how to prioritize gas use. For now, storage facilities are 25% filled and the government doesn’t need to intervene in the market.

“Only in the third phase, the state will intervene and regulate the gas flow,” Habeck said, adding that the energy regulator Bundesnetzagentur “will at that moment decide which regions and which industry sectors will be served on a secondary basis.”

Germany’s VCI chemical producer association said the decision to enact the first stage of the emergency plan wouldn’t have an immediate impact on the sector, a major consumer of Russian gas. The VCI is regularly discussing the sector’s energy situation with a crisis team at Germany’s economy ministry, according to a spokesman.

Paying Russia in rubles would require European energy firms to renegotiate their long-term contracts, a process that could take months if not years. It could also backfire, as utilities could in turn require more favorable terms from Gazprom, including shortening terms or changing pricing mechanisms.

“If they can’t find a solution, that will probably go to arbitration,” Corbeau said, commenting on energy companies. “And that’s a very long process.”

Europe’s energy traders were on Tuesday already bracing for supply disruptions, with German gas prices surging to a premium of about 14 euros a megawatt-hour to the European benchmark traded in the Netherlands, according to broker data. On Wednesday, Dutch gas futures climbed to a high of 124.26 euros, before trading 9% higher by 12:17 p.m. in Amsterdam.

“Russia’s demands to pay for gas in rubles continues to lack details and therefore after last week’s announcement has partly been downplayed with regards to impacting short-term gas supply,” said Tom Marzec-Manser, head of gas analytics at ICIS in London. “But today’s early warning from Germany will reignite those concerns to a certain degree.”

(Updates with Kremlin statement in second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods