European Gas Gyrates as Russian Supply Risk Stalks Market

(Bloomberg) -- European natural gas swung between gains and losses as the market continues to face volatility over the risk of a cut in supplies from Russia.

Benchmark futures closed higher Friday after erasing an 11% decline and paring the biggest weekly drop this year. Prices have halved from the record high hit early this week.

“Such fluctuations just show there is a tension in the market, and people are having a hard time in assessing the impacts the war in Ukraine will have on gas supplies,” said Niek van Kouteren, a senior trader at Dutch energy company PZEM.

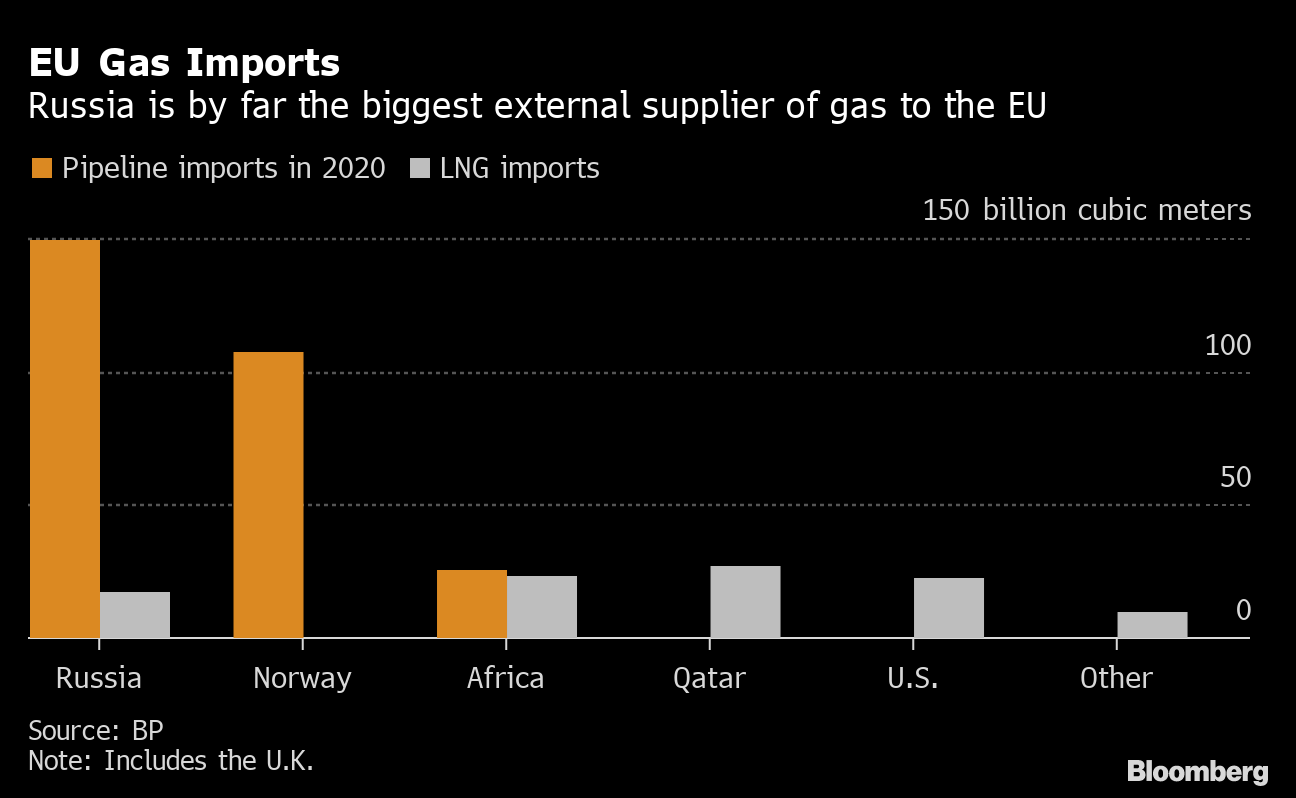

The threat of a supply squeeze eased after Russia excluded energy and raw materials from an export ban on more than 200 products. The country is the European Union’s biggest gas supplier, accounting for about 40% of imports, and the bloc is trying to tap all available resources to reduce this dependence.

Europe’s gas market has experienced unprecedented volatility following Russia’s invasion of Ukraine last month and subsequent international penalties designed to isolate Moscow.

While so far sparing energy, the European Commission plans to impose a fourth package of measures against Russia on Saturday, Commission President Ursula Von Der Leyen said.

“We are seeing significant uncertainty as sanctions are moving very fast, impacting markets,” James Atkin, an energy partner at law firm Reed Smith LLP, said in an interview. “There is uncertainty as to the scope of future sanctions which impact dealing with Russian counterparts and Russian energy sources.”

While Russian gas shipments crossing Ukraine continued as normal on Friday, any prospect that the attacks will intensify could pose risks to Europe’s supplies, according to PZEM’s van Kouteren. Russian President Vladimir Putin said he would bring in fighters from the Middle East, though he later cited “positive movement” in talks with Ukraine. Ukrainian Foreign Minister Dmytro Kuleba said he doesn’t see progress in the talks and reiterated that the country could compromise on neutral status if offered security guarantees.

International Sanctions

Any sanctions on Russia that could also hit European economies hard should be avoided, EU climate chief Frans Timmermans said on German radio. “We have to make sure that we make things hard for Putin but prevent our society from being weakened,” he said.

Timmermans added that the continent could cope with a potential curb on Russian gas exports.

Also See: Europe’s Plan to Cut Russian Fuel Starts a Global Gas Fight

Export restrictions that Russia announced Thursday aren’t likely to have much effect on the country’s trade and are focused on sectors where Russian goods aren’t globally significant, analysts from Citigroup Inc. said in a report.

“We read this as a warning that further escalation in the use of economic instruments by the West could lead to more meaningful restrictions on commodities,” they said.

Energy Crunch

Europe was in the midst of an energy supply crunch, due to low gas inventories, before the war, and prices for the fuel have been elevated since late last year.

Vessels hauling liquefied natural gas continue to reach European ports to help to alleviate the shortage, with those from the U.S. leading the way. A total of at least 28 U.S. LNG cargoes are set to arrive this month.

With most global LNG locked in long-term contracts, the flexibility could come from the spot market, but that means higher prices, Reed Smith’s Atkin said.

“There will be a point when LNG is too costly and other fuels will be used,” he said.

Europe Ramps Up Coal Burning With Natural Gas Out of Favor

Milder weather forecasts have also helped to keep gas prices in check in recent days, with above normal seasonal temperatures seen across most of northwest and central Europe, according to Maxar.

Still, traders remain cautious. Earlier this week, Russian and Ukrainian officials exchanged warnings about the risk to gas transit infrastructure as Russian troops entered stations that pump the fuel toward Europe. Russia also threatened to cut supplies of natural gas via the Nord Stream 1 pipeline to Europe.

Dutch front-month gas, the European benchmark, closed up 3.8% at 131.23 euros per megawatt-hour, but down 32% on the week. German front-month power futures declined 5.5%, paring earlier losses.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost

China May Maintain Rapid Pace of Atomic Power Reactor Approvals