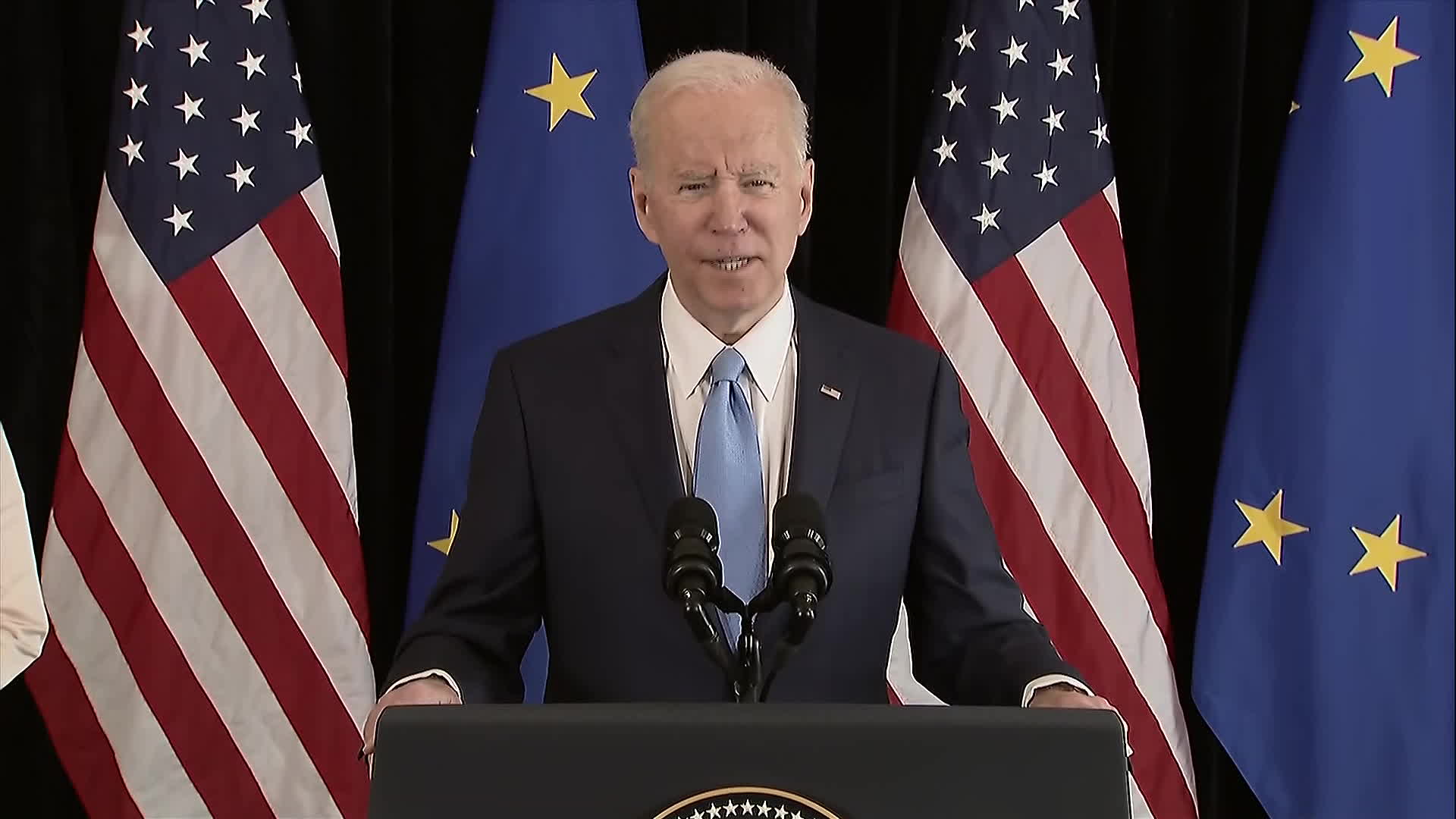

European Gas Falls as U.S. Agrees Deal to Cut Russian Dependence

(Bloomberg) -- European natural gas fell in anticipation of more liquefied natural gas supplies heading to the continent from the U.S.

Benchmark gas futures declined 9.3%, after earlier swinging between gains and losses. The U.S. agreed to boost shipments of LNG to Europe this year, and ensure demand for 50 billion cubic meters of the fuel from America until at least 2030. Though it paves the way for the continent to reduce its reliance on Russia, flows from Moscow will continue to make up the major part of supply.

U.S., EU Unveil LNG Supply Deal to Cut Dependence on Russia (2)

The new deal will replace Russian LNG, European Commission President Ursula von der Leyen said. The bloc has been attempting to pivot its energy policy away from Russia, which gathered urgency after Moscow’s invasion of Ukraine raised the prospect of disrupted pipeline flows.

Still, the continent buys massive amounts of the fuel from Russia through pipelines, and replacing all of those volumes will be a challenge. Governments in the region have been hunting for supplies from around the world, but have to compete with energy-hungry consumers in Asia. Europe’s ability to import is also capped by its current regasification capacity, number of terminals and interconnectors.

Under the plan unveiled Friday, an extra 15 billion cubic meters of American LNG will go to Europe in 2022. While this “represents the first steps in diversifying away from Russia,” it amounts to about just 3% of EU demand, consultant Inspired Energy Plc said in a report. “The additional volumes from the U.S. are still quite far off what will be needed to stop reliance on Russia.”

Those supplies have been largely unscathed as the war enters its second month. Flows via key pipeline routes are set to be mostly unchanged on Friday, and Gazprom PJSC said its shipments across Ukraine are normal.

Nations are coming under pressure to isolate President Vladimir Putin’s regime, and punish Russia for the invasion of Ukraine. Germany, one of the biggest buyers of Russian energy, is targeting an almost complete halt of the country’s gas imports by the middle of 2024, and to broadly end purchases of oil and coal this year.

Dutch front-month gas futures declined as much as 12.5% to 97.63 euros a megawatt hour, and settled at 101.269 euros. The U.K. equivalent contract was 11% lower at 236.61 pence a therm.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says