Europe Gas Rises 60% With Traders Backing Away From Russia Deals

(Bloomberg) -- European natural gas surged as much as 60% as supply fears were compounded by traders trying to avoid exposure to a key Russian player in the market.

Benchmark futures rose to a record high, before easing slightly. Gas and power traders are backing away new deals with Gazprom PJSC’s trading unit, according to people familiar with the matter. There’s a further risk that companies start unwinding previously agreed contracts or clearing houses decide to stop doing business with the Russian company’s unit, liquidating their positions.

The war has sent commodity prices soaring -- with Brent crude topping $113 a barrel on Wednesday -- as buyers, traders and shippers remain wary of dealing with Russian supplies. Disruptions in gas supplies could also come from damage to infrastructure in Ukraine, but the risk of sanctions applying to energy “remains a real possibility,” said Kaushal Ramesh, a senior analyst at Rystad Energy.

But for now Russian supplies continue, and have even increased since the invasion of Ukraine last week. Shipments arriving at the key European entry point of Velke Kapusany in Slovakia have rebounded to normal levels and gas flowed to Germany via the Yamal-Europe pipeline overnight, with more capacity booked for later on Wednesday.

Dutch front-month gas futures rose to above 194 euros a megawatt-hour, a record high, and were 34% higher at 162.80 euros at 11:15 a.m. in Amsterdam. The U.K. equivalent contract climbed 33%.

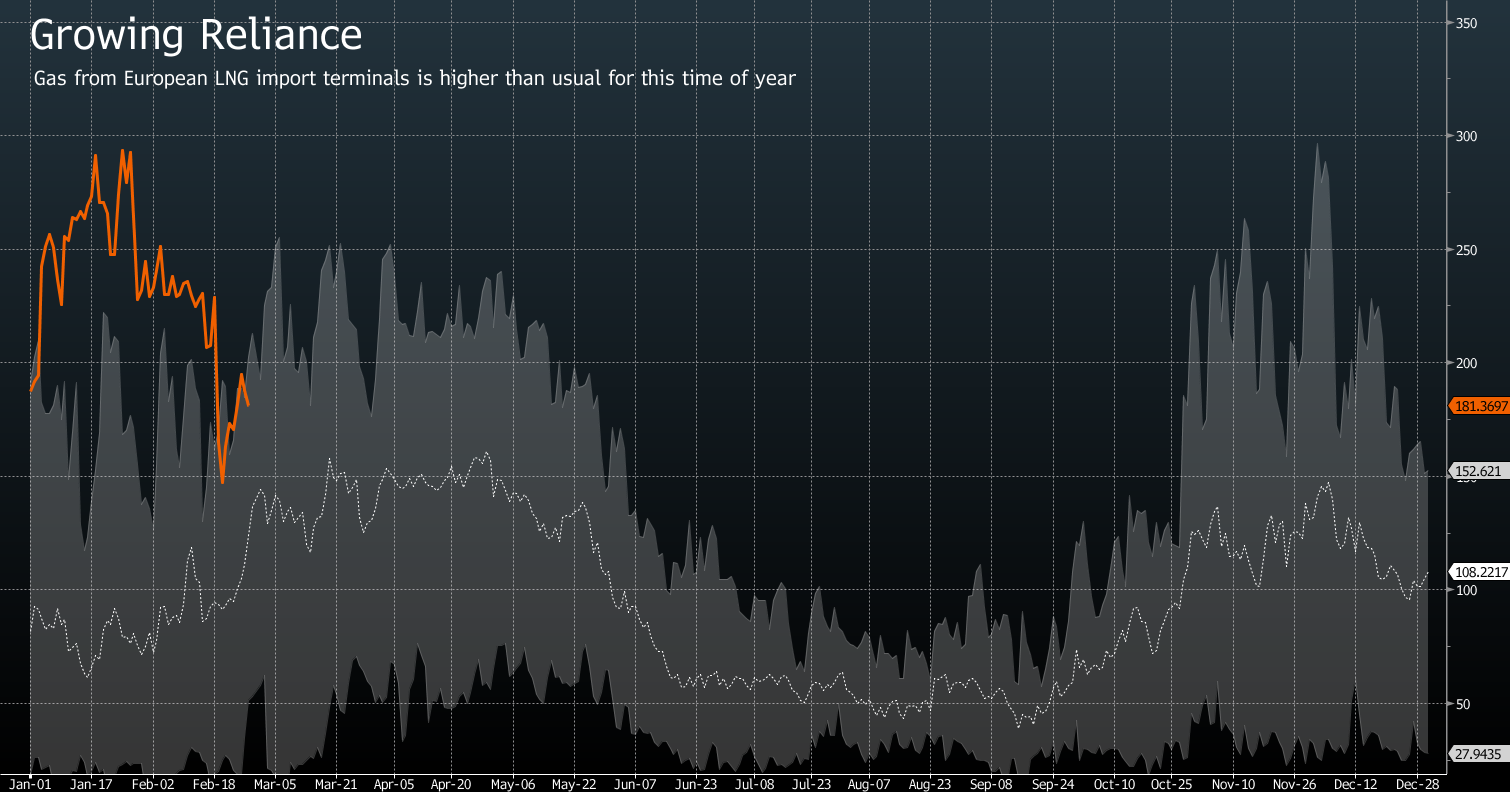

Europe relies on Russia for about a third of its gas, and any disruption could keep prices high for longer, making it difficult to refill storage facilities over the summer, and prolonging the energy crunch. Governments in the region are looking to boost liquefied natural gas imports, which puts them in competition with Asian buyers also starting replenishing their stocks from March onwards.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis