European Gas Falls to Lowest Since First Days of Ukraine War

(Bloomberg) -- European natural gas futures settled at the lowest level since the first few days of the Ukraine war as Russian flows across the country remain steady and warmer weather approaches.

Ukraine’s largest state-owned gas company said it would continue shipping the fuel to Europe as long as it’s “technically possible,” even as Russian forces keep up their assault on the country.

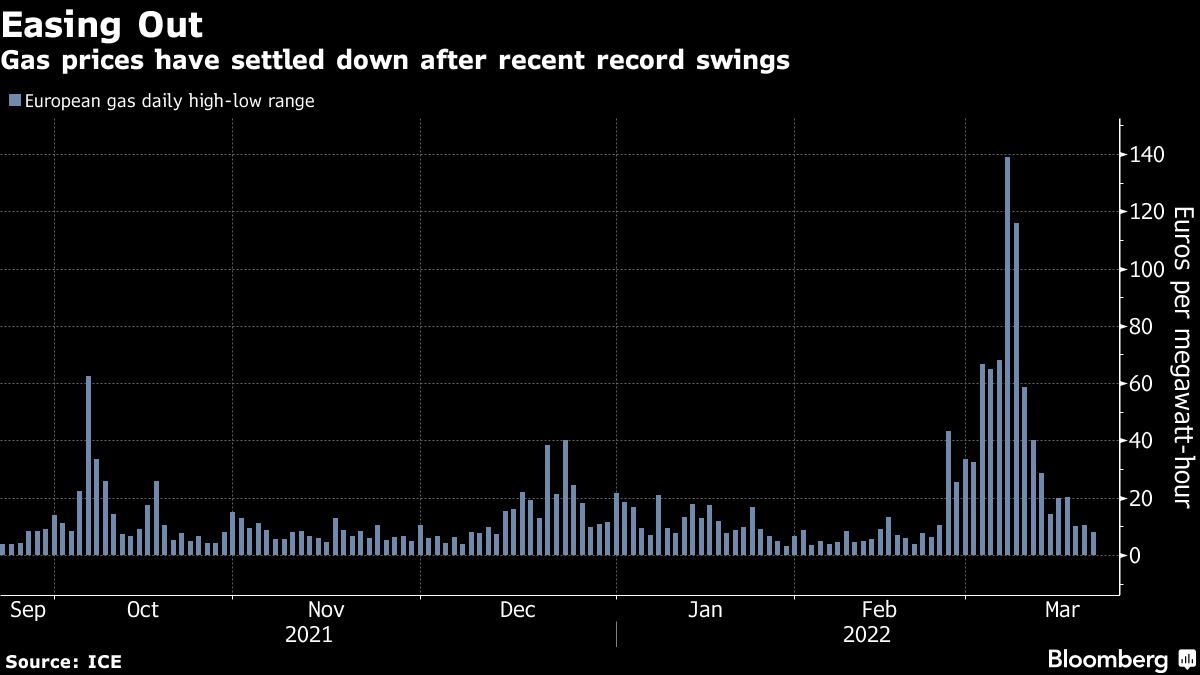

Gas prices have settled somewhat, following unprecedented volatility after the start of the war last month. Russia accounts for about 40% of the European Union’s gas demand, and about a third of those shipments transit Ukraine. The continent was facing a supply crunch even before the conflict, due to low storage levels that elevated prices.

Traders remain on edge about any potential disruption in flows or an escalation of international sanctions to isolate Moscow.

While Russia has targeted gas-distribution networks to cut off supplies from Ukrainian cities, “it’s obvious that they are very, very careful not to damage” transit infrastructure, said Yuriy Vitrenko, chief executive officer of NJSC Naftogaz Ukrainy.

“They don’t want to hurt their own commercial interest and their commercial relationship with the West,” he added in a Bloomberg TV interview.

Read More: Ukraine Says Russia Still Pays in Hard Currency for Gas Transit

Dutch futures, the European benchmark, fell 8.3% to 96.30 euros per megawatt-hour. That’s the lowest settlement price since Feb. 25, the second day of the war. The U.K. equivalent contract declined 8.4%, while German month-ahead power dropped 10%.

Russian Supplies

Russian supplier Gazprom PJSC didn’t book any space to send gas to Germany via the Yamal-Europe pipeline during a regular day-ahead auction, meaning deliveries via that route may remain halted on Tuesday. The company also opted not to book any pipeline space for April to send gas through the link, monthly auction results on Monday showed.

Still, shipments across Ukraine remained stable on Monday, and Gazprom earlier said transit is normal and in line with clients’ requests. Orders for Russian gas to Europe via the Nord Stream link edged higher, but they’re still lower than the level at the start of last week.

Vitrenko said all of Ukraine’s key gas transit infrastructure facilities remain in the country’s control, though Russian troops entered three major compressor stations recently and are “still around.”

Winter’s End

Several European Union countries are pushing for a fifth round of sanctions on Russia. So far the bloc has been reluctant to penalize gas and oil flows from the country, though many companies are shunning Russian crude, a key source of revenue for Moscow.

“With Russia most likely getting desperate for revenues -- as they are forced to sell deeply discounted oil -- the supply outlook has improved,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Combined with a warm weather forecast across Northern Europe and strong imports of liquefied natural gas, that’s pushing gas prices down. “I doubt that we are out of the woods just yet, but with winter behind us the imminent threat has disappeared,” Hansen said.

Also See: U.S. LNG Projects in Line for Boost From Europe’s Russia Pivot

European gas stockpiles are currently about 25% full and at the lowest seasonal level since 2018, according to data compiled by Bloomberg. Inventories typically bottom out at the end of winter and rise in April with the onset of spring.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says