Gas Surges in Europe as Heat Wave Clashes With Supply Cuts

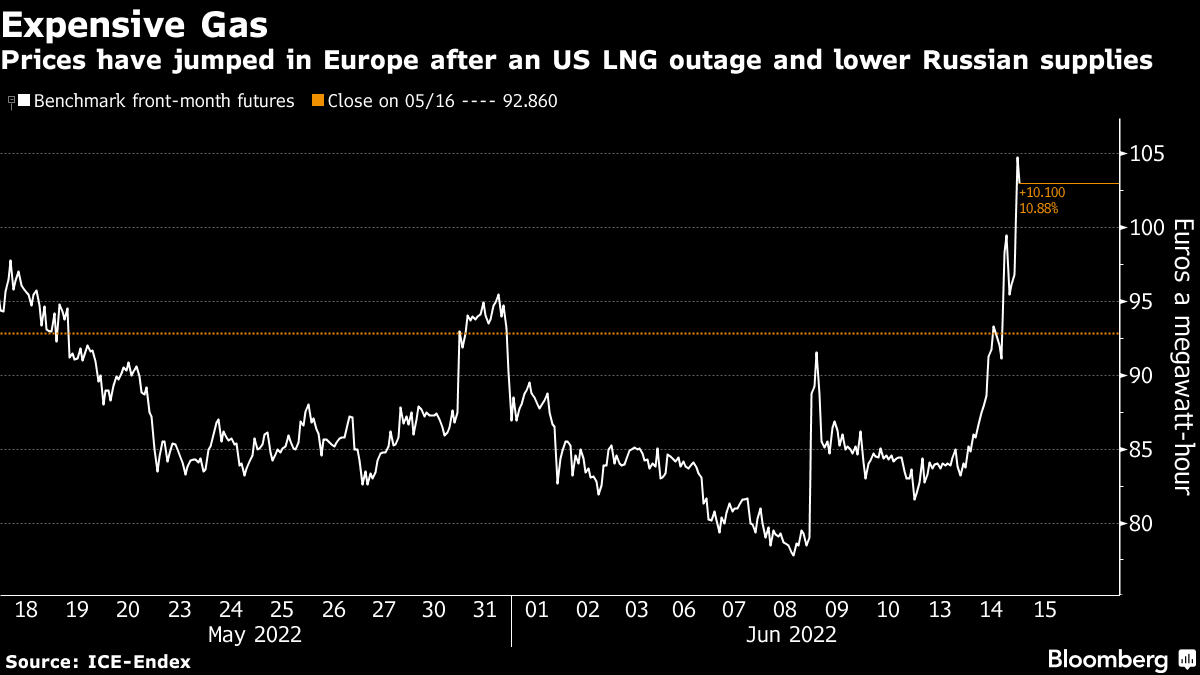

(Bloomberg) -- European natural gas prices jumped as reduced supplies raised concerns about the pace of refilling storage sites in time for next winter, just as a heat wave boosts demand for cooling.

Benchmark futures rose as much as 8%, increasing for a third day. A liquefied natural gas export facility in the US -- a vital source of supply for Europe -- will remain shut for longer than initially anticipated following a fire last week. At the same time, technical issues have curbed Russian flows through a major pipeline to Germany by about 40%.

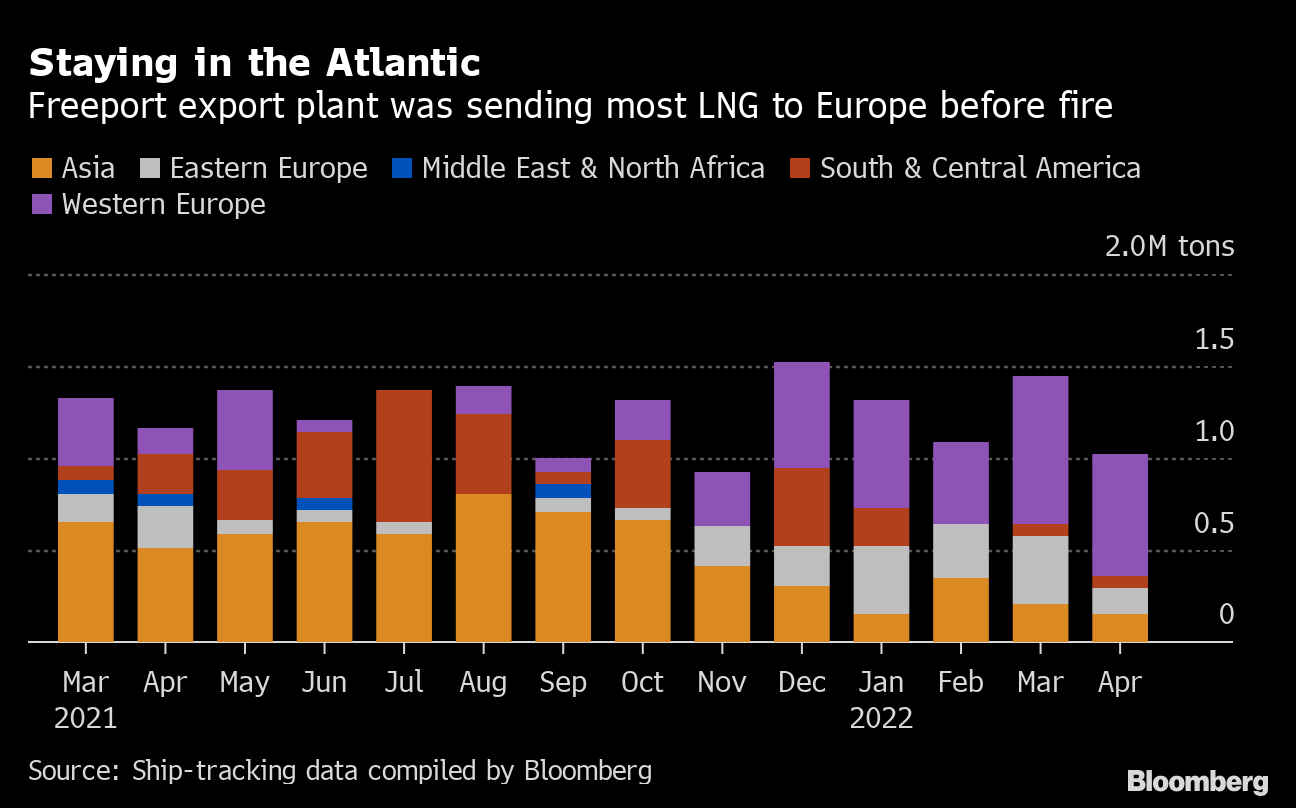

The bout of intense heat that’s gripping Europe is pushing up gas demand and further tightening the market. The continent, which has relied on US LNG to fill the gap resulting from lower Russian flows, may have to compete more fiercely with Asian buyers to secure spare supply as they rush to replenish storage facilities before demand peaks again in the winter.

Also read: Heat Wave Spreads Across Europe as Summer Highs Come Early

“This will make it harder for Europe to meet its storage targets this summer as the region is now losing supply from the east and the west, and the continent could be in for a winter season of sustained high prices as a result,” said Xi Nan, vice president for gas and LNG markets at Rystad Energy A/S.

Storage sites across Europe have been getting a boost of injections, with facilities more than half full as companies tap all available resources. Eurasia Group estimates most would be topped up by late August if the pace of boosting inventories seen in early June continues, putting the continent in a good position to withstand any supply shocks in the winter.

But the recent outages could hamper the plan.

Dutch front-month gas futures, the European benchmark, were 2.4% higher at 99.39 euros per megawatt-hour as of 11:54 am in Amsterdam. They rose 16% on Tuesday to the highest level in a month. The UK equivalent jumped as much as 7% on Wednesday.

Power prices tracked gas, with the month-ahead German contract rising almost 6% to 216 euros per megawatt-hour, the highest intraday level since May 13.

Freeport Shutdown

The operator of the Freeport LNG export facility in Texas -- shut last week after the fire -- said it may take 90 days for the plant to be partially back online, far longer than an earlier projection of a minimum three weeks. Full capacity isn’t expected to be available until late 2022.

That was after Russia’s Gazprom PJSC said flows via the Nord Stream pipeline, the biggest link to the European Union, will be limited, after Siemens failed to return on time some equipment it was repairing for the link’s entry point in the Baltic Sea. Sanctions against Russia because of the war in Ukraine have left a turbine key for the functioning of the pipeline stuck in Canada.

Gazprom has also cut gas flows to Italy on Wednesday by about 15%, a spokesperson for the Italian energy company Eni said. Gazprom didn’t provide any reason for the move.

Also read: Russia Sanctions Leave Nord Stream Turbine Stranded Abroad

The Freeport project provided roughly 2.5% of European demand in May, according to Rystad. Combined with the lower Nord Stream supply, about 6.3% of the continent’s demand has been knocked out, the consultant said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods