Exxon, Chevron Score Record Profits as Markets Convulse

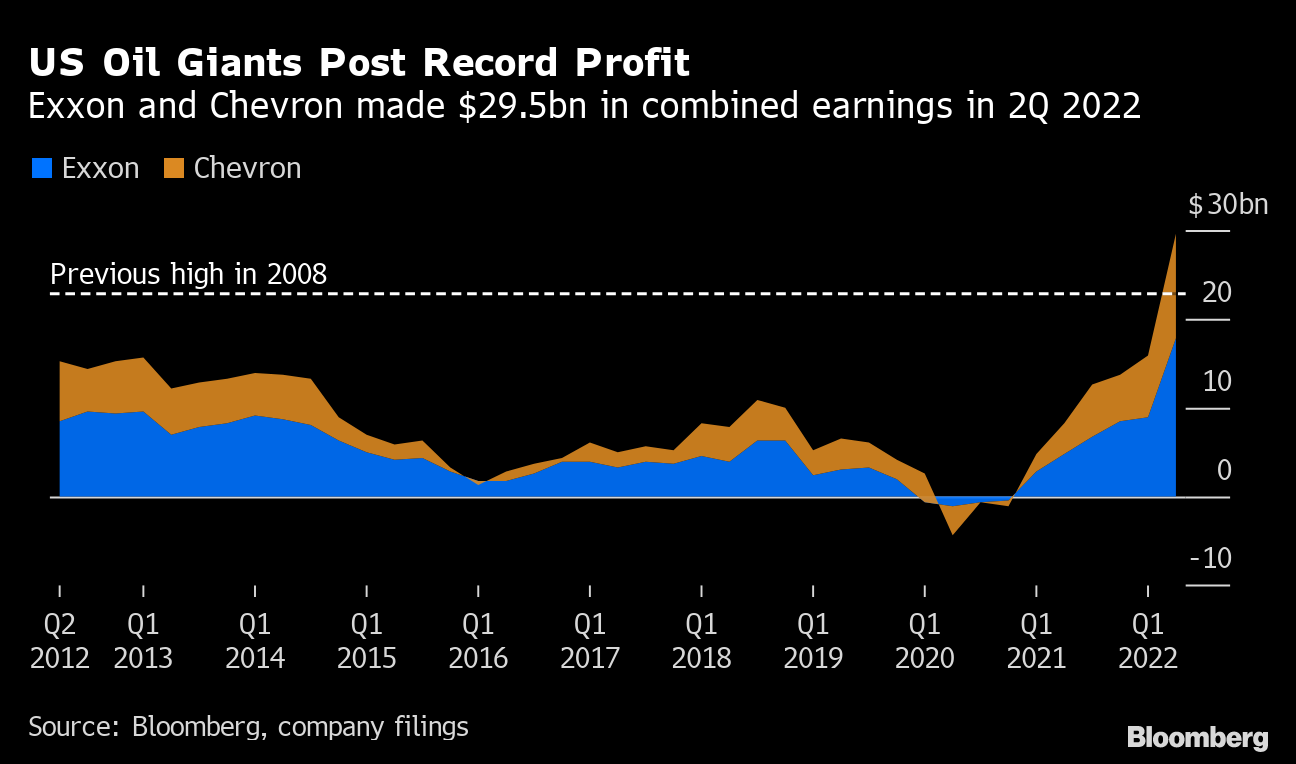

(Bloomberg) -- Exxon Mobil Corp. and Chevron Corp. posted their highest-ever profits, reaping the rewards from surging commodity prices amid supply disruptions and rising demand.

Exxon, which surpassed its previous quarterly profit record by more than $3 billion, warned Friday that global energy supplies will remain tight and expensive for the foreseeable future. Chevron, meanwhile, promised investors a massive increase in share buybacks even as it cautioned that the cost of doing business will climb.

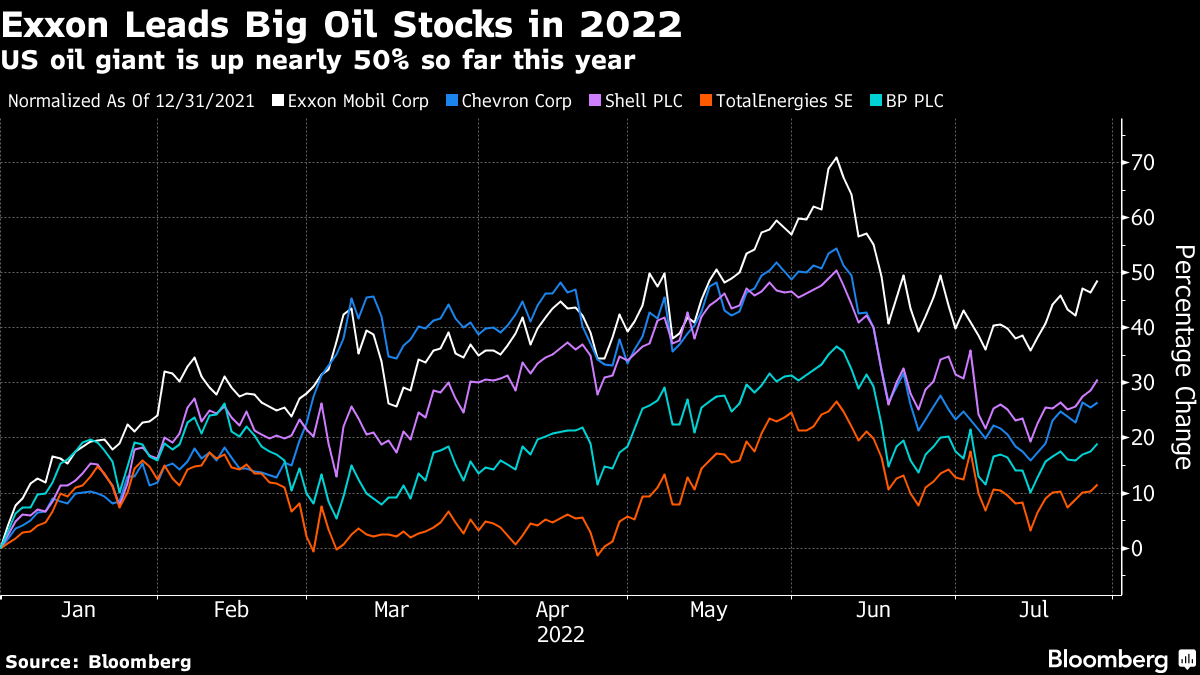

The titans of North American oil followed European peers Shell Plc and TotalEnergies SE in posting unprecedented second-quarter results four months after Russia’s invasion of Ukraine threw worldwide commodity markets into disarray, aggravating already rampant inflation.

Chevron shares jumped as much as 9.5% for the day’s second-best performance in the S&P 500 Index. Exxon rose almost 5%, bringing its year-to-date advance to 58%.

The oil sector’s sky-high profits come at a politically tricky time for an industry accused of profiteering from the fallout from Vladimir Putin’s aggression while failing to invest enough in new drilling. Still, the recent retreat in crude and gasoline prices may provide oil executives with some cover from the backlash they faced in June, when President Joe Biden accused Exxon of making “more money than God.”

See also: TOPLive blog coverage of Exxon and Chevron earnings

With recession fears gathering pace, the second quarter may end up marking the high point for Big Oil this year. International crude prices jumped above $120 a barrel during the April-to-June period -- a 14-year high -- but have since fallen by about 20%. US refining margins also have deflated somewhat since touching all-time highs, though natural gas prices remain elevated around the world.

What The Analysts Are Saying

“Exceptional capture of refining margins” drove the profit beat at Chevron. “Strong cash flow generation sees further deleverage and has allowed the ceiling of the $5-10bn share buyback to be raised to $15bn.”

-- Citigroup’s Alastair Syme

For Exxon, “the key drivers of the beat were the upstream as well as lower corporate costs relative to our estimates.”

-- Biraj Borkhataria, RBC Capital Markets

However, Exxon misses free cash flow consensus by $2 billion, perhaps one reason why it left its buyback unchanged. “We suspect during the call there will be focus on criteria under which XOM would increase its buyback.”

-- Jason Gabelman, Cowen & Co.

Exxon’s second-quarter adjusted earnings of $4.14 per share beat the $3.98 forecast by the Bloomberg Consensus. Net income reached $17.9 billion, surpassing the previous record set in 2008.

Sign up here for Elements, Bloomberg’s daily energy and commodities newsletter.

As for Chevron, net income of $11.6 billion exceeded the previous record set in 2008 by almost 50%.

Chevron’s oil and natural gas-producing division led the way with earnings $8.6 billion, more than double a year earlier. Refining also had a standout quarter, with a fourfold increase in profit.

Chevron’s adjusted per-share earnings reached $5.82, the San Ramon-based company said in a statement, 86 cents above the Bloomberg Consensus. Chevron pledged to pour up to $5 billion more into stock repurchases just three months after its last boost.

Surprise Profits

The sheer scale of Big Oil’s earnings is even a surprise even for analysts who had expected the sector to post a landmark quarter. It also underscores the depth of the energy crises afflicting economies around the world.

Chevron Chief Executive Officer Mike Wirth sought to rebut criticism that the company is profiteering and enriching investors at the expense of consumers.

“We more than doubled investment compared to last year to grow both traditional and new energy business lines,” Wirth said in the statement. “Chevron is increasing energy supplies to help meet the challenges facing global markets,” he said, referencing the company’s strides in lifting oil output in the Permian Basin and acquiring a renewable- fuel maker.

The buyback increase indicates Wirth and his team expect strong cash flow to persist even after oil prices retreated about 20% in the past few weeks. Chevron executives have been adamant that shareholder rewards much be paid consistently through volatile commodity cycles and not pared back when energy prices dip.

(Updates scope of share-price moves in fourth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis