European Gas Extends Scorching Rally With Supply Fears Mounting

(Bloomberg) -- Natural gas in Europe headed for the longest stretch of daily gains in more than nine months as persistent fears of deeper supply cuts by Moscow spread through the market.

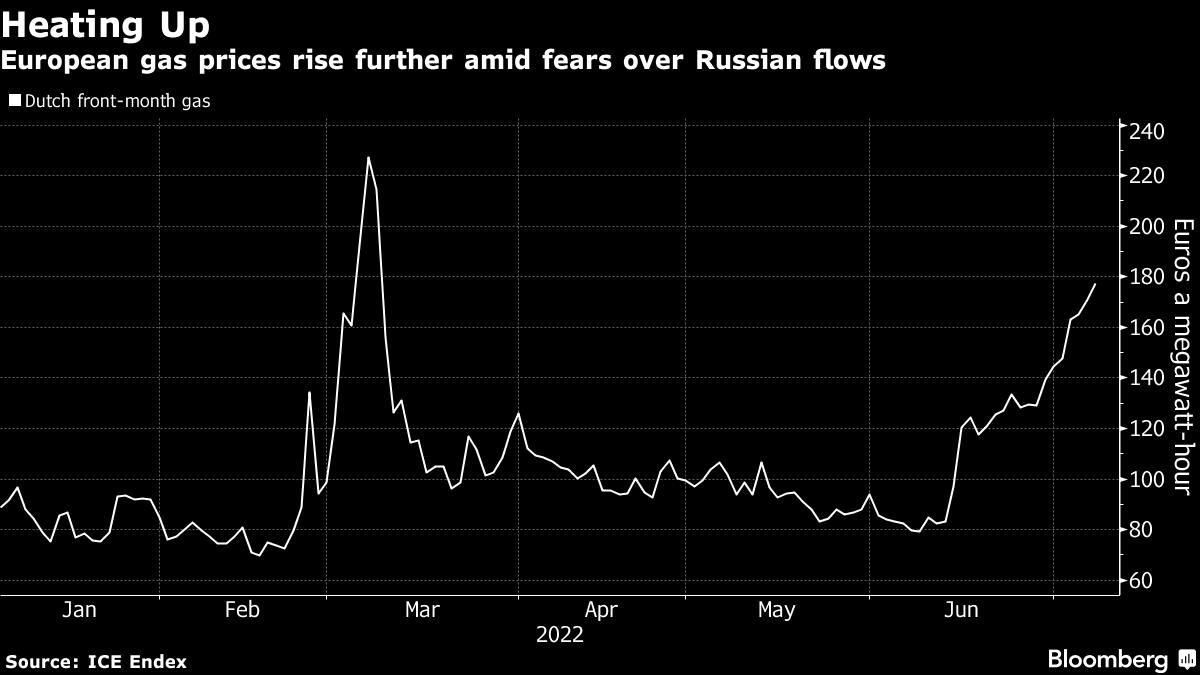

Benchmark gas futures, which have doubled their value over the past month, rose as much as 7.3% for a seventh day of increases. The crisis has also sent power prices to record highs as Russia’s tightening hold on energy supplies brings the risk that Europe may struggle to keep the heat and lights on this winter.

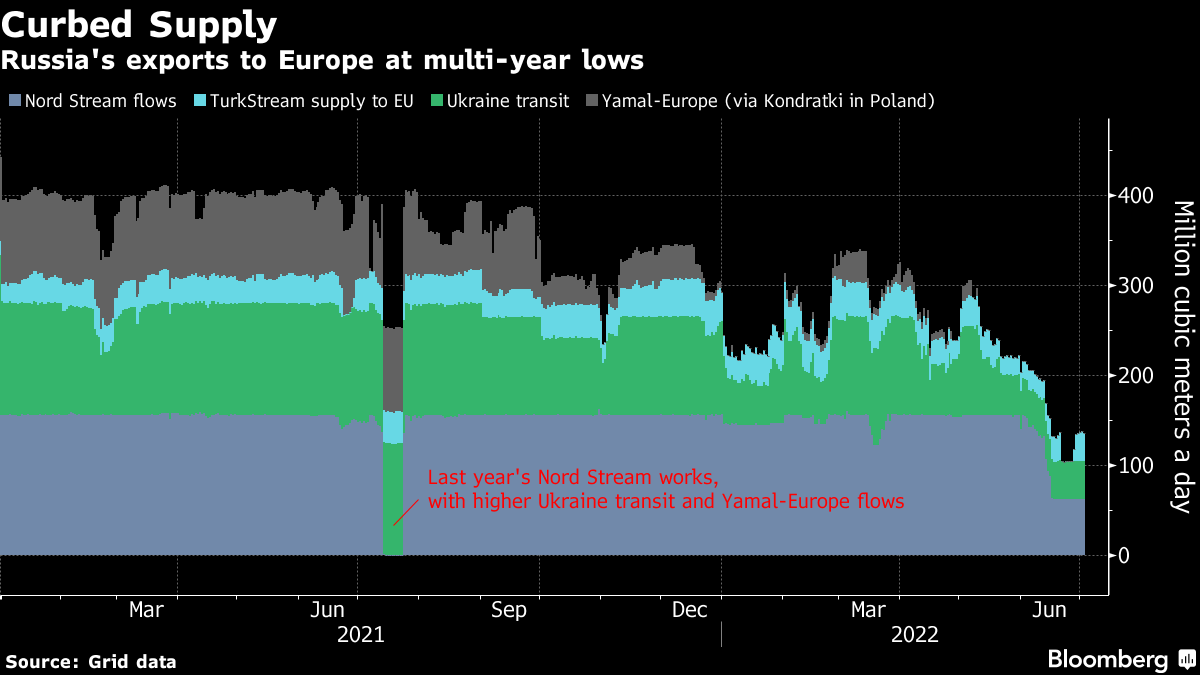

A key pipeline from Russia to Germany is supplying at just 40% of its capacity and is scheduled to close for seasonal maintenance starting next week. Concerns are mounting that it won’t return to full service after the work. Russia slashed flows through the link last month, citing technical issues with turbines that are need to be serviced in Canada -- with one already stuck there following Ottawa’s sanctions against Moscow.

A prolonged halt would jeopardize plans to have storage sites sufficiently filled in time for winter, when demand typically peaks. German Economy Minister Robert Habeck urged Canada to release the turbine before the Nord Stream maintenance begins on Monday, which would remove an excuse for Moscow to continue capping supplies through the link.

“It is with a heavy heart that we had to ask for this,” Habeck told Bloomberg News late Wednesday. “We need capacities in Nord Stream 1 to fill up our storage.”

Nord Stream needs six major turbines to pump gas across the Baltic Sea, which have to be regularly sent back to Canada for maintenance, but only two are currently in operation. One turbine was being overhauled in Montreal and can’t be returned because of the sanctions that prohibit vital technical services from being exported to Russia’s fossil-fuel industry. Other turbines are still in Russia, but not all of them are working because of the needed maintenance, according to supplier Gazprom PJSC.

“The gas crisis in Europe shows little sign of abating anytime soon, and Germany is at the heart of it,” analysts at Jefferies said in a note.

Europe is in the middle of the biggest energy crunch in decades. A heatwave in the region, drop in German wind power generation next week, poor hydro output in southern Europe and weak nuclear generation in France are all adding to fears about Nord Stream flows, EnergyScan said in a note.

“Gas demand for power generation remains particularly high for this time of year” even though the high prices are weakening consumption in other industries, EnergyScan said.

Dutch front-month gas, the European benchmark, traded 5.2% higher at 179.90 euros per megawatt-hour at 12:01 p.m. in Amsterdam. The U.K. equivalent contract rose 16%.

The Fallout

European leaders are preparing to control the fallout, which is already squeezing utilities’ finances and contributing to surging inflation. Germany’s parliament will vote on legislation on Thursday to allow the government to curtail generation from power stations that are not deemed essential for security of supply. The nation is trying to find ways it can conserve fuel to make sure that storage is full before the heating season.

The new legislation would authorize Berlin to provide financial aid to energy companies or even bail them out. It would also create the possibility of sharing the cost of higher import prices between consumers and companies.

Before it invaded Ukraine, Russia covered the supply gap during Nord Stream maintenance with higher flows through another major pipeline, Yamal-Europe, which runs through Belarus and Poland. Gazprom also used its own storage sites in the European Union.

Those options are no longer on the table after Moscow in May imposed sanctions on the Polish owner of the Yamal link and a former Gazprom unit with EU storage capacity.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis