EU Gas Price Cap Would Have Been Triggered Over 40 Days This Year

(Bloomberg) -- The European Union agreed to cap natural gas prices next year through a complex plan with several caveats. Still, it could have prevented some of the extreme spikes seen this summer.

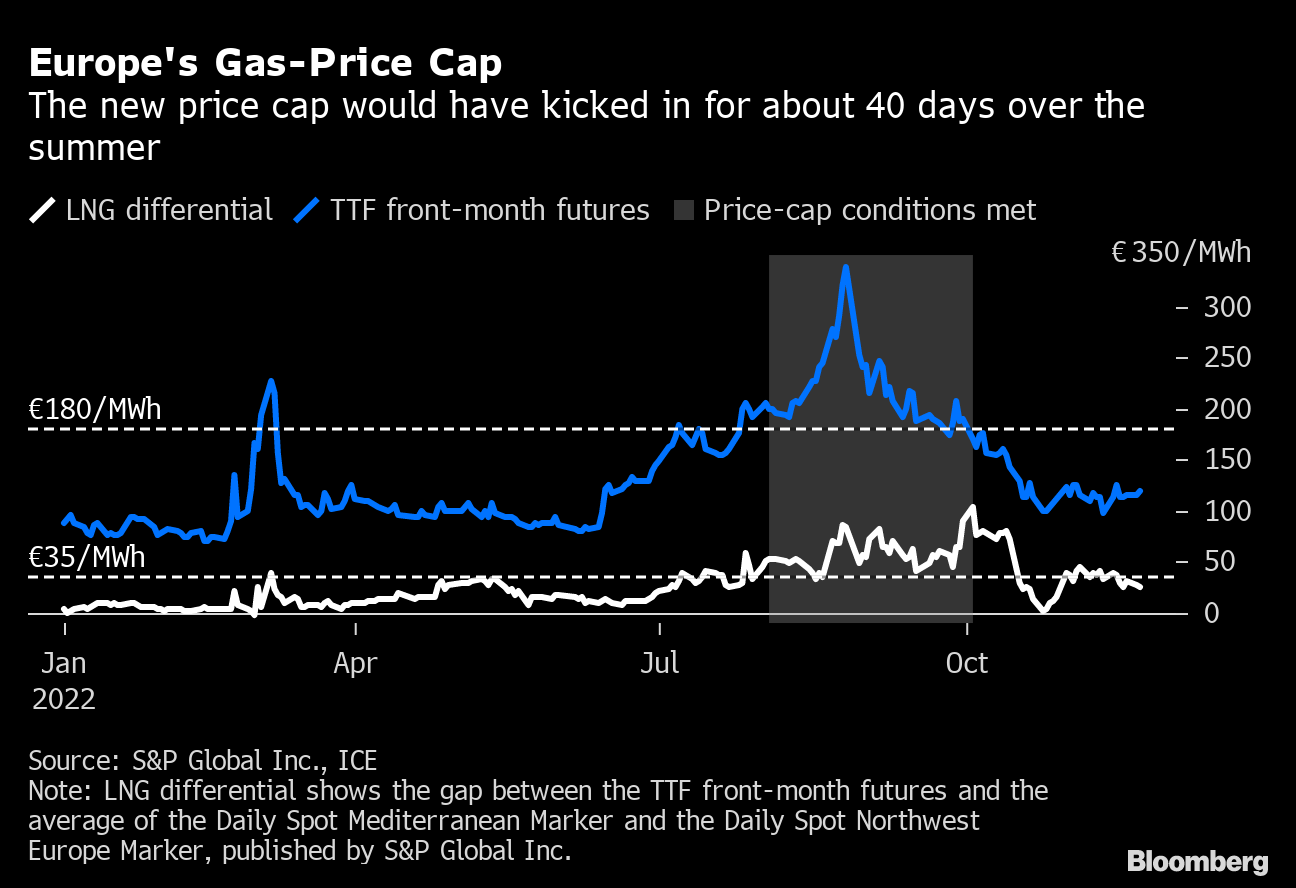

The cap, set to take effect Feb. 15, requires a few conditions before it is triggered: for three working days, the benchmark price must be above €180 ($191) a megawatt-hour and also at least €35 above global prices for liquefied natural gas.

If it had had been introduced this year, the cap could have been used on roughly 40 days in August and September — when prices neared records — Bloomberg calculations from S&P Global Commodity Insights data show.

The measure is designed to prevent extreme market swings, and once activated, it will remain in place for at least 20 working days. It will also apply to all EU gas-trading hubs, with a possibility to opt out later. Regulatory bodies will also be asked to do an impact assessment before February and the measure can be scrapped if the risks outweigh the benefits, EU Commissioner Kadri Simson said.

Many suppliers have already warned that much-needed LNG cargoes could favor Asia if prices there are higher than the caps in Europe. The move — without an associated cap on demand — also risks making Europe’s gas supply deficit worse by encouraging consumption, Goldman Sachs Group Inc. analysts including Samantha Dart said in a report.

Read: Europe’s Gas Price Cap Threatens to Intensify Energy Crisis

Even higher risks are seen for exchanges and market liquidity. “If the cap is activated, deals will go to over-the-counter and liquidity at the hubs will rapidly contract,” said Jonathan Stern, distinguished research fellow at the Oxford Institute for Energy Studies. “But we have yet to see how the cap works in practice and what it will mean for hubs around Europe.”

Price Concerns

A surge in gas futures in August sparked concerns about prices spiraling out of control due to speculation, rather than supply and demand. Since then, Dutch front-gas, the most traded futures, have lost about 70% of their value as supply worries eased — to trade around €100, near the lowest in a month.

While the slump has removed some of the immediate pressure on the market, EU ministers see the ceiling as a way to make sure that the price spikes of the summer don’t happen again.

The LNG element of the cap is to make sure that Europe remains an attractive market for supplies, a concern cited by countries like Germany. The cap will be in place during the summer when Europe is trying to refill its gas storage without a significant chunk of supply from Russia.

Europe has been hit by roughly $1 trillion from surging energy costs in the fallout of Russia’s war in Ukraine. The EU has said it expects the crisis to roll into next year and the impact of sustained higher prices will continue to cause pain to industry and households.

“We have a long phase of observation,” until February, German Economy Minister Robert Habeck said Monday. “Should the results of the market and financial institutions be such that the mechanism is doomed to fail, it will have to be corrected again.”

Impact on Exchanges

The price ceiling could have “potentially irrevocable negative effects” on the functioning of the region’s energy markets lasting well beyond the current crisis, the Association of European Energy Exchanges said last month.

If participants move away from centralized exchanges to the OTC market — to avoid interventions — that would mean lower liquidity and revenue for bourses, while also putting pressure on spot prices, they’ve warned.

Intercontinental Exchange Inc., operating Europe’s biggest gas bourse, said it would assess the technical feasibility, the impact on financial stability, and whether the market can operate in a “fair and orderly” way under a cap.

“It’s not easy to understand its ultimate impact,” said Simone Tagliapietra, a researcher at the Bruegel think-tank in Brussels. “Anyhow, this is no silver bullet.”

--With assistance from and .

(Updates with analyst comments in fifth paragraph, gas prices in seventh.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods