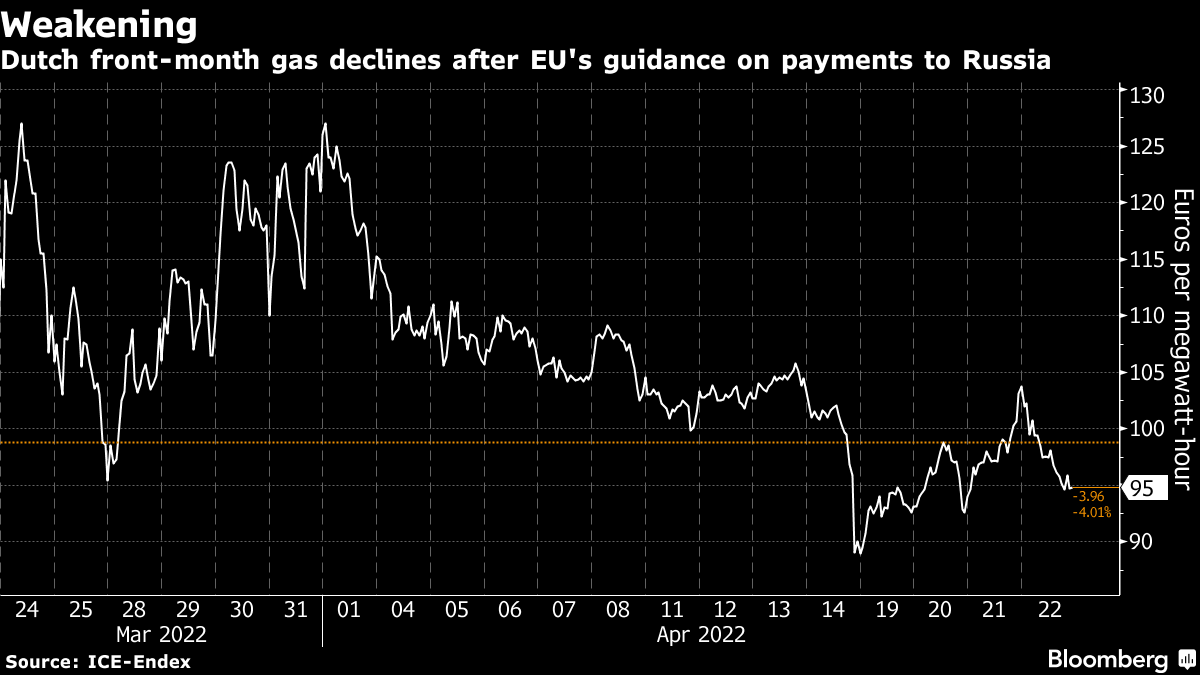

European Gas Falls After EU Guides on Paying for Russian Supply

(Bloomberg) -- Natural gas prices in Europe extended losses after the European Union suggested companies could keep paying for natural gas in euros.

The bloc has indicated that Russia’s demand for payment in rubles may violate sanctions imposed on Moscow following the invasion of Ukraine. Russia had previously signaled that agreements would be fulfilled only when rubles had been received from Gazprombank JSC.

EU Suggests Companies Should Keep Paying for Russia Gas in Euros

The continent’s benchmark gas futures were 4.8% lower, after rising as much as 5.2% earlier on Friday. Companies across Europe have been waiting for the EU’s final decision and the drop in prices signals traders expect a resolution on the payment issue can be found.

Non-compliance to Moscow’s demands could result in supplies to Europe being cut off. However, large volumes of liquefied natural gas that are headed to the continent and the end of peak winter heating demand have countered some of the risks. European nations have also pushed back on the new payment terms, and potential disruptions aren’t seen as imminent with most bills due only later next month.

The EU said the scope for exemptions is not yet clear and companies could continue paying in euros. It advised buyers to seek confirmation from Moscow that this was possible.

The U.K. has issued a temporary license allowing payments to Russian lender Gazprombank, which the country has sanctioned, until the end of May for gas used in the European Union. It potentially signals flows will continue uninterrupted for the next few weeks at least.

Meanwhile, orders for Russian gas transiting Ukraine have inched higher in the past two days, but are still far below levels seen before Easter. Gazprom PJSC reiterated that it’s sending volumes in line with clients’ requests.

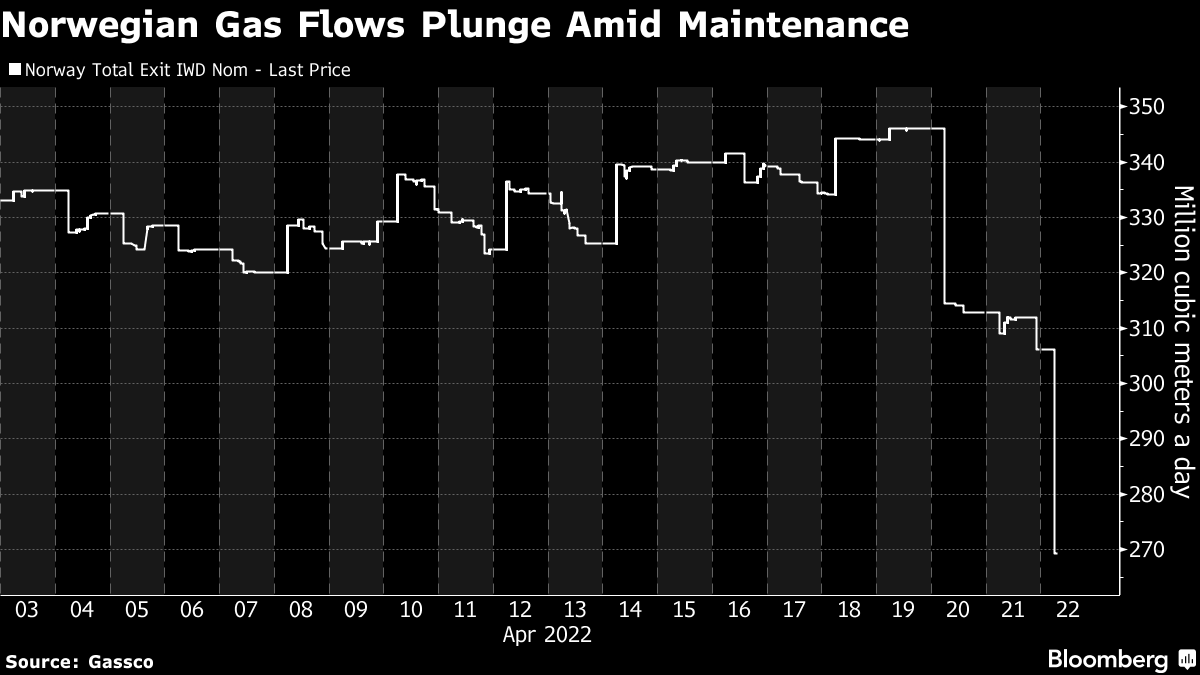

Supplies from Norway are set to slump to the lowest levels in more than three months with seasonal work at the giant Troll field on Friday, according to nominations from operator Gassco AS. There are also unplanned outages at the Kollsnes processing plant.

“Europe should continue to benefit from high LNG supply, without having to overbid,” consultant EnergyScan wrote in a note. “But there is a reason for concern about the sharp drop in Norwegian supply. The missing volumes are probably being sought from power plants, which are asked to favor generation from coal.”

READ: EU Gas Has Shrugged Off Putin’s Ruble-Payment Demand. Here’s Why

Front-month gas futures were trading 5% lower at 95.10 euros per megawatt-hour at 5:51 p.m. in Amsterdam. The equivalent contract in the U.K. slid 11.3%.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says