Europe’s Fragile Energy Market Braces for Putin’s Next Move

(Bloomberg) -- Europe may be hurtling toward a sudden halt of Russian gas, a scenario that would trigger energy rationing, higher inflation and a deep recession.

A showdown over payment terms has already led Moscow to turn off taps to Poland and Bulgaria. With supply already tight, it won’t take much more to send energy markets into shock.

Europe’s natural gas balance is “fragile and it remains just one supply disruption away from completely falling apart,” said Shikha Chaturvedi, an analyst at JPMorgan Chase & Co.

Unless processes can be resolved to meet Kremlin demands while also steering clear of European Union sanctions, more countries are at risk of being shut off in coming days or weeks.

Europe relies on Russian gas for one fifth of its electricity generation, and a minor disruption could quickly ripple across the continent. Storage levels are currently at just 32% capacity, compared with the target of at least 80% needed to keep homes heated and factories running through the winter.

The shutoff of Poland and Bulgaria shows the strain. While the volumes are relatively low, the shortfall soaked up supplies from Germany and liquefied natural gas cargoes. That reduces the buffer to cope with further disruption.

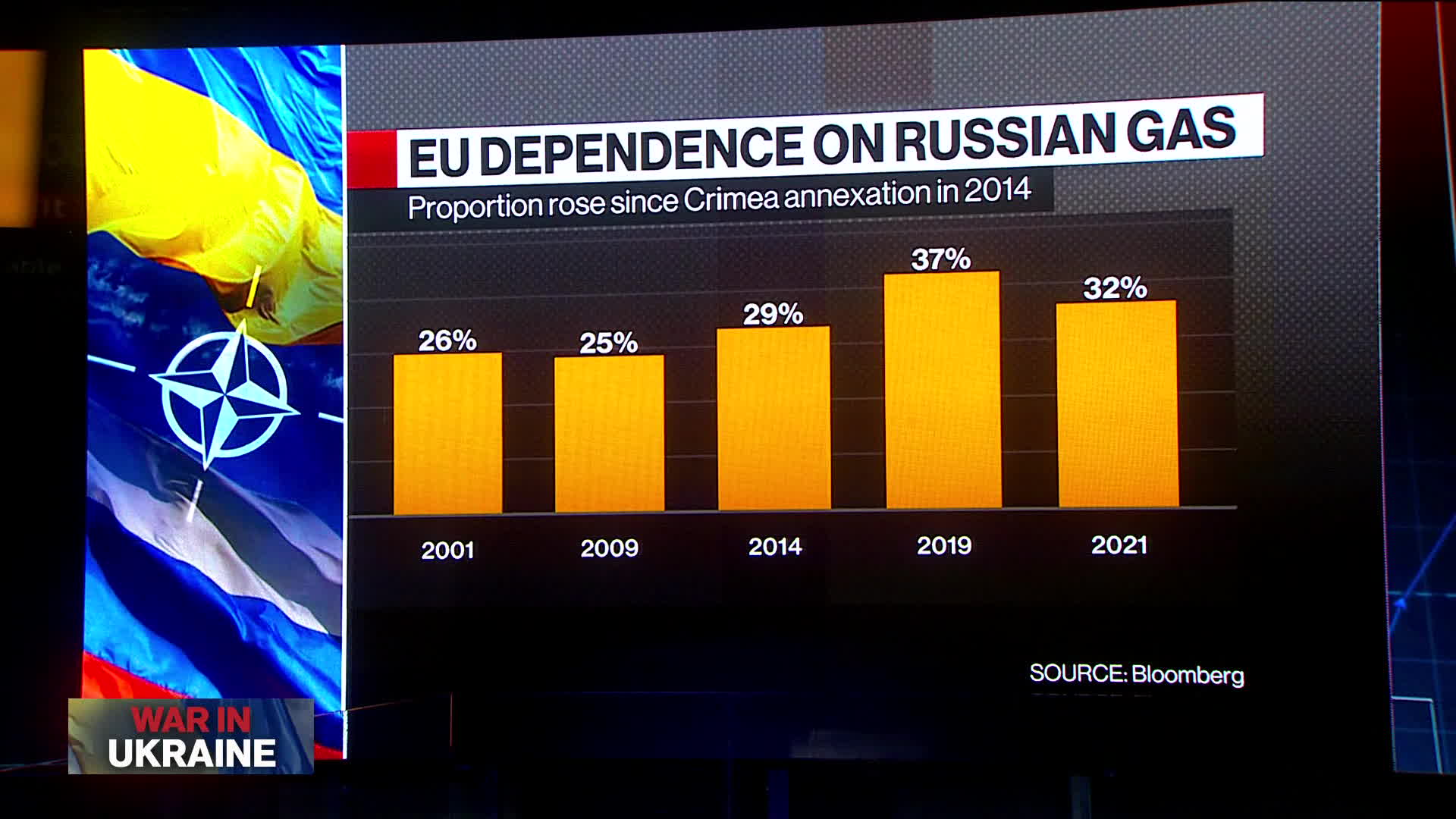

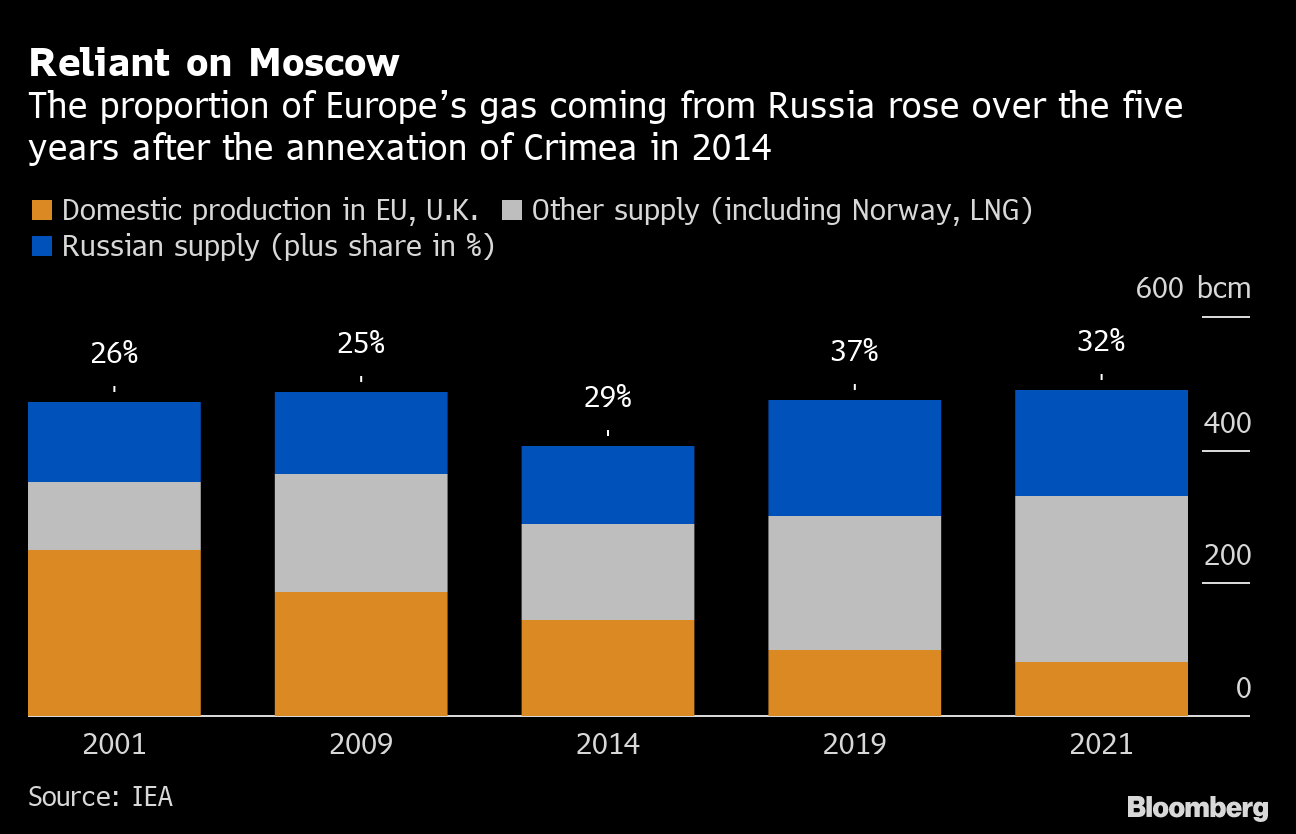

President Vladimir Putin has decreed that gas customers in Europe pay in rubles, which the EU says violates sanctions and has called for companies to continue paying in euros -- leaving it up to the Kremlin to refuse or accept. While the bloc aims to cut its dependency on Russian gas by two thirds this year, an abrupt halt would come too soon.

The EU has offered vague guidelines in an effort to stand up to Russia over its invasion of Ukraine while maintaining gas flows. On Friday, Russia clarified the rules on how European customers are required to pay, easing the terms slightly but still leaving doubts over the role of the country’s sanctioned central bank in converting euros to rubles.

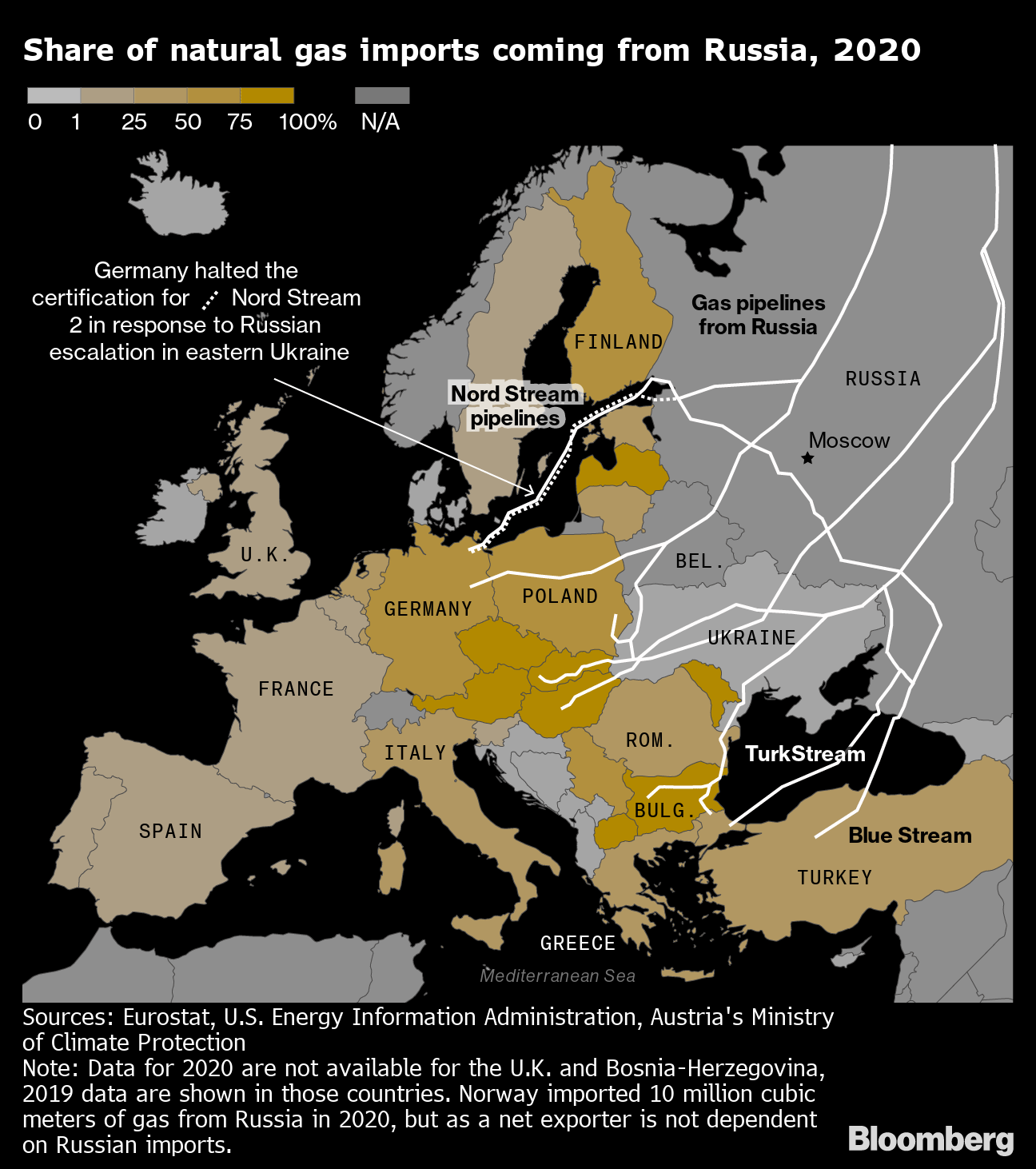

EU energy ministers will gather in Brussels on Monday for an emergency meeting to discuss options to maintain energy supplies and the fallout from the move by state-owned Gazprom PJSC to cut off Poland and Bulgaria. The standoff risks creating divisions between heavy importers such as Germany and those less exposed like France.

If Russia refused to send the fuel -- critical for chemicals processes and powering auto factories -- European governments would quickly implement rationing mechanisms. A complete halt in supplies across the region would lead to a 10% reduction of industrial demand, according to energy consultancy Wood Mackenzie.

Germany still relies on Russia for 35% of its gas needs after starting to diversify even before the war started. Chancellor Olaf Scholz’s administration has invoked the first step of an emergency plan, which includes closely monitoring usage. The next stage would involve directing supply.

Even without energy rationing, Europe’s economy is on shaky ground. The euro zone grew a slower-than-expected 0.2% in the first quarter, reflecting a contraction in Italy, stagnation in France and weak expansion in Spain. Germany narrowly avoided a recession.

“Russia is showing that it’s ready to get serious,” German Economy Minister Robert Habeck said in Berlin last week, acknowledging that the country won’t be in position to offset Russian gas for more than a year. “That’s not realistic, but we have to nonetheless attempt the unrealistic.”

If a cut off in gas supplies were to last more than a few months, it would have major economic implications for Europe. Higher gas prices would increase the risk for euro-zone inflation, already predicted to be at elevated levels of 7% this year, according to Edward Gardner, a commodities analyst at Capital Economics.

“Given the reliance of Germany’s heavy industry on Russian gas, any interruption would represent a significant drag on economic growth,” said Mark Haefele, chief investment officer at UBS Global Wealth Management.

Uniper SE, Germany’s largest importer of Russian gas, is pursuing a workaround that would see it opening a euro account in Russia and allowing the funds to be converted by Gazprombank PJSC -- one of the few Russian lenders that hasn’t been sanctioned. It has to make a payment in late May. Berlin has signaled the plan is in compliance with EU guidelines, but it’s unclear if it will satisfy Moscow.

Companies from Austria and Italy have also said they believe that they will be able to keep gas flowing. That optimism has kept a lid on prices, with European gas futures rising just 1.1% last week despite the shutoff of two EU member states.

Already contending with Europe’s penalties and plans to phase out imports of Russian coal and oil, the Kremlin would risk eliminating another source of revenue if it plays hard ball over gas payments. “Russia’s loss of export earnings would be significant,” research group Energy Aspects said in a note this week.

Even if a crisis is averted for now, Putin could still try again to use gas to hurt the EU and undermine the bloc’s solidarity.

“The concern for investors is that the move signals a growing willingness by Russia to use the termination of energy exports as a form of retaliation against nations opposing its invasion of Ukraine,” said UBS’s Haefele.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Zambia Paid $82 Million to China Before Debt Revamp Deal

Canada to End 30% Stake Limit to Boost Pension Fund Investment

Turkey’s Aydem Group Plans 2025 IPOs for Power Grid Operators

Germany’s Record-Beating Stocks Head for Further Gains in 2025

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says