European Gas, Power Prices Jump Again to Records

(Bloomberg) --

European natural gas and power prices jumped to records, signaling the supply shortage will only get worse just as the winter season starts on Friday.

Stockpiles of everything from gas to coal and water for electricity production are in short supply and there are few signs the situation will improve anytime soon as demand continues to roar back from a pandemic-driven lull.

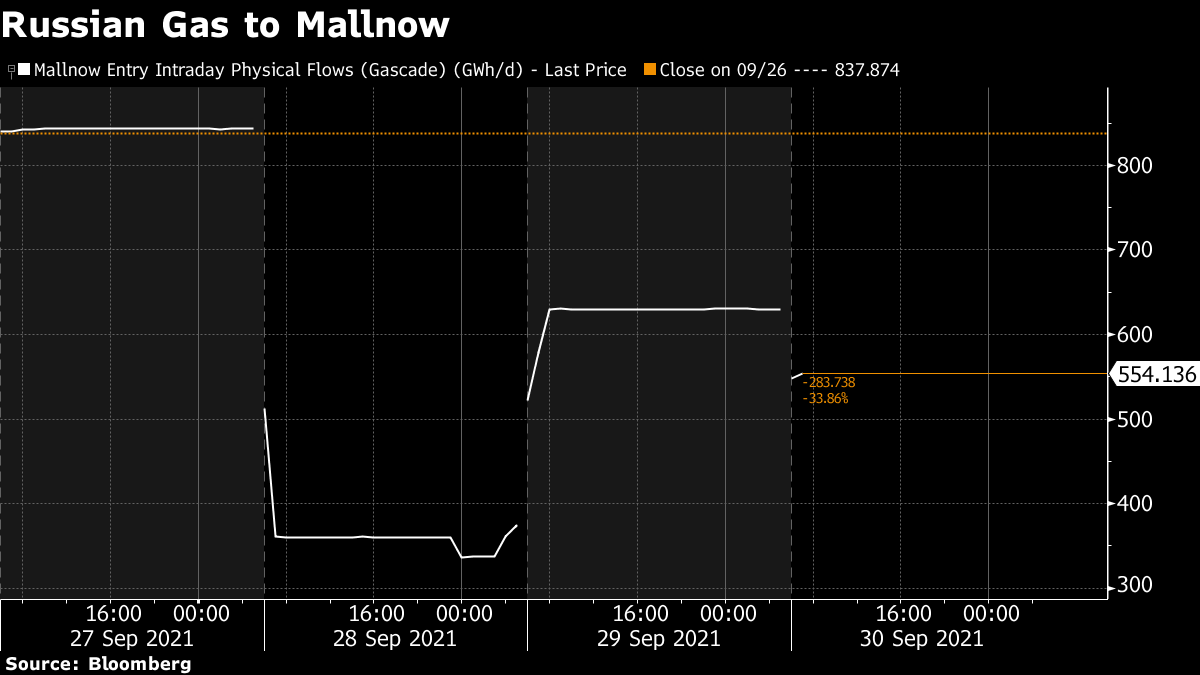

Russian gas flows to Germany’s Mallnow terminal dropped, paring yesterday’s partial recovery. Supplies via the major transit route are about a third less than at the beginning of the week. And European utilities seeking to buy more coal from Russia will also be disappointed as any exports are likely to be limited.

Europe Asking Russia for More Coal Is Set for Disappointment

The scale of supply constraints have caught the market off guard, just as countries are about to start drawing down on the gas in storage. European stocks are at the lowest in more than a decade for this time of year.

“We didn’t predict these prices coming,” Alex Grant, senior vice president at Equinor ASA, said at a conference in London on Wednesday. “In the prices there is a risk premium for what might happen going forward and the risk is still very much dependent on gas supply.”

Another three small U.K. energy providers went out of business on Wednesday, bringing the tally to 10 just in the past two months. Some 1.7 million homes have now been forced to switch providers.

U.K. Energy Firms Stretched to Limit as More Suppliers Fail

Meanwhile, French Prime Minister Jean Castex is scheduled to announce measures the government intends to put in place to mitigate the increase in energy prices this evening.

Inflows of gas as LNG to Europe will remain stymied by competition from Asia, according to an Inspired Energy report. “As system tightness continues in China, demand for coal and LNG is likely to remain elevated, seeing Asia remain the preferred seller direction for LNG cargoes,” it said.

Dutch natural gas for next month, the European benchmark, rose as much as 13.4% to 98.23 euros per megawatt-hour. The U.K. contract also surged 17.4% to a new high of 252.53 pence a term. Both contracts have more-than-doubled in price over the past month.

German power for next year jumped as much as 12% to 132 euros per megawatt-hour, while the French equivalent gained 10.3% to 135.50 euros per megawatt-hour. Both reached record highs on Thursday.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally

UK Nuclear Plants to Stay Online Longer in Clean-Power Boost