Activist Investor Urges Germany’s RWE to Exit Coal Quicker

(Bloomberg) -- A small activist investor wants RWE AG to accelerate a transition to clean power, saying the German utility giant could double in value by closing and separating its lignite operations more quickly.

The shares could exceed 61 euros ($72) as part of a “credible plan” to divest assets run on lignite, the most polluting form of coal, Enkraft Capital GmbH said. These are no longer economically relevant, it wrote in a Sept. 6 letter to RWE’s chief executive officer and its chairman, a copy of which was seen by Bloomberg News. Another large German fund, Deka Investment GmbH, said it supports Enkraft’s view.

The fossil-fuels sector is under pressure to do more to tackle climate change, and RWE will phase out coal-fired power by 2038 as part of a German government target. Though Enkraft is a small investor focused on renewable energy, Engine No. 1’s recent campaign against Exxon Mobil Corp. has shown how even little-known hedge funds can be successful exerting influence on energy giants.

Enkraft has been involved in energy and activist campaigns before. It urged wind-farm operator PNE AG to entertain rival bids after a takeover offer from Morgan Stanley’s infrastructure fund in 2019. It says it owns more than 500,000 RWE shares and is advised by 7Square, a firm typically hired by large investors like Elliott Management Corp. and Cerberus Capital Management LP for campaigns in Germany.

RWE confirmed it was contacted by Enkraft and said it was “always open to discussing its business strategy with investors.”

Enkraft also said RWE could reap a 10 billion-euro to 13 billion-euro windfall if it halts production at lignite plants and sold emissions rights that it amassed in the past at lower costs. Carbon futures have surged about 90% this year to a record.

RWE’s shares rose by 1.5% to 33.23 euros by 11:57 a.m. in Frankfurt. The stock has fallen about 4% so far this year.

Though RWE has one of the largest renewable-energy portfolios among European utilities, it still generates about a quarter of its power from lignite plants. It has come under fire from investors and environmental activists in recent years for not transitioning away from fossil fuels faster.

“RWE’s business model must quickly become less CO2-dependent,” Ingo Speich, head of sustainability and corporate governance at Deka Investment, said in an emailed statement. “A debate about the speed at which CO2 can be reduced is to be welcomed, and major structural changes in the group must not be taboo.”

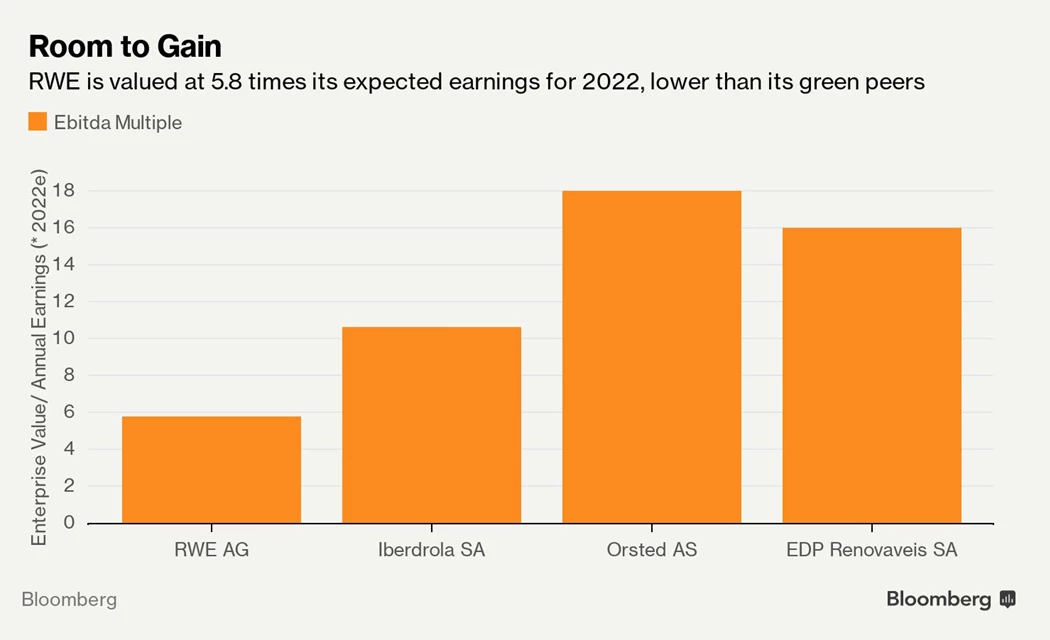

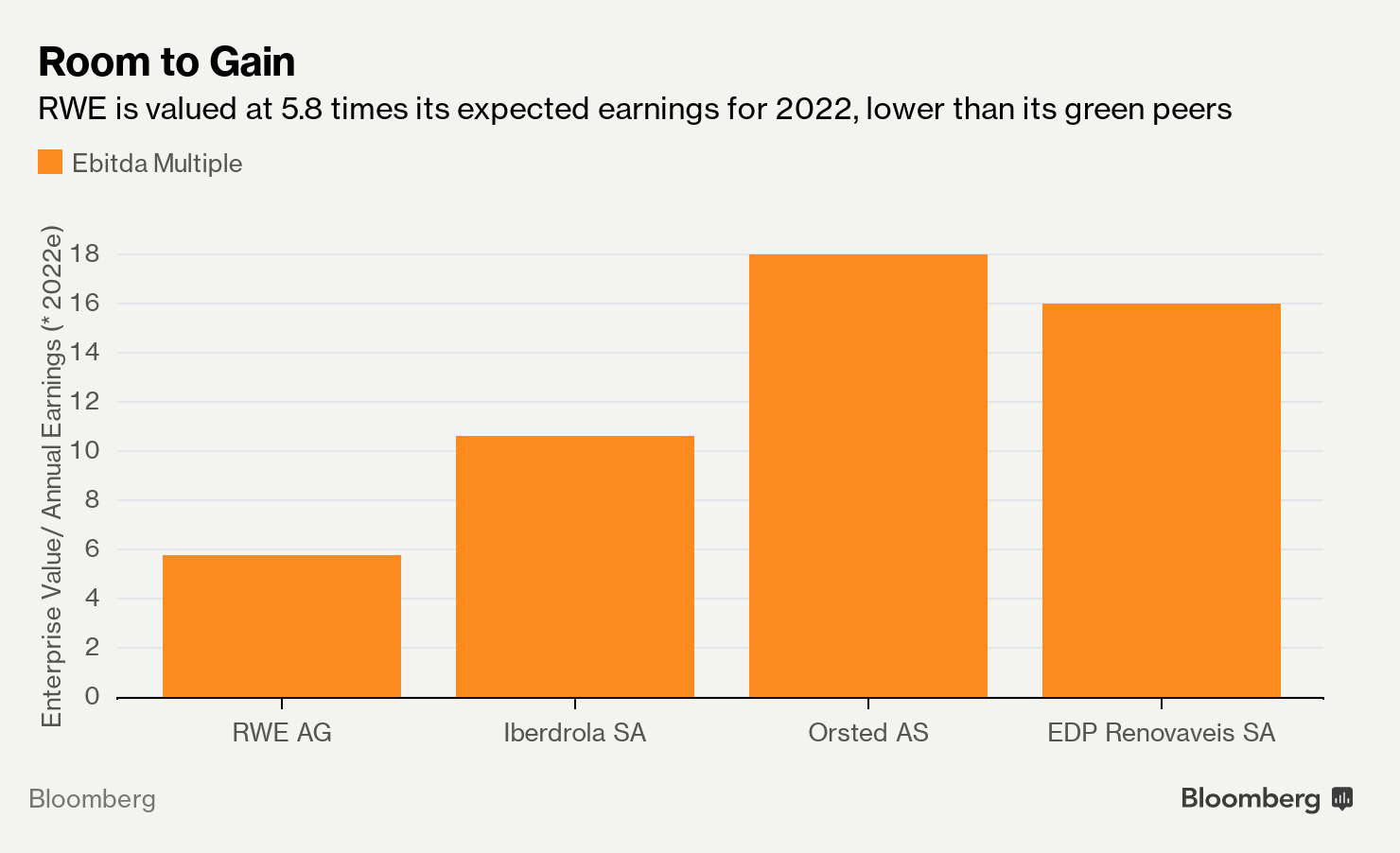

RWE would benefit from a re-rating to peers that focuses on green energy, like EDP Renovaveis SA or Orsted AS, Enkraft said, adding that those companies are valued at 19 times their expected earnings for 2022. RWE is valued roughly six times its earnings before certain items.

RWE has raised the prospect that Germany’s next government could revise the nation’s road map to phase out lignite, potentially forcing the company to close its power plants earlier. Analysts also say higher carbon costs could prompt RWE to shutter lignite assets quicker.

The “higher the carbon price, more the incentives for RWE to accelerate coal closures” and use money raised from selling emissions rights to offset accelerated lignite closure costs, Bernstein analysts said in a recent note.

(Updates with comments from Deka Investment)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.

KEEPING THE ENERGY INDUSTRY CONNECTED

Subscribe to our newsletter and get the best of Energy Connects directly to your inbox each week.

By subscribing, you agree to the processing of your personal data by dmg events as described in the Privacy Policy.

More utilities news

Equinor takes FID on UK’s first carbon capture projects at Teesside

BMW, Mercedes Add New Executives as Carmakers Tackle Crisis

Thames Water CEO Steers Away From Break Up After Covalis Bid

Germany Expecting Tight Power Conditions as Wind Output Falls

Nuclear Power Not Cost-Effective in Australia, Science Body Says

Vancouver Mayor Proposes Using Bitcoin in City Finances

Thames Water Gets £5 Billion Takeover Bid From Covalis

Lithium Powerhouse Chile Eyes New Lithium Extraction Methods

Aramco, Linde and SLB to build one of the largest CCS hubs globally